Question: Select the incorrect alternative in relation to the bad debts deduction of 5 2 5 - 3 5 ITAA 9 7 : A taspayer accounting

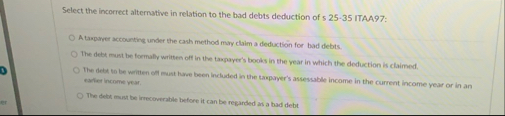

Select the incorrect alternative in relation to the bad debts deduction of ITAA:

A taspayer accounting under the cash method may claim a deduction for bad debis.

The debt must be formally written off in the taxpayer's books in the year in which the defluction is claimed.

The detat to be werthen off must have been included in the taxpayer's assessable income in the current income year or in an exter income war.

The debt must be irrece orrable before it can be regarded as a bad debt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock