Question: SECTION B (50 Marks) Question Two a) On the 18th March 2020, the Monetary Policy Committee (MPC) of the Bank of Ghana took the following

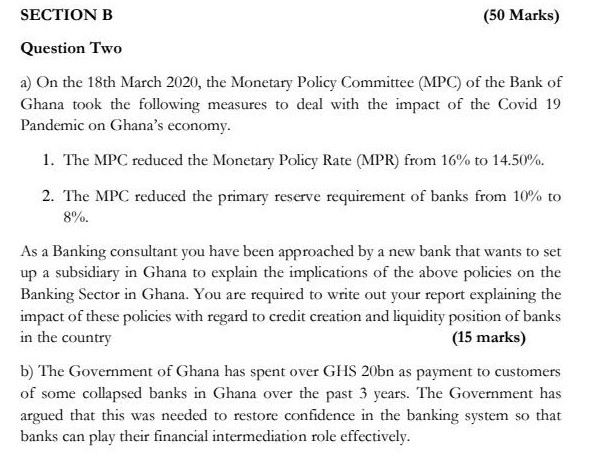

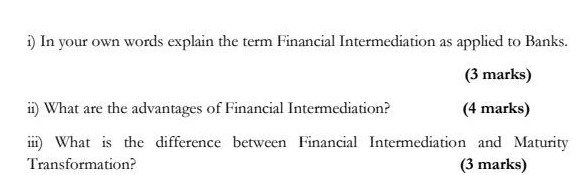

SECTION B (50 Marks) Question Two a) On the 18th March 2020, the Monetary Policy Committee (MPC) of the Bank of Ghana took the following measures to deal with the impact of the Covid 19 Pandemic on Ghana's economy. 1. The MPC reduced the Monetary Policy Rate (MPR) from 16% to 14.50%. 2. The MPC reduced the primary reserve requirement of banks from 10% to 8%. As a Banking consultant you have been approached by a new bank that wants to set up a subsidiary in Ghana to explain the implications of the above policies on the Banking Sector in Ghana. You are required to write out your report explaining the impact of these policies with regard to credit creation and liquidity position of banks in the country (15 marks) b) The Government of Ghana has spent over GHS 20bn as payment to customers of some collapsed banks in Ghana over the past 3 years. The Government has argued that this was needed to restore confidence in the banking system so that banks can play their financial intermediation role effectively. 1) In your own words explain the term Financial Intermediation as applied to Banks. (3 marks) i) What are the advantages of Financial Intermediation? (4 marks) 1) What is the difference between Financial Intermediation and Maturity Transformation? (3 marks) SECTION B (50 Marks) Question Two a) On the 18th March 2020, the Monetary Policy Committee (MPC) of the Bank of Ghana took the following measures to deal with the impact of the Covid 19 Pandemic on Ghana's economy. 1. The MPC reduced the Monetary Policy Rate (MPR) from 16% to 14.50%. 2. The MPC reduced the primary reserve requirement of banks from 10% to 8%. As a Banking consultant you have been approached by a new bank that wants to set up a subsidiary in Ghana to explain the implications of the above policies on the Banking Sector in Ghana. You are required to write out your report explaining the impact of these policies with regard to credit creation and liquidity position of banks in the country (15 marks) b) The Government of Ghana has spent over GHS 20bn as payment to customers of some collapsed banks in Ghana over the past 3 years. The Government has argued that this was needed to restore confidence in the banking system so that banks can play their financial intermediation role effectively. 1) In your own words explain the term Financial Intermediation as applied to Banks. (3 marks) i) What are the advantages of Financial Intermediation? (4 marks) 1) What is the difference between Financial Intermediation and Maturity Transformation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts