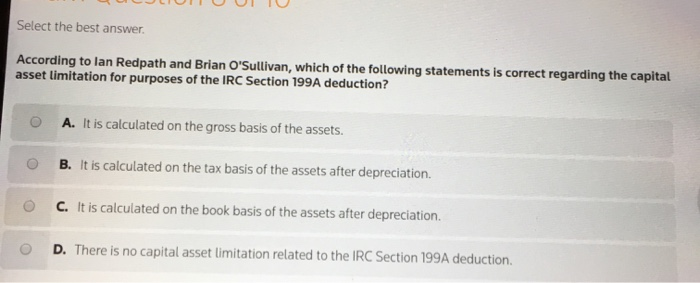

Question: Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following statements is correct regarding the capital asset limitation for purposes

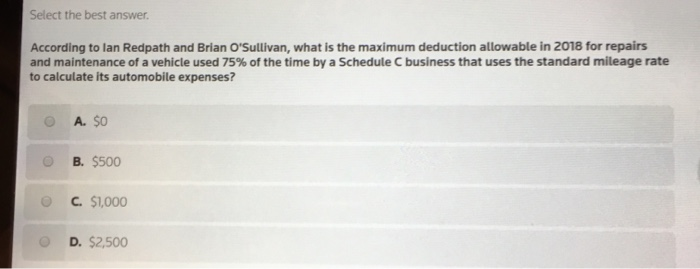

Select the best answer. According to lan Redpath and Brian O'Sullivan, which of the following statements is correct regarding the capital asset limitation for purposes of the IRC Section 199A deduction? O A. It is calculated on the gross basis of the assets. B. It is calculated on the tax basis of the assets after depreciation. C. It is calculated on the book basis of the assets after depreciation. D. There is no capital asset limitation related to the IRC Section 199A deduction Select the best answer. According to lan Redpath and Brian O'Sullivan, what is the maximum deduction allowable in 2018 for repairs and maintenance of a vehicle used 75% of the time by a Schedule C business that uses the standard mileage rate to calculate its automobile expenses? A. $0 B. $500 C. $1,000 D. $2,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts