Question: show me step by step how to solve these 2 problems please. 3. ABC Inc is projected to have EBITDA of $50 in year 1

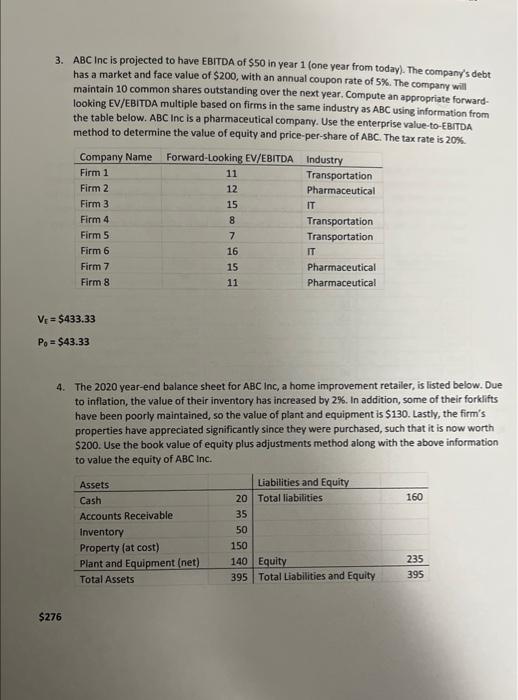

3. ABC Inc is projected to have EBITDA of $50 in year 1 (one year from today). The company's debt has a market and face value of $200, with an annual coupon rate of 5%. The company will maintain 10 common shares outstanding over the next year. Compute an appropriate forwardlooking EV/EBITDA multiple based on firms in the same industry as ABC using information from the table below. ABC Inc is a pharmaceutical company. Use the enterprise value-to-EBrTDA method to determine the value of equity and price-per-share of ABC. The tax rate is 20%. VC=$433.33 P0=$43.33 4. The 2020 year-end balance sheet for ABC inc, a home improvement retailer, is listed below. Due to inflation, the value of their inventory has increased by 2%. In addition, some of their forklifts have been poorly maintained, so the value of plant and equipment is $130. Lastly, the firm's properties have appreciated significantly since they were purchased, such that it is now worth $200. Use the book value of equity plus adjustments method along with the above information to value the equity of ABC inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts