Question: Show your work. Do not just write down the final answers. I suggest that you use formulas to solve the problems, If you want to

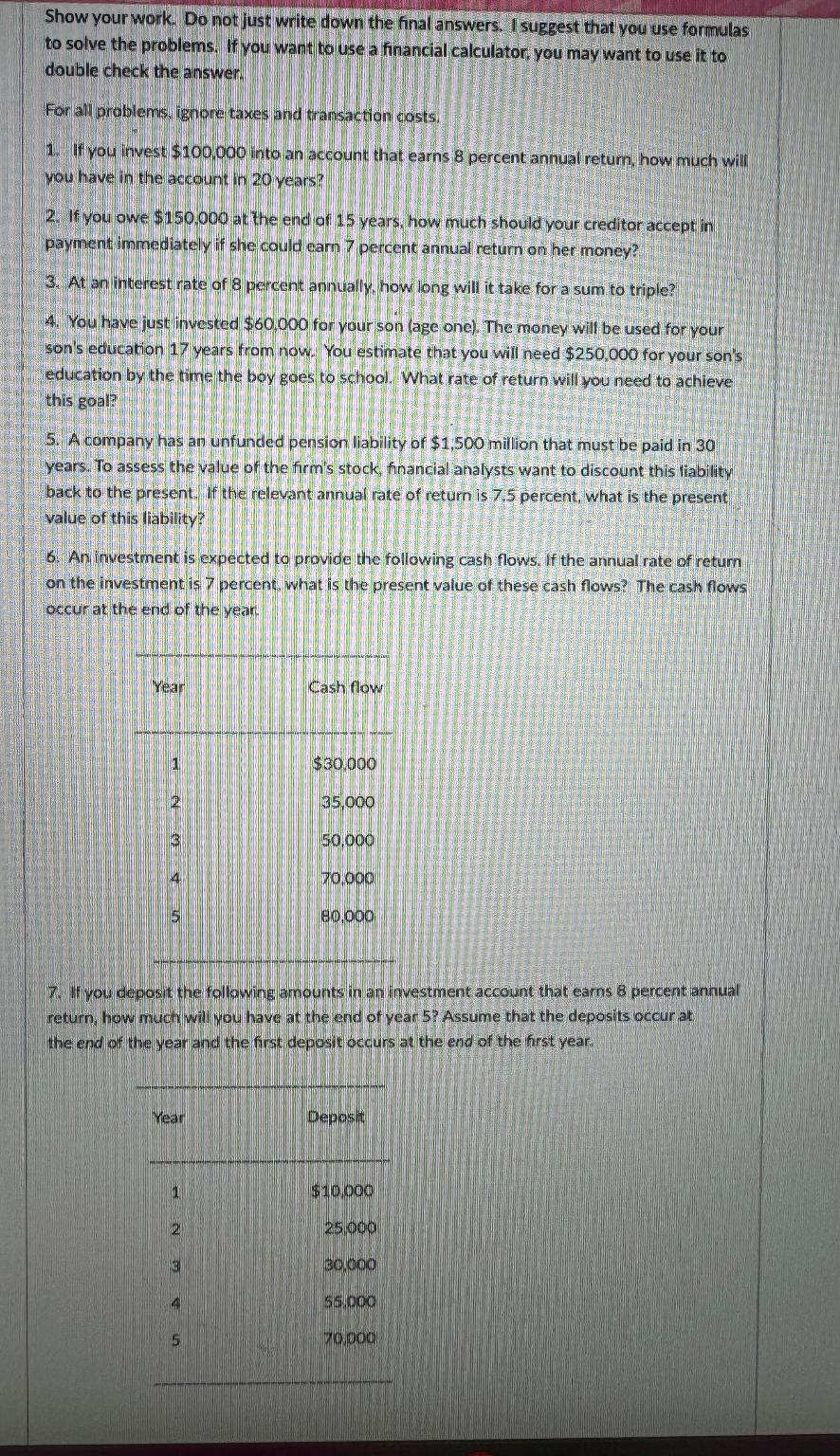

Show your work. Do not just write down the final answers. I suggest that you use formulas to solve the problems, If you want to use a financial calculator, you may want to use it to double check the answer.

For all problemis, ignore taxes and transaction costs:

If you invest $ into an account that earns percent annual retum, how much will you have in the account in years?

If you owe $ at the end of years, how much should your creditor accept in payment immediately if she could earn percent annual return on her money?

At an interest rate of percent annually how long will it take for a sum to triple?

You have just invested $ for vour son age one The money will be used for your son's education years from now. You estimate that you will need $ for your son's education by the time the boy goes to school. What rate of return will you need to achieve this goal?

A company has an unfunded pension liability of $ million that must be paid in years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant annual rate of retum is percent, what is the present value of this liability?

An investment is expected to provide the following cash flows. If the annual rate of return on the investment is percent, what is the present value of these cash flows? The cash flows occur at the end of the year.

tableYearCash flow$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock