Question: SHOW WORK FOR PT 2 Ch6 1. Assuming that the term structure of interest rates is determined as posited by the pure expectations theory, which

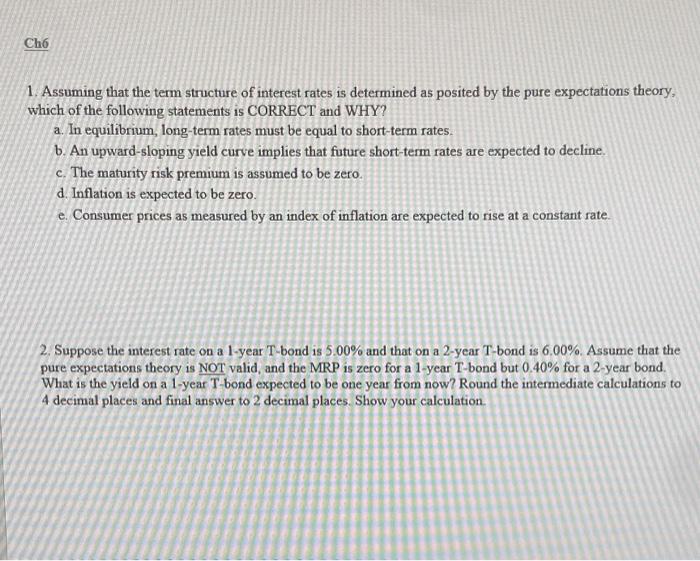

Ch6 1. Assuming that the term structure of interest rates is determined as posited by the pure expectations theory, which of the following statements is CORRECT and WHY? a. In equilibrium, long-term rates must be equal to short-term rates. b. An upward-sloping yield curve implies that future short-term rates are expected to decline. c. The maturity risk premium is assumed to be zero. d. Inflation is expected to be zero. e. Consumer prices as measured by an index of inflation are expected to rise at a constant rate. 2. Suppose the interest rate on a 1-year T-bond is 5.00% and that on a 2-year T-bond is 6.00% Assume that the pure expectations theory is NOT valid, and the MRP is zero for a 1-year T-bond but 0.40% for a 2-year bond. What is the yield on a 1-year T-bond expected to be one year from now? Round the intermediate calculations to 4 decimal places and final answer to 2 decimal places. Show your calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts