Question: SECTION B R ANSWER ANY TWO (2) QUESTIONS QUESTION 2 [30 MARKS] (a) A company has a $1000 face value bond and a maturity of

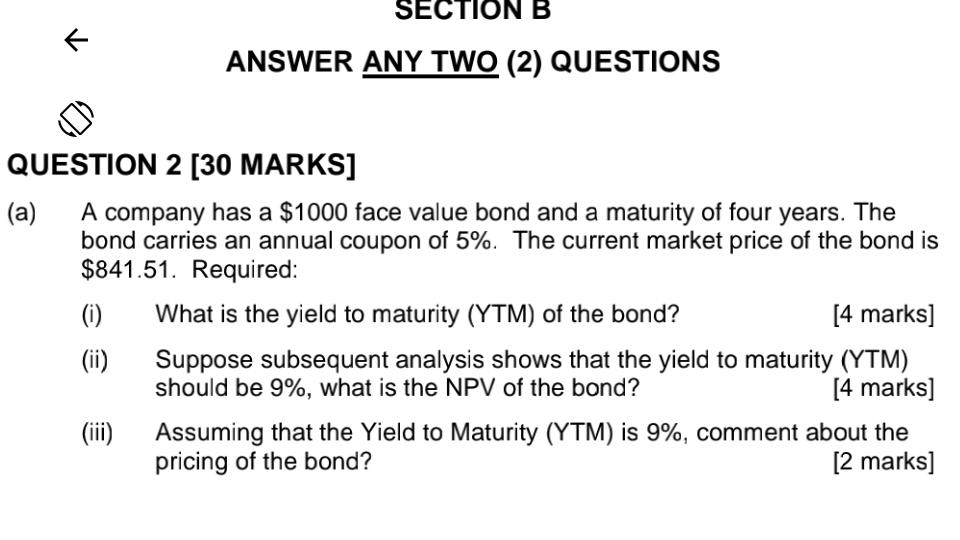

SECTION B R ANSWER ANY TWO (2) QUESTIONS QUESTION 2 [30 MARKS] (a) A company has a $1000 face value bond and a maturity of four years. The bond carries an annual coupon of 5%. The current market price of the bond is $841.51. Required: (1) What is the yield to maturity (YTM) of the bond? [4 marks] (ii) Suppose subsequent analysis shows that the yield to maturity (YTM) should be 9%, what is the NPV of the bond? [4 marks] (iii) Assuming that the Yield to Maturity (YTM) is 9%, comment about the pricing of the bond? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts