Question: Select the accounts that will be impacted by the following transaction and drag them to the correct section of the accounting equation. Once the T-account

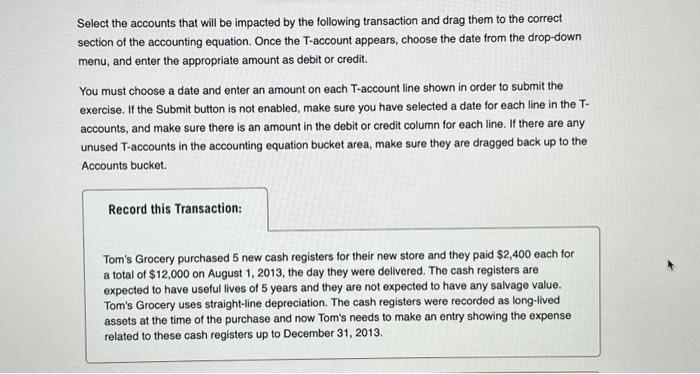

Select the accounts that will be impacted by the following transaction and drag them to the correct section of the accounting equation. Once the T-account appears, choose the date from the drop-down menu, and enter the appropriate amount as debit or credit. You must choose a date and enter an amount on each T-account line shown in order to submit the exercise. If the Submit button is not enabled, make sure you have selected a date for each line in the T accounts, and make sure there is an amount in the debit or credit column for each line. If there are any unused T-accounts in the accounting equation bucket area, make sure they are dragged back up to the Accounts bucket. Record this Transaction: Tom's Grocery purchased 5 new cash registers for their new store and they paid $2,400 each for a total of $12,000 on August 1,2013, the day they were delivered. The cash registers are expected to have useful lives of 5 years and they are not expected to have any salvage value. Tom's Grocery uses straight-line depreciation. The cash registers were recorded as long-lived assets at the time of the purchase and now Tom's needs to make an entry showing the expense related to these cash registers up to December 31, 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts