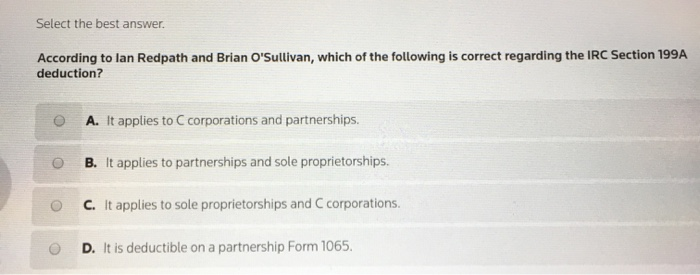

Question: Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following is correct regarding the IRC Section 199A deduction? A. It

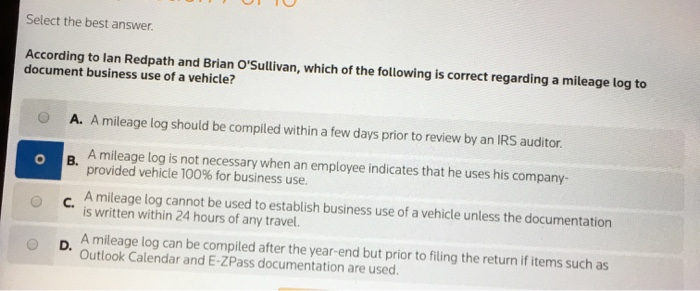

Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following is correct regarding the IRC Section 199A deduction? A. It applies to C corporations and partnerships. B. It applies to partnerships and sole proprietorships. C. It applies to sole proprietorships and C corporations. D. It is deductible on a partnership Form 1065. Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following is correct regarding a mileage log to document business use of a vehicle? A. A mileage log should be compiled within a few days prior to review by an IRS auditor. B A mileage log is not necessary when an employee indicates that he uses his company- provided vehicle 100% for business use. Oo A mileage log cannot be used to establish business use of a vehicle unless the documentation *** is written within 24 hours of any travel, D. A mileage log can be compiled after the year-end but prior to filing the return if items such as * Outlook Calendar and E ZPass documentation are used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts