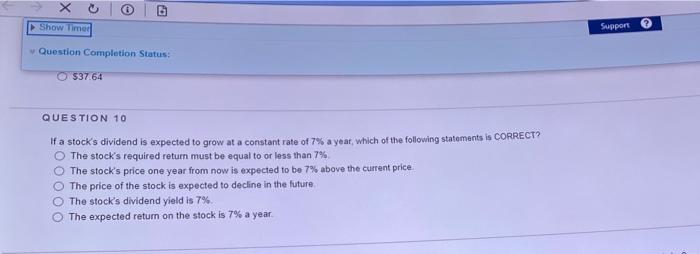

Question: Show Timer Support Question Completion Status: $37.64 QUESTION 10 If a stock's dividend is expected to grow at a constant rate of 7% a year,

Show Timer Support Question Completion Status: $37.64 QUESTION 10 If a stock's dividend is expected to grow at a constant rate of 7% a year, which of the following statements is CORRECT? The stock's required return must be equal to or less than 7% The stock's price one year from now is expected to be 7% above the current price The price of the stock is expected to decline in the future The stock's dividend yield is 7% The expected return on the stock is 7% a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts