Question: Section A - Multiple Choice Questions - Answer All Questions (5x1 mark = 5 marks) 1. Depreciation refers to a) Decrease in the value of

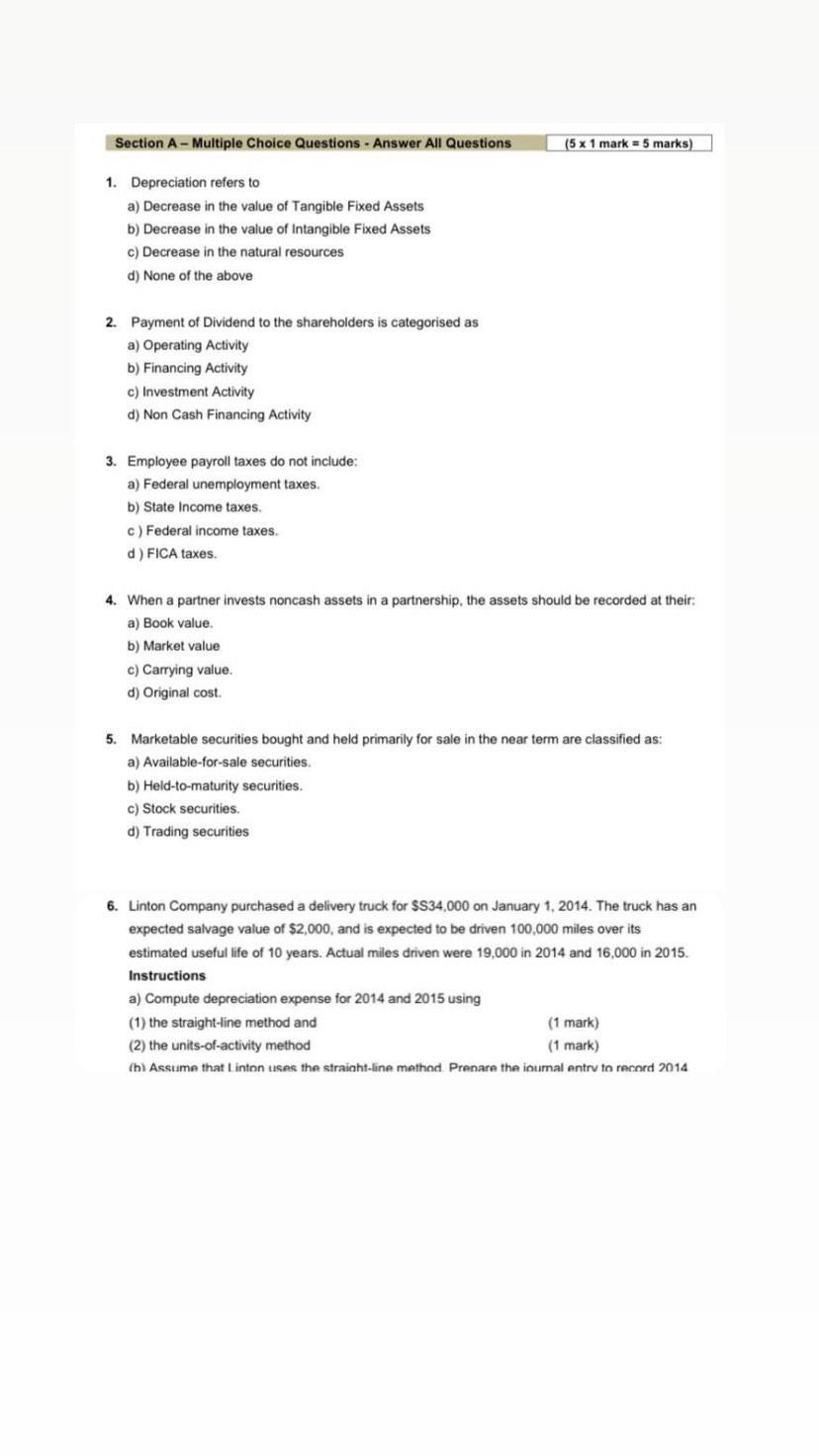

Section A - Multiple Choice Questions - Answer All Questions (5x1 mark = 5 marks) 1. Depreciation refers to a) Decrease in the value of Tangible Fixed Assets b) Decrease in the value of Intangible Fixed Assets c) Decrease in the natural resources d) None of the above 2. Payment of Dividend to the shareholders is categorised as a) Operating Activity b) Financing Activity c) Investment Activity d) Non Cash Financing Activity 3. Employee payroll taxes do not include: a) Federal unemployment taxes. b) State Income taxes. c) Federal income taxes. d) FICA taxes. 4. When a partner invests noncash assets in a partnership, the assets should be recorded at their a) Book value b) Market value c) Carrying value d) Original cost. 5. Marketable securities bought and held primarily for sale in the near term are classified as: a) Available-for-sale securities. b) Held-to-maturity securities. c) Stock securities d) Trading securities 6. Linton Company purchased a delivery truck for $S34,000 on January 1, 2014. The truck has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its estimated useful life of 10 years. Actual miles driven were 19,000 in 2014 and 16,000 in 2015. Instructions a) Compute depreciation expense for 2014 and 2015 using (1) the straight-line method and (1 mark) (2) the units-of-activity method (1 mark) (b) Assume that Linton uses the straight-line method Prepare the ioural entry to record 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts