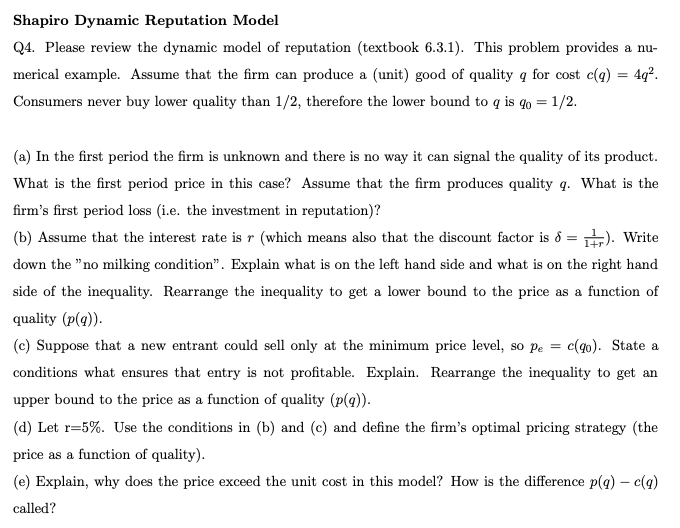

Question: Shapiro Dynamic Reputation Model Q4. Please review the dynamic model of reputation (textbook 6.3.1). This problem provides a nu = 4q2 merical example. Assume that

Shapiro Dynamic Reputation Model Q4. Please review the dynamic model of reputation (textbook 6.3.1). This problem provides a nu = 4q2 merical example. Assume that the firm produce a (unit) good of quality c(g) q for cost can Consumers never buy lower quality than 1/2, therefore the lower bound to q is qo = 1/2. way it can signal the quality of its product (a) In the first period the firm is unknown and there is no C What is the first period price in this case? Assume that the firm produces quality q. What is the firm's first period loss (i.e. the investment in reputation)? (b) Assume that the interest rate is r which means also that the discount factor is 6 Write down the "no milking condition". Explain what is on the left hand side and what is on the right hand side of the inequality. Rearrange the inequality to get a lower bound to the price as a function of quality (p(g) c(go) State a (c) Suppose that a new entrant could sell only at the minimum price level, So Pe conditions what ensures that entry is not profitable. Explain. Rearrange the inequality to get an upper bound to the price as a function of quality (p(q)) (d) Let r 5%. Use the conditions in (b) and (c) and define the firm's optimal pricing strategy (the function of quality) price as a (e) Explain, why does the price exceed the unit cost in this model? How is the difference p(q) - c(g) called? Shapiro Dynamic Reputation Model Q4. Please review the dynamic model of reputation (textbook 6.3.1). This problem provides a nu = 4q2 merical example. Assume that the firm produce a (unit) good of quality c(g) q for cost can Consumers never buy lower quality than 1/2, therefore the lower bound to q is qo = 1/2. way it can signal the quality of its product (a) In the first period the firm is unknown and there is no C What is the first period price in this case? Assume that the firm produces quality q. What is the firm's first period loss (i.e. the investment in reputation)? (b) Assume that the interest rate is r which means also that the discount factor is 6 Write down the "no milking condition". Explain what is on the left hand side and what is on the right hand side of the inequality. Rearrange the inequality to get a lower bound to the price as a function of quality (p(g) c(go) State a (c) Suppose that a new entrant could sell only at the minimum price level, So Pe conditions what ensures that entry is not profitable. Explain. Rearrange the inequality to get an upper bound to the price as a function of quality (p(q)) (d) Let r 5%. Use the conditions in (b) and (c) and define the firm's optimal pricing strategy (the function of quality) price as a (e) Explain, why does the price exceed the unit cost in this model? How is the difference p(q) - c(g) called

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts