Question: SIMULATION SENSITIVITY PROBLEMS 1. Airline Revenue Management. Alpha Airlines has ordered a new fleet of DC- 717s. At this stage of the contract, Alphas operations

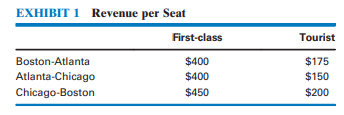

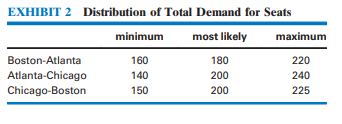

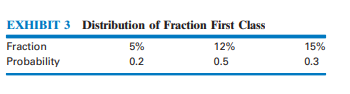

SIMULATION SENSITIVITY PROBLEMS 1. Airline Revenue Management. Alpha Airlines has ordered a new fleet of DC- 717s. At this stage of the contract, Alphas operations manager must specify the seating configuration on the aircraft that will be used on the Boston-Atlanta-ChicagoBoston circuit. Alpha flies this route once each day. The configuration decision involves specifying how many rows will be allocated for first class and how many for tourist class. If the aircraft were configured entirely of tourist rows (containing six seats each), there would be forty rows. Firstclass seats are wider and afford more legroom, so that, in order to make room for one first-class row (containing four seats), two tourist rows must be removed. Thus, conversion from tourist to first-class seating involves the loss of some seats, but the conversion may be appealing because the revenues are higher for first-class passengers than for tourist passengers (see Exhibit 1). A perfect match between the configuration and the demand for seats is seldom possible. Historical data suggest a probability distribution of demand for seats on each leg (as detailed in Exhibit 2). There is another distribution for the fraction of demand that corresponds to first-class seats (Exhibit 3), which seems to apply on all legs, although the fraction that occurs in one market on any day is independent of the fraction in the other markets. Finally, there is some chance that all seats in either seating category will be booked on a given leg when demand for that category occurs. Under present management policies, such demand is simply lost to competitors.

The fixed cost of operating the full circuit is $100,000 per day. Alpha Airlines is seeking a profit-maximizing configuration.

a. What is the expected profit per day for a configuration of three first-class rows and thirty-four tourist rows? For convenience, you may allow fractional values of demand in your model.

b. With the suggested configuration, what proportion of the days will Alpha at least break even on the BostonAtlanta ChicagoBoston circuit?

c. For the demand that Alpha faces, what is the maximum expected profit, and what is the seat configuration that achieves it?

Tourist EXHIBIT 1 Revenue per Seat First-class Boston-Atlanta $400 Atlanta-Chicago $400 Chicago-Boston $450 $175 $150 $200 EXHIBIT 2 Distribution of Total Demand for Seats minimum most likely maximum Boston-Atlanta 160 180 220 Atlanta-Chicago 140 200 240 Chicago-Boston 150 200 225 EXHIBIT 3 Distribution of Fraction First Class Fraction 5% 12% Probability 0.2 0.5 15% 0.3Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts