Question: Simulation Project (100 Points) Please read the problems carefully, build a simulation model for each problem and answer each part accordingly. 11. In preparing for

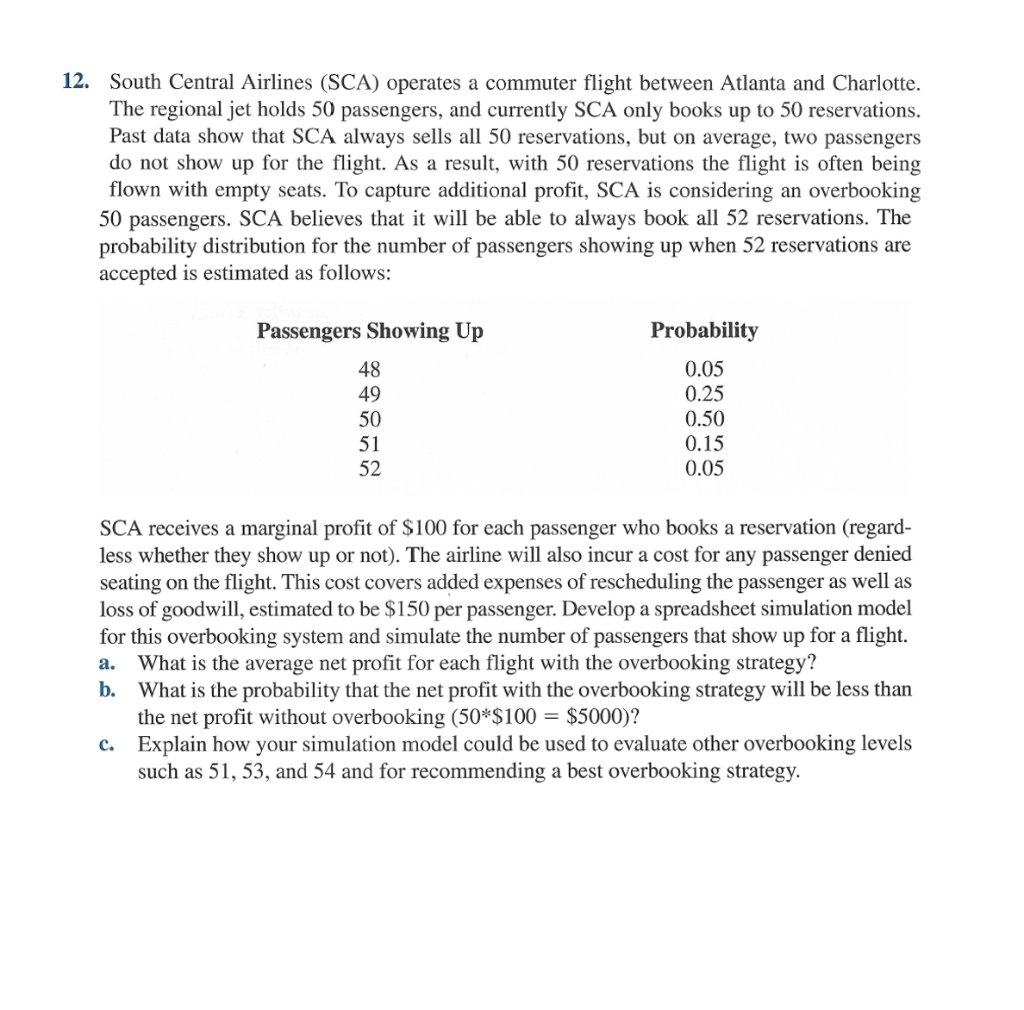

Simulation Project (100 Points) Please read the problems carefully, build a simulation model for each problem and answer each part accordingly. 11. In preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed a new doll called The Dougie that teaches children how to dance. The fixed cost to produce the doll is $100,000. The variable cost, which includes material, labor, and shipping costs, is $34 per doll. During the holiday selling season, FTC will sell the dolls for $42 each. If FTC overpro- duces the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per doll. Demand for new toys during the holiday selling season is extremely uncertain. Forecasts are expected sales 60,000 dolls with a standard deviation of 15,000. The normal probability distribution is assumed to be a good description of the demand. FTC has tentatively decided to produce 60,000 units (the same as average demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision. a. Create a what-if spreadsheet model using a formula that relate the values of production quantity, demand, sales, revenue from sales, amount of surplus, revenue from sales of surplus, total cost, and net profit. What is the profit corresponding to average demand (60,000 units)? b. Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000, simulate the sales of the Dougie doll using a production quantity of 60,000 units. What is the estimate of the average profit associated with the produc- tion quantity of 60,000 dolls? How does this compare to the profit corresponding to the average demand (as computed in part (a))? c. Before making a final decision on the production quantity, management wants an anal- ysis of a more aggressive 70,000-unit production quantity and a more conservative 50,000-unit production quantity. Run your simulation with these two production quan- tities. What is the mean profit associated with each? d. In addition to mean profit, what other factors should FTC consider in determining a production quantity? Compare the three production quantities (50,000, 60,000, and 70,000) using all these factors. What trade-offs occur? What is your recommendation? 12. South Central Airlines (SCA) operates a commuter flight between Atlanta and Charlotte. The regional jet holds 50 passengers, and currently SCA only books up to 50 reservations. Past data show that SCA always sells all 50 reservations, but on average, two passengers do not show up for the flight. As a result, with 50 reservations the flight is often being flown with empty seats. To capture additional profit, SCA is considering an overbooking 50 passengers. SCA believes that it will be able to always book all 52 reservations. The probability distribution for the number of passengers showing up when 52 reservations are accepted is estimated as follows: Passengers Showing Up 48 49 50 51 52 Probability 0.05 0.25 0.50 0.15 0.05 SCA receives a marginal profit of $100 for each passenger who books a reservation (regard- less whether they show up or not). The airline will also incur a cost for any passenger denied seating on the flight. This cost covers added expenses of rescheduling the passenger as well as loss of goodwill, estimated to be $150 per passenger. Develop a spreadsheet simulation model for this overbooking system and simulate the number of passengers that show up for a flight. a. What is the average net profit for each flight with the overbooking strategy? b. What is the probability that the net profit with the overbooking strategy will be less than the net profit without overbooking (50*$100 = $5000)? c. Explain how your simulation model could be used to evaluate other overbooking levels such as 51, 53, and 54 and for recommending a best overbooking strategy