Question: SECTION B Question 8. [19 points) PART A. Montezemolo & Associates manages a $100 million equity portfolio for the multimanager Montalbano Pension Fund. Mr. Lindblad,

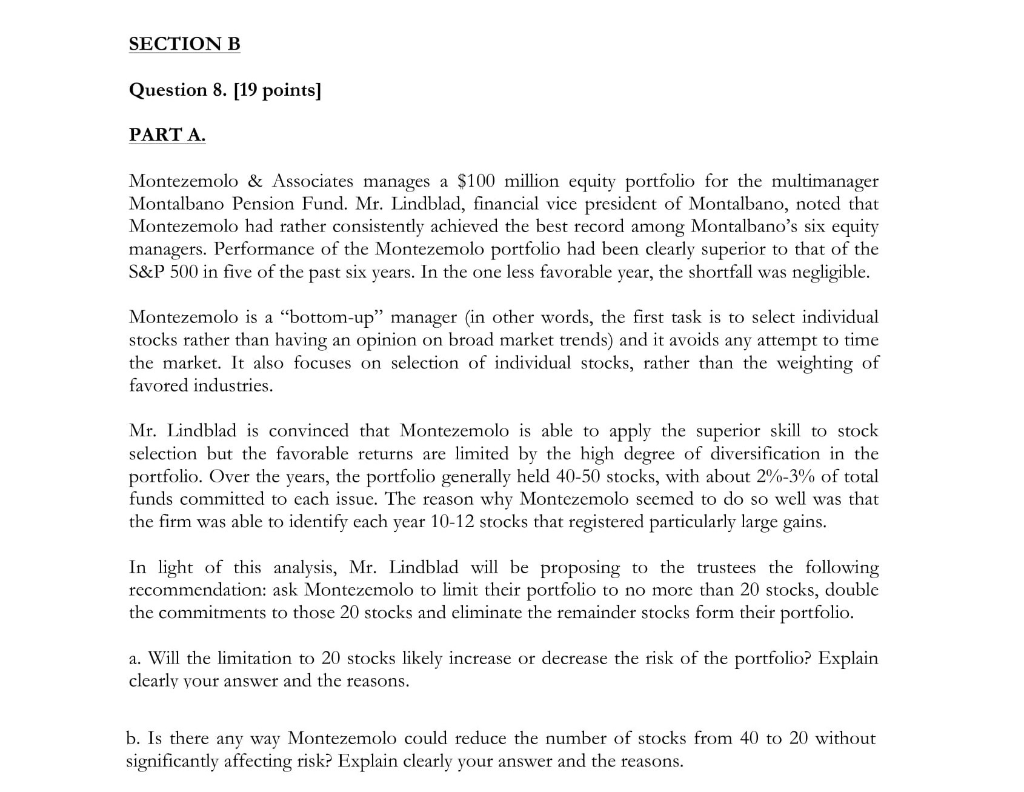

SECTION B Question 8. [19 points) PART A. Montezemolo & Associates manages a $100 million equity portfolio for the multimanager Montalbano Pension Fund. Mr. Lindblad, financial vice president of Montalbano, noted that Montezemolo had rather consistently achieved the best record among Montalbano's six equity managers. Performance of the Montezemolo portfolio had been clearly superior to that of the S&P 500 in five of the past six years. In the one less favorable year, the shortfall was negligible. Montezemolo is a "bottom-up manager (in other words, the first task is to select individual stocks rather than having an opinion on broad market trends) and it avoids any attempt to time the market. It also focuses on selection of individual stocks, rather than the weighting of favored industries. Mr. Lindblad is convinced that Montezemolo is able to apply the superior skill to stock selection but the favorable returns are limited by the high degree of diversification in the portfolio. Over the years, the portfolio generally held 40-50 stocks, with about 2%-3% of total funds committed to cach issue. The reason why Montezemolo seemed to do so well was that the firm was able to identify each year 10-12 stocks that registered particularly large gains. In light of this analysis, Mr. Lindblad will be proposing to the trustees the following recommendation: ask Montezemolo to limit their portfolio to no more than 20 stocks, double the commitments to those 20 stocks and eliminate the remainder stocks form their portfolio. a. Will the limitation to 20 stocks likely increase or decrease the risk of the portfolio? Explain clearly your answer and the reasons. b. Is there any way Montezemolo could reduce the number of stocks from 40 to 20 without significantly affecting risk? Explain clearly your answer and the reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts