Question: SECTION A You must answer ONE questions from Section A. You must use ONE WHITE answer sheet per question. To provide an answer that exceeds

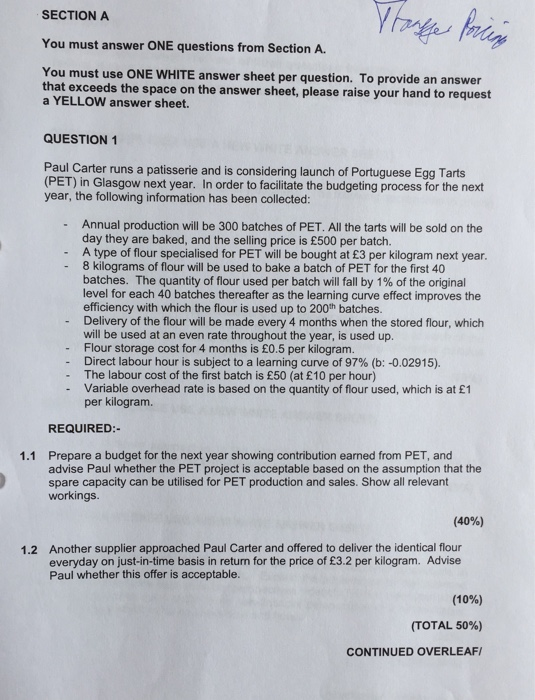

SECTION A You must answer ONE questions from Section A. You must use ONE WHITE answer sheet per question. To provide an answer that exceeds the space on the answer sheet, please raise your hand to request a YELLOW answer sheet. QUESTION 1 Paul Carter runs a patisserie and is considering launch of Portuguese Egg Tarts (PET) in Glasgow next year. In order to facilitate the budgeting process for the next year, the following information has been collected: Annual production will be 300 batches of PET. All the tarts will be sold on the day they are baked, and the selling price is 500 per batch. A type of flour specialised for PET will be bought at 3 per kilogram next year. 8 kilograms of flour will be used to bake a batch of PET for the first 40 batches. The quantity of flour used per batch will fall by 1% of the original level for each 40 batches thereafter as the learning curve effect improves the efficiency with which the flour is used up to 200th batches. Delivery of the flour will be made every 4 months when the stored flour, which will be used at an even rate throughout the year, is used up. - - - - - Flour storage cost for 4 months is 0.5 per kilogram. -Direct labour hour is subject to a learning curve of 97% (b:-002915). The labour cost of the first batch is 50 (at 10 per hour) Variable overhead rate is based on the quantity of flour used, which is at 1 per kilogram. - REQUIRED:- 1.1 Prepare a budget for the next year showing contribution earned from PET, and advise Paul whether the PET project is acceptable based on the assumption that the spare capacity can be utilised for PET production and sales. Show all relevant workings (40%) Another supplier approached Paul Carter and offered to deliver the identical flour everyday on just-in-time basis in return for the price of 3.2 per kilogram. Advise Paul whether this offer is acceptable. 1.2 (10%) (TOTAL 50%) CONTINUED OVERLEAF SECTION A You must answer ONE questions from Section A. You must use ONE WHITE answer sheet per question. To provide an answer that exceeds the space on the answer sheet, please raise your hand to request a YELLOW answer sheet. QUESTION 1 Paul Carter runs a patisserie and is considering launch of Portuguese Egg Tarts (PET) in Glasgow next year. In order to facilitate the budgeting process for the next year, the following information has been collected: Annual production will be 300 batches of PET. All the tarts will be sold on the day they are baked, and the selling price is 500 per batch. A type of flour specialised for PET will be bought at 3 per kilogram next year. 8 kilograms of flour will be used to bake a batch of PET for the first 40 batches. The quantity of flour used per batch will fall by 1% of the original level for each 40 batches thereafter as the learning curve effect improves the efficiency with which the flour is used up to 200th batches. Delivery of the flour will be made every 4 months when the stored flour, which will be used at an even rate throughout the year, is used up. - - - - - Flour storage cost for 4 months is 0.5 per kilogram. -Direct labour hour is subject to a learning curve of 97% (b:-002915). The labour cost of the first batch is 50 (at 10 per hour) Variable overhead rate is based on the quantity of flour used, which is at 1 per kilogram. - REQUIRED:- 1.1 Prepare a budget for the next year showing contribution earned from PET, and advise Paul whether the PET project is acceptable based on the assumption that the spare capacity can be utilised for PET production and sales. Show all relevant workings (40%) Another supplier approached Paul Carter and offered to deliver the identical flour everyday on just-in-time basis in return for the price of 3.2 per kilogram. Advise Paul whether this offer is acceptable. 1.2 (10%) (TOTAL 50%) CONTINUED OVERLEAF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts