Question: a. Analyse Royal Bhd's cash flows performance based on operating, investing and financing activities. b. Currently, Royal Bhd.'s director announce that company expected to issue

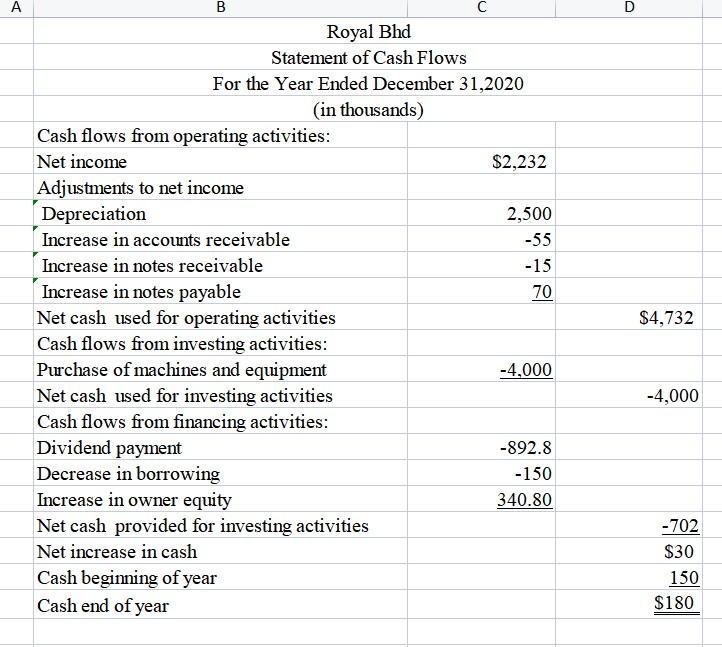

a. Analyse Royal Bhd's cash flows performance based on operating, investing and financing activities.

b. Currently, Royal Bhd.'s director announce that company expected to issue 10,000 units of bond with the coupon rate of 6% and selling at par six months from now. Based on the current financial position of Royal Bhd, analyse the impact of this announcement toward company' s major stakeholders and potential stakeholders.

c. Discuss the approaches in preparing Cash Flows Statements.

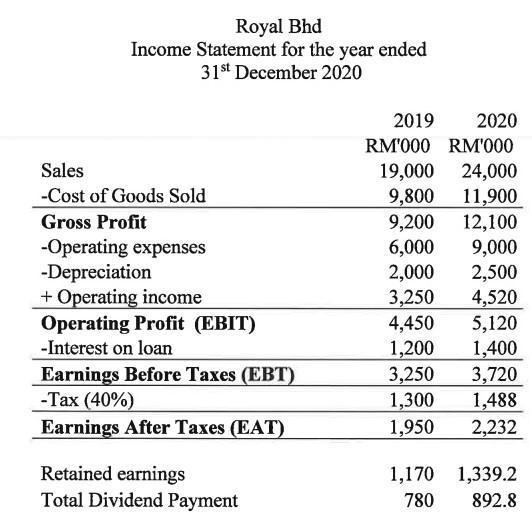

Royal Bhd Income Statement for the year ended 31st December 2020 Sales -Cost of Goods Sold Gross Profit -Operating expenses -Depreciation + Operating income Operating Profit (EBIT) -Interest on loan Earnings Before Taxes (EBT) -Tax (40%) Earnings After Taxes (EAT) Retained earnings Total Dividend Payment 2019 2020 RM'000 RM'000 19,000 24,000 9,800 11,900 9,200 12,100 6,000 9,000 2,000 2,500 3,250 4,520 5,120 1,400 3,720 1,488 2,232 4,450 1,200 3,250 1,300 1,950 1,170 1,339.2 780 892.8

Step by Step Solution

3.53 Rating (174 Votes )

There are 3 Steps involved in it

A Analyzing Royal Bhds cash flows performance based on operating investing and financing activities can be done by looking at the companys cash flow s... View full answer

Get step-by-step solutions from verified subject matter experts