Question: Show work please Additional Turn-In Problem 1 (The Sharpe Ratio) The table below reports the rate of return for mutual fund A, mutual fund B,

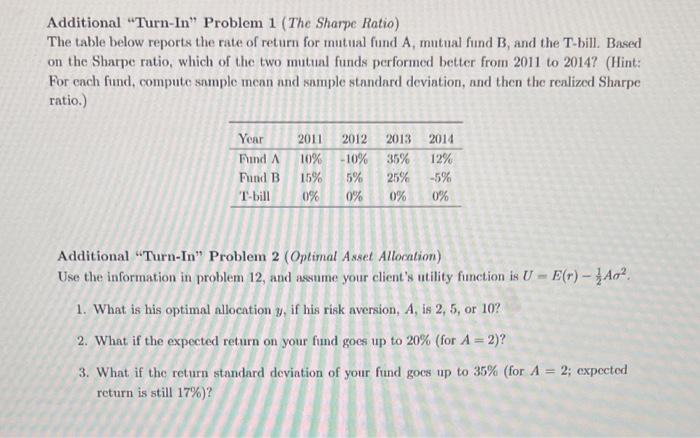

Additional "Turn-In" Problem 1 (The Sharpe Ratio) The table below reports the rate of return for mutual fund A, mutual fund B, and the T-bill. Based on the Sharpe ratio, which of the two mutual funds performed better from 2011 to 2014? (Hint: For each find, compute sample mean and sample standard deviation, and then the realized Sharpe ratio.) Year Fund A Fund B -bill 2011 2012 2013 10%-10% 35% 15% 5% 0% 0% 0% 2014 12% -5% 25% 0% Additional "Turn-In" Problem 2 (Optimal Asset Allocation) Use the information in problem 12, and assume your client's utility function is U = E(r) - Ao? 1. What is his optimal allocation y, if his risk aversion, A, is 2, 5, or 107 2. What if the expected return on your fiind goes up to 20% (for A = 2)? 3. What if the return standard deviation of your fund gocs up to 35% (for A = 2; expected return is still 17%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts