Question: Reed Company has two departments, a machining department and a finishing department. The following information relates to the finishing department: Work-in-Process, November 1, was

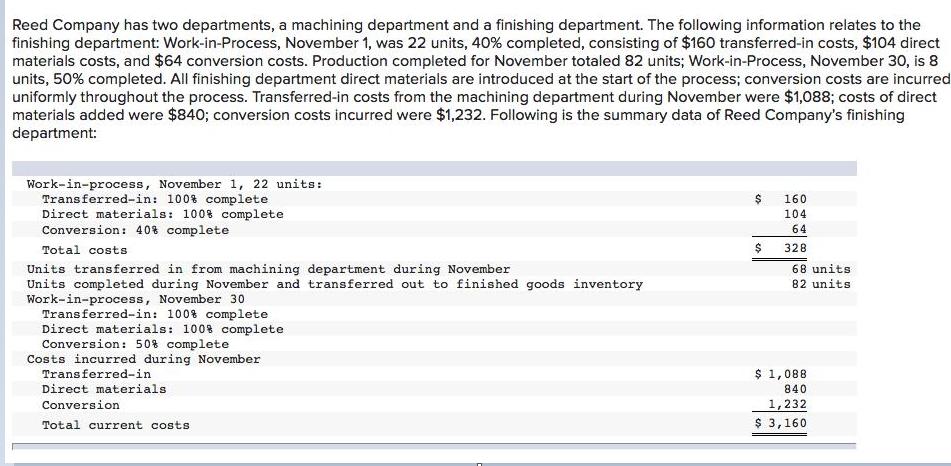

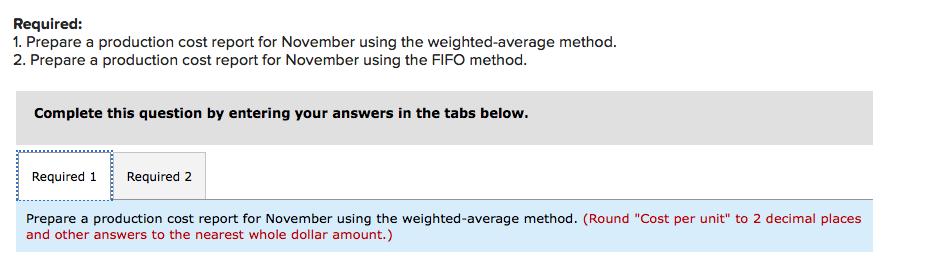

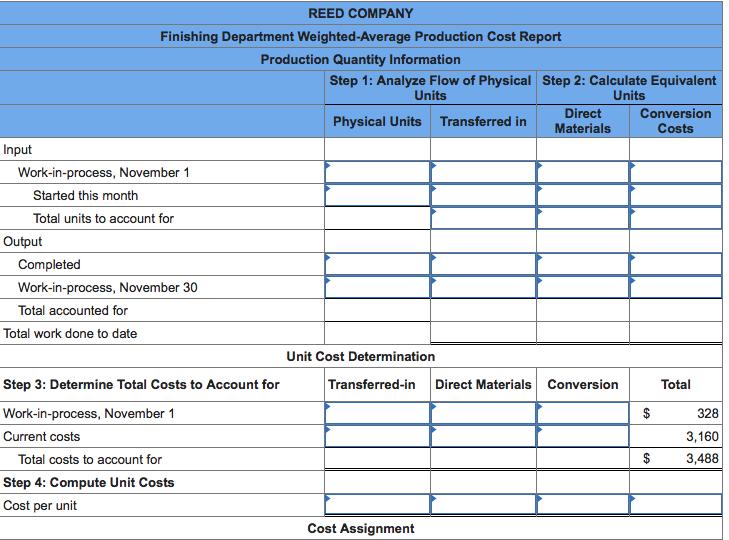

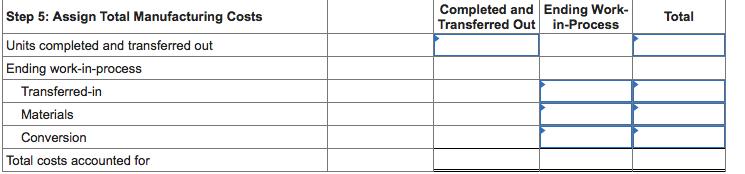

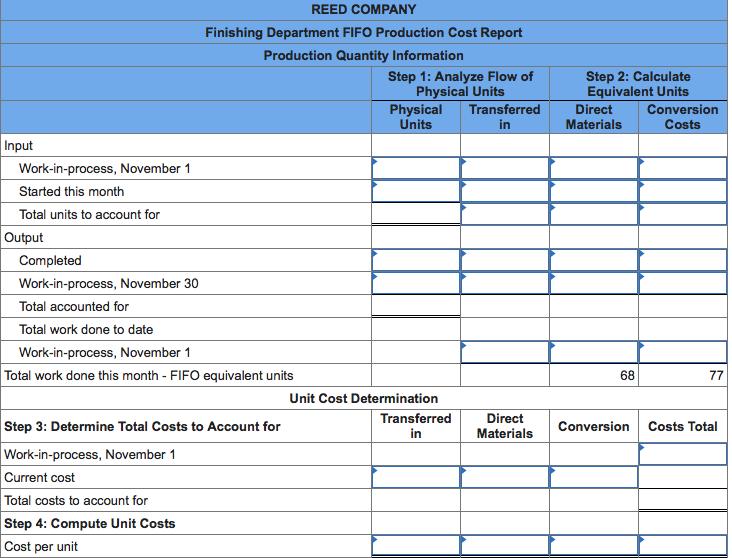

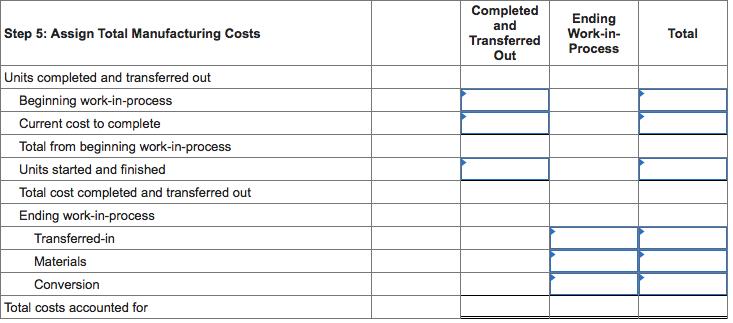

Reed Company has two departments, a machining department and a finishing department. The following information relates to the finishing department: Work-in-Process, November 1, was 22 units, 40% completed, consisting of $160 transferred-in costs, $104 direct materials costs, and $64 conversion costs. Production completed for November totaled 82 units; Work-in-Process, November 30, is 8 units, 50% completed. All finishing department direct materials are introduced at the start of the process; conversion costs are incurred uniformly throughout the process. Transferred-in costs from the machining department during November were $1,088; costs of direct materials added were $840; conversion costs incurred were $1,232. Following is the summary data of Reed Company's finishing department: Work-in-process, November 1, 22 units: Transferred-in: 100% complete Direct materials: 1008 complete Conversion: 40% complete 160 104 64 Total costs 2$ 328 68 units Units transferred in from machining department during November Units completed during November and transferred out to finished goods inventory Work-in-process, November 30 Transferred-in: 100% complete Direct materials: 1008 complete Conversion : 50% complete Costs incurred during November 82 units Transferred-in $ 1,088 Direct materials 840 Conversion 1,232 Total current costs $ 3,160 Required: 1. Prepare a production cost report for November using the weighted-average method. 2. Prepare a production cost report for November using the FIFO method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a production cost report for November using the weighted-average method. (Round "Cost per unit" to 2 decimal places and other answers to the nearest whole dollar amount.) REED COMPANY Finishing Department Weighted-Average Production Cost Report Production Quantity Information Step 1: Analyze Flow of Physical Step 2: Calculate Equivalent Units Units Physical Units Transferred in Direct Materials Conversion Costs Input Work-in-process, November 1 Started this month Total units to account for Output Completed Work-in-process, November 30 Total accounted for Total work done to date Unit Cost Determination Step 3: Determine Total Costs to Account for Transferred-in Direct Materials Conversion Total Work-in-process, November 1 $ 328 Current costs 3,16 Total costs to account for $ 3,488 Step 4: Compute Unit Costs Cost per unit Cost Assignment Completed and Ending Work- Transferred Out in-Process Step 5: Assign Total Manufacturing Costs Total Units completed and transferred out Ending work-in-process Transferred-in Materials Conversion Total costs accounted for REED COMPANY Finishing Department FIFO Production Cost Report Production Quantity Information Step 1: Analyze Flow of Physical Units Physical Units Step 2: Calculate Equivalent Units Transferred in Direct Materials Conversion Costs Input Work-in-process, November 1 Started this month Total units to account for Output Completed Work-in-process, November 30 Total accounted for Total work done to date Work-in-process, November 1 Total work done this month - FIFO equivalent units 68 77 Unit Cost Determination Transferred Direct Step 3: Determine Total Costs to Account for Work-in-process, November 1 Conversion Costs Total in Materials Current cost Total costs to account for Step 4: Compute Unit Costs Cost per unit Completed and Transferred Out Ending Work-in- Process Step 5: Assign Total Manufacturing Costs Total Units completed and transferred out Beginning work-in-process Current cost to complete Total from beginning work-in-process Units started and finished Total cost completed and transferred out Ending work-in-process Transferred-in Materials Conversion Total costs accounted for

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

ANSWER is ... View full answer

Get step-by-step solutions from verified subject matter experts