Question: Section I: Five (5) Multiple-Choice Questions Alex retired on January 1, 2022, at age 65. He is trying to figure out his 2022 tax situation

Section I: Five (5) Multiple-Choice Questions

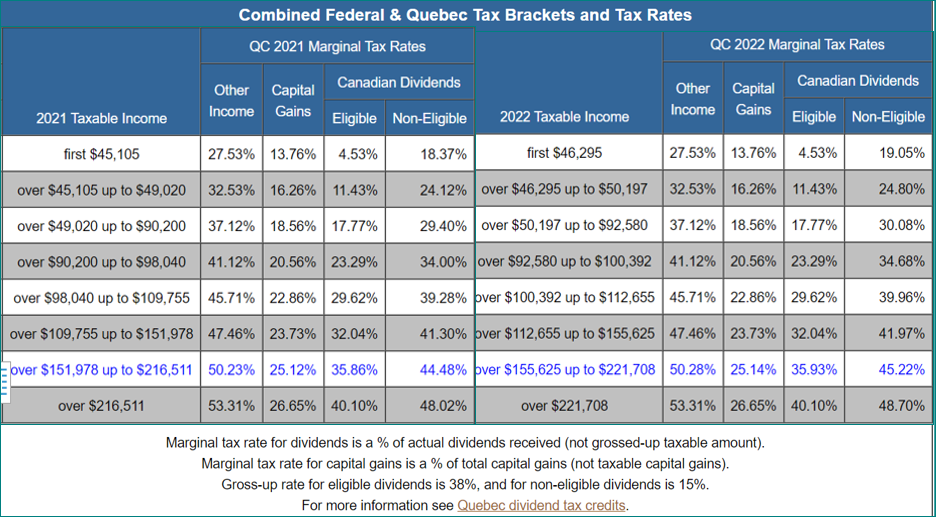

- Alex retired on January 1, 2022, at age 65. He is trying to figure out his 2022 tax situation as his income is so different from what he is used to.What is Alex's estimated marginal rate of tax for 2022 if he withdraws $10,250 from his Registered Retirement Savings Plan (RRSP), withdraws $10,000 from his Tax-Free Savings Account (TFSA), receives a retiree pension from his employer of $17,000, receives his Quebec Pension Plan (QPP) of $15,043 and receives his Old Age Security (OAS) pension benefits of $7,707. (All amounts are annualized and gross. See Table A; ignore Non-Refundable Tax Credits, and Quebec Abatement.)

- 27.53%

- 32.53%

- 37.12%

- 41.12%

- 45.71%

- Liz purchased 2,000 shares of Cosmetic Inc. for a total of $5,300 in April 2021 and was excited to receive a total of $1,400 in dividends throughout the year on these shares. She decides to sell 800 shares in April 2022 when the stock price hits $9.20/share. What is her Return On Investment (ROI) over the one year that she held them?

- 661%

- 561%

- 423%

- 382%

- 274%

- Lindsay is living with her mother but looking to purchase her first home. She just graduated from Concordia and landed her first full-time job; she has no savings. The property she is eyeing is $150,000. She wants a conventional mortgage. She figures she can save $975 at the beginning of each month and earn 7% compounded monthly. Approximately, how many years will it take her to accumulate the minimum required down payment for a conventional mortgage?

- 3.6 years

- 4.32 years

- 1.98 years

- 2.82 years

- 2.35 years

- For mutual funds, a Balanced Growth and Income Fund contain both growth stocks and stocks that pay high dividends. This type of fund__________________________________________.

- focuses on firms that pay a high level of dividends with less focus on growth.

- distributes dividends periodically, while offering more potential for an increase in the fund's value.

- focuses on firms that are more established than small-cap firms but may have less growth potential.

- focuses on stocks that have potential for above-average growth.

- attempts to mirror the movements of an existing equity index.

- Investors measure the risk of investments to determine the degree of uncertainty surrounding their future returns. Three common measures of an investment's risk are its ___________, ___________________, and its ________________.

- wealth; money; interest rates

- range of returns; the standard deviation of its returns; beta

- sector funds; monetary policy; consumer price index (CPI)

- default rate; US dollar; economic growth

- fiscal policy; inflation; asset allocation

Section I completed, continue to Section II.

Section II: Five (5) Mini-Cases

Mini-Case A:

Ankit invested in a great mutual fund called Fabulous Inc., however, with the pandemic and the effects on the economy, the mutual fund has taken quite a hit. Ankit needs the money and has no choice but to sell in his third year of holding this mutual fund. Three yearsago, Ankitpurchased 2,000 shares for $19.35/share and decided to sell all his shares on April 8, 2022, when the share price was at $8.25/share. His investment broker counselled him not to sell as the fund was a back-end loaded fund.

| Year funds are redeemed/sold | Deferred sales charge |

| Within the first year | 6% |

| In the second year | 5% |

| In the third year | 4% |

| In the fourth year | 3% |

| In the fifth year | 2% |

| In the sixth year | 1% |

| After the sixth year | 0% |

- What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the value of the fund when it is redeemed? (ignore income taxes)

Calculate the amount that Ankit will receive:

- What is the amount that Ankit will receive for the sale of these shares if the deferred sales charge is based on the original share price when purchased? (ignore income taxes)

Calculate the amount that Ankit will receive:

- Ankit is a resident of Quebec and in the highest marginal tax bracket. Ankit is trying to figure out his taxes payable based on the following sale of his stocks. Ankit has capital gains of $30,000 that were triggered in January of this year on the sale of other stocks and now has the sale of Fabulous Inc. Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date.(Take your response in a) into consideration and Table A)

Calculate the amount of taxes payable that Ankit will pay on the sale of his shares to date:

TABLE A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts