Question: SECTION B: CONCEPT ANALYSIS INSTRUCTION: Read and understand the given statement and answer the following question in your own words. Do not copy directly from

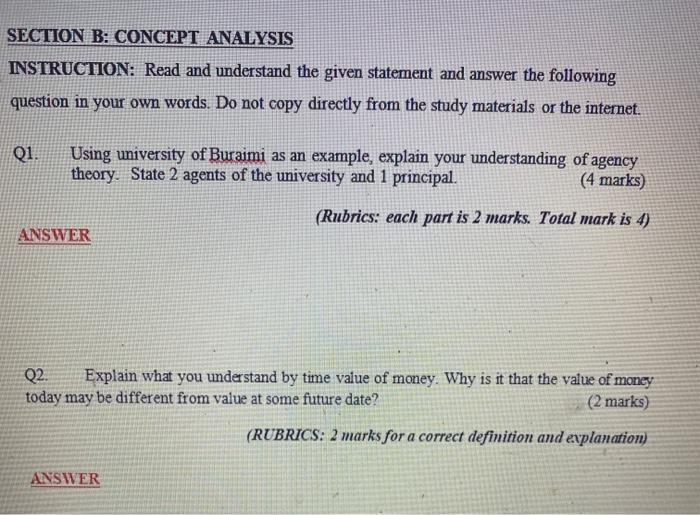

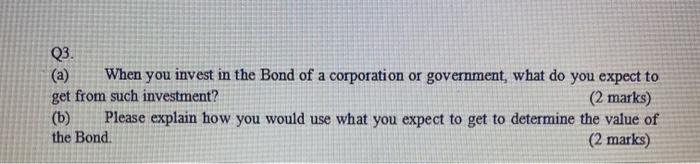

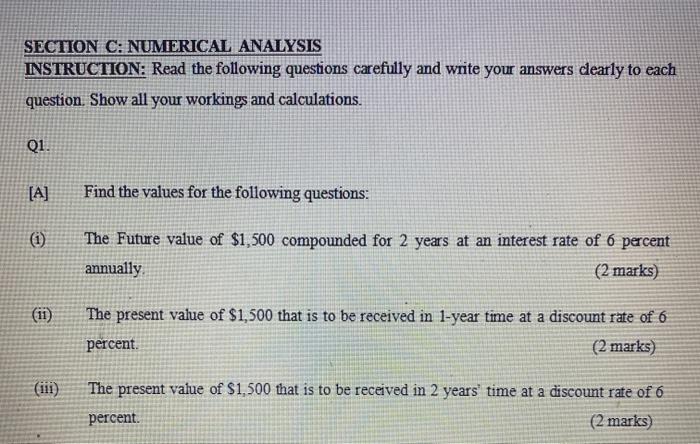

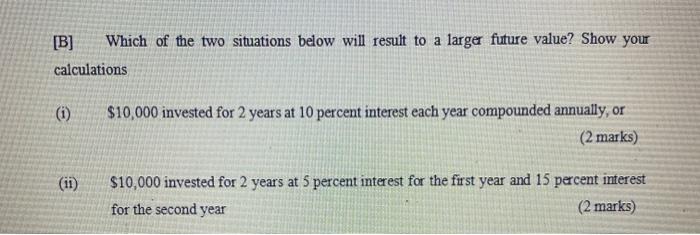

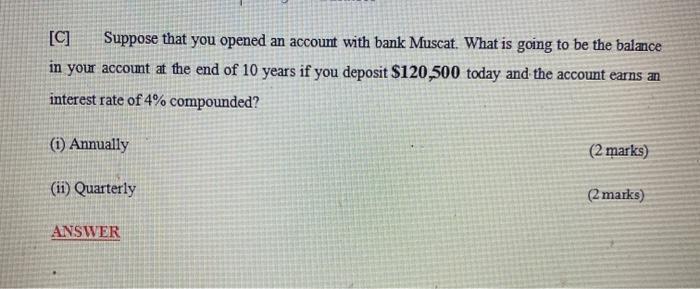

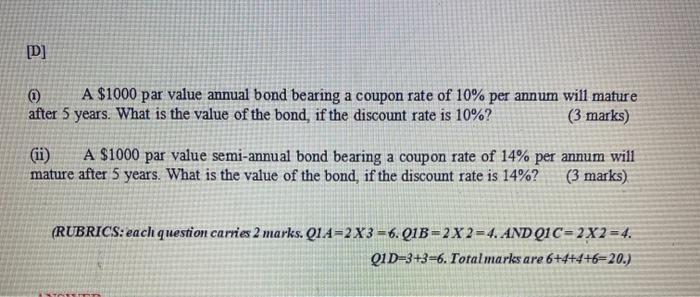

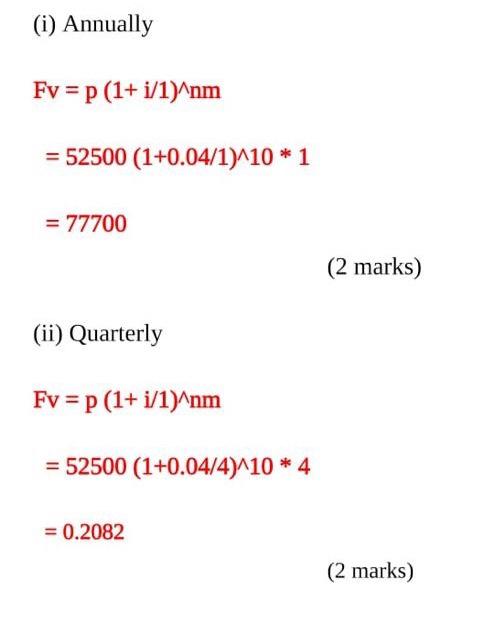

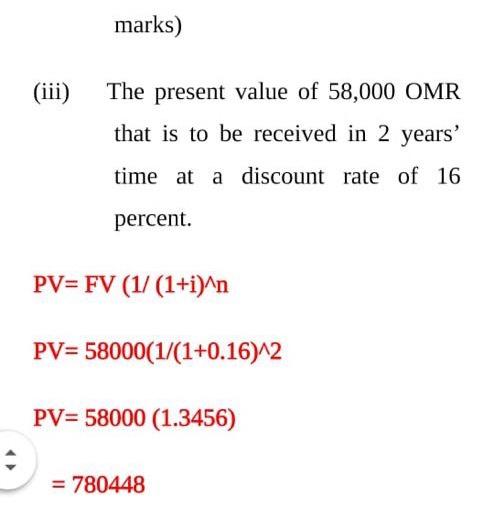

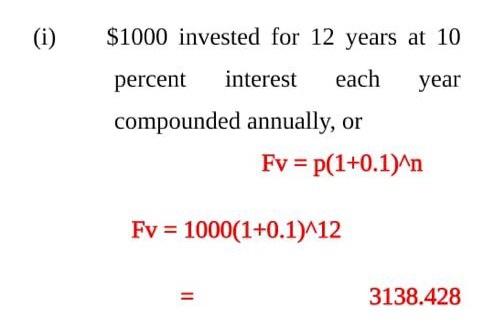

SECTION B: CONCEPT ANALYSIS INSTRUCTION: Read and understand the given statement and answer the following question in your own words. Do not copy directly from the study materials or the internet. Q1. Using university of Buraimi as an example, explain your understanding of agency theory. State 2 agents of the university and 1 principal. (4 marks) (Rubrics: each part is 2 marks. Total mark is 4) ANSWER Q2. Explain what you understand by time value of money. Why is it that the value of money today may be different from value at some future date? (2 marks) (RUBRICS: 2 marks for a correct definition and explanation) ANSWER Q3. (a) When you invest in the Bond of a corporation or government, what do you expect to get from such investment? (2 marks) (b) Please explain how you would use what you expect to get to determine the value of the Bond. (2 marks) SECTION C: NUMERICAL ANALYSIS INSTRUCTION: Read the following questions carefully and write your answers dearly to each question. Show all your workings and calculations. Q1. [A] Find the values for the following questions: The Future value of $1,500 compounded for 2 years at an interest rate of 6 percent annually (2 marks) (11) The present value of $1,500 that is to be received in 1-year time at a discount rate of 6 percent. (2 marks) The present value of $1,500 that is to be received in 2 years' time at a discount rate of 6 percent. (2 marks [B] Which of the two situations below will result to a larger future value? Show your calculations (i) $10,000 invested for 2 years at 10 percent interest each year compounded annually, or (2 marks) $10,000 invested for 2 years at 5 percent interest for the first year and 15 percent interest for the second year (2 marks) [C] Suppose that you opened an account with bank Muscat. What is going to be the balance in your account at the end of 10 years if you deposit $120,500 today and the account earns an interest rate of 4% compounded? (1) Annually (2 marks) (ii) Quarterly (2 marks) ANSWER [D] 0 A $1000 par value annual bond bearing a coupon rate of 10% per annum will mature after 5 years. What is the value of the bond, if the discount rate is 10%? (3 marks) A $1000 par value semi-annual bond bearing a coupon rate of 14% per annum will mature after 5 years. What is the value of the bond, if the discount rate is 14%? (3 marks) (RUBRICS: each question carries 2 marks. Q1A=2 X3 =6.01B=2X 2=4. AND QIC=2X2 = 4. Q1D=3+3=6. Total marks are 6+4+4+6=20.) (i) Annually Fv=P (1+i/1)^nm = 52500 (1+0.04/1) 10 * 1 = 77700 (2 marks) (ii) Quarterly Fv =P (1+i/1)^nm = 52500 (1+0.04/4)^10 * 4 = 0.2082 (2 marks) marks) (iii) The present value of 58,000 OMR that is to be received in 2 years' time at a discount rate of 16 percent. PV=FV (1/ (1+i)^n PV= 58000(1/(1+0.16)^2 PV=58000 (1.3456) = 780448 (i) $1000 invested for 12 years at 10 percent interest each year compounded annually, or Fv = P(1+0.1)^n Fv = 1000(1+0.1) 12 3138.428

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts