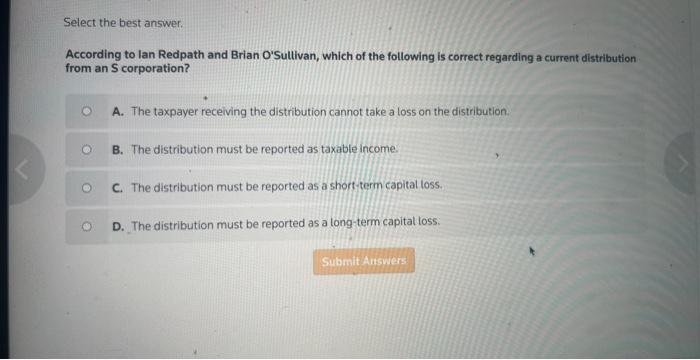

Question: Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following is correct regarding a current distribution from an S corporation?

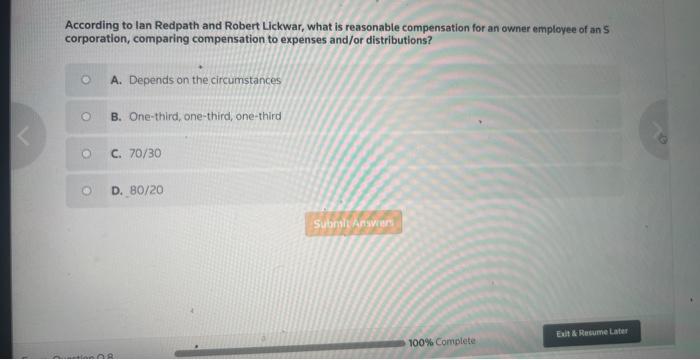

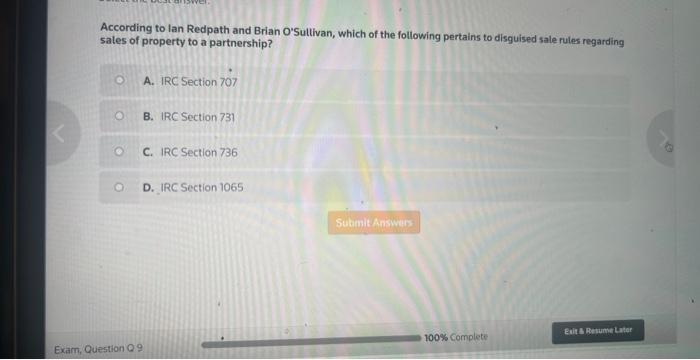

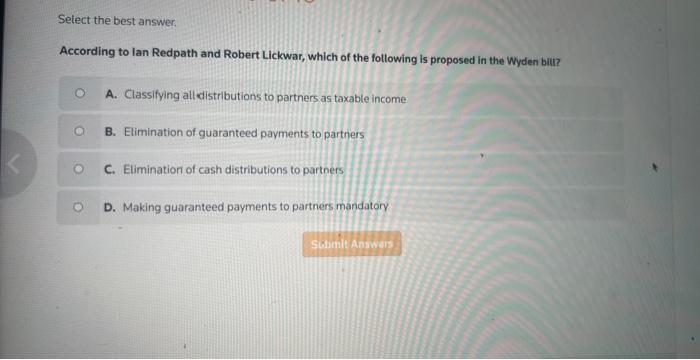

Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following is correct regarding a current distribution from an S corporation? O A. The taxpayer receiving the distribution cannot take a loss on the distribution. O B. The distribution must be reported as taxable Income. O C. The distribution must be reported as a short-term capital loss, O D. The distribution must be reported as a long-term capital loss. Submit AnswersAccording to lan Redpath and Robert Lickwar, what is reasonable compensation for an owner employee of an 5 corporation, comparing compensation to expenses and/or distributions? A. Depends on the circumstances O B. One-third, one-third, one-third C. 70/30 D. 80/20 Edit & Retume Later 100% CompleteAccording to lan Redpath and Brian O'Sullivan, which of the following pertains to disguised sale rules regarding sales of property to a partnership? A. IRC Section 707 O B. IRC Section 731

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts