Question: Show your work, please Thanks Johnson Ltd. reported the following information on financial statements for the year ended December 31, 2019: Accounts receivable Allowance for

Show your work, please

Thanks

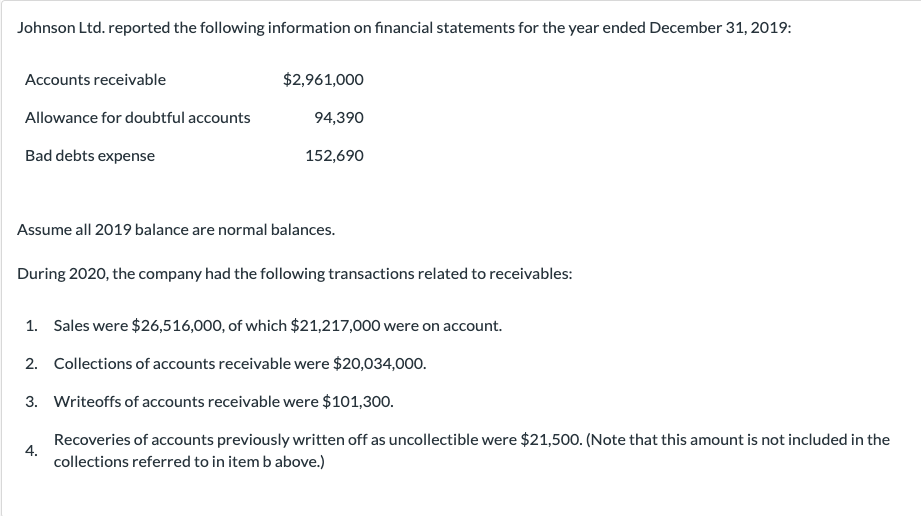

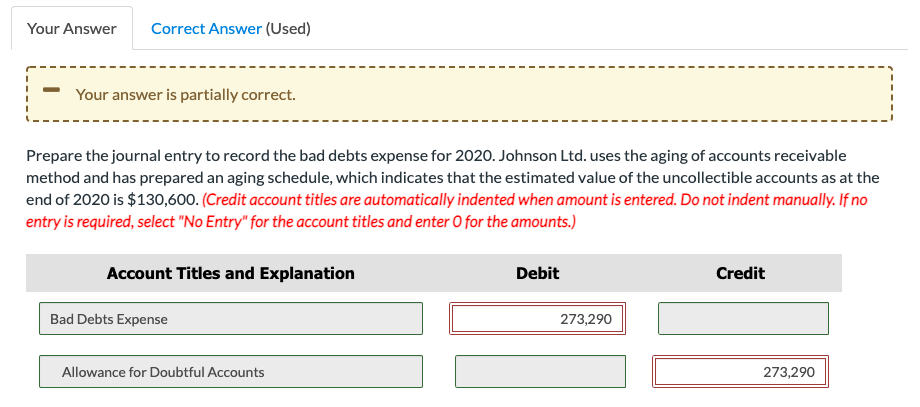

Johnson Ltd. reported the following information on financial statements for the year ended December 31, 2019: Accounts receivable Allowance for doubtful accounts Bad debts expense $2,961,000 94,390 152,690 Assume all 2019 balance are normal balances. During 2020, the company had the following transactions related to receivables: 1. Sales were $26,516,000, of which $21,217,000 were on account. 2. Collections of accounts receivable were $20,034,000. 3. Writeoffs of accounts receivable were $101,300. Recoveries of accounts previously written off as uncollectible were $21,500. (Note that this amount is not included in the collections referred to in item b above.) 4. Your Answer Correct Answer (Used) Your answer is partially correct. Prepare the journal entry to record the bad debts expense for 2020. Johnson Ltd. uses the aging of accounts receivable method and has prepared an aging schedule, which indicates that the estimated value of the uncollectible accounts as at the end of 2020 is $130,600. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Bad Debts Expense Allowance for Doubtful Accounts Debit 273,290 Credit 273,290

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts