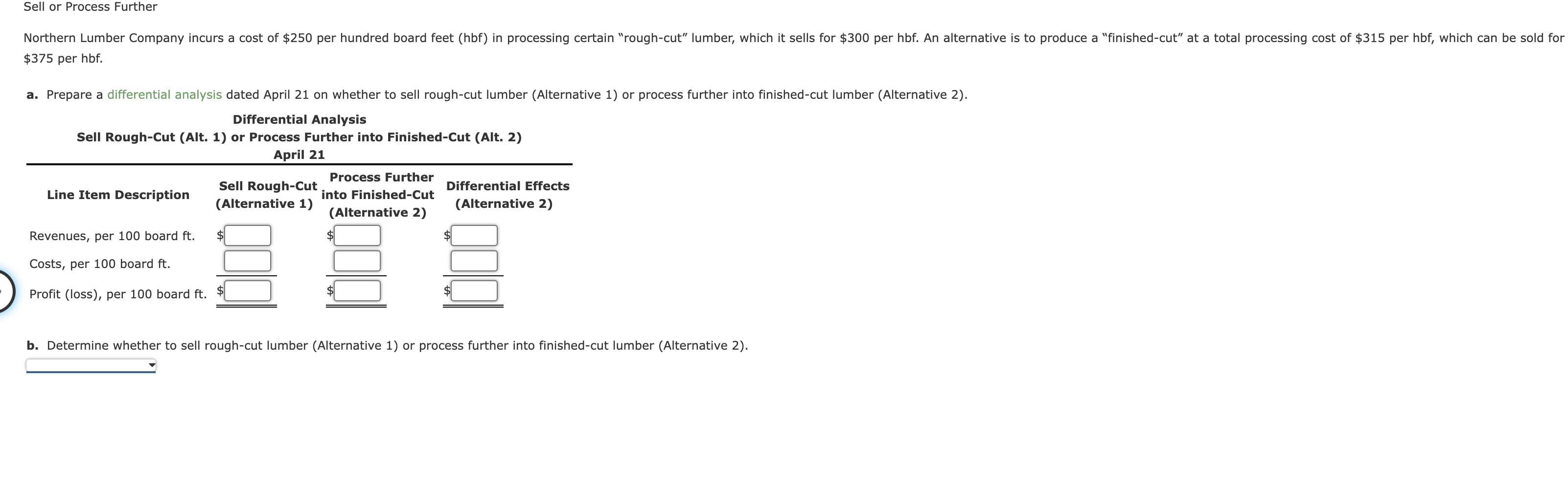

Question: Sell or Process Further $ 3 7 5 per hbf . a . Prepare a differential analysis dated April 2 1 on whether to

Sell or Process Further $ per hbf

a Prepare a differential analysis dated April on whether to sell roughcut lumber Alternative or process further into finishedcut lumber Alternative

Differential Analysis

Sell RoughCut Alt or Process Further into FinishedCut Alt

April

b Determine whether to sell roughcut lumber Alternative or process further into finishedcut lumber Alternative MakeorBuy Decision labor cost. The unit costs to produce comparable carrying cases are expected to be as follows:

If Pizana Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be of the direct labor costs. Differential Analysis Make Alt or Buy Alt Carrying Case

May

b Assuming there were no better alternative uses for the spare capacity, it would

to manufacture the carrying cases. Fixed factory overhead is

to this decision. Building a balanced scorecard concerned about her ability to manage and control the business. Gutierrez describes how the company was built, its key success factors, and its recent growth: equipment. I made unique meals from quality ingredients and didn't serve anything that wasn't perfect. I changed my location daily and notified customers of my location via Twitter. to do everything that I used to do by myself. Now, I work with my team to build the menu, set daily locations for the trucks, and manage the operations of the business. them. I rely on them to maintain the quality that I established when I opened my first truck. the prices that I charge for my meals and the success of my business.

Identify whether these measures best fit the learning and growth, internal processes, customer, or financial performance perspective of the balanced scorecard.

Possible Balanced Scorecard Measures

Average ingredients cost per order

Number of meals purchased

Online customer review ratings

Number of customer complaints

Average employee wage

Average training hours per new employee

Quality ratings of ingredients suppliers

Gross profit

Profit margin

Number of unique meals on the menu

Performance Perspective Average rate of returnnew product $ and an year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows:

begintabularlr

Cost per unit:

Direct labor & $

Direct materials &

Factory overhead including depreciation &

hline Total cost per unit & boxed

endtabular

Determine the average rate of return on the equipment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock