Question: sitcuts... 1 X E X 56% ? TEIEVAD ADOTT not alleet The Vam Or Le murin. Under conditions of perfect market, rational investors, absence of

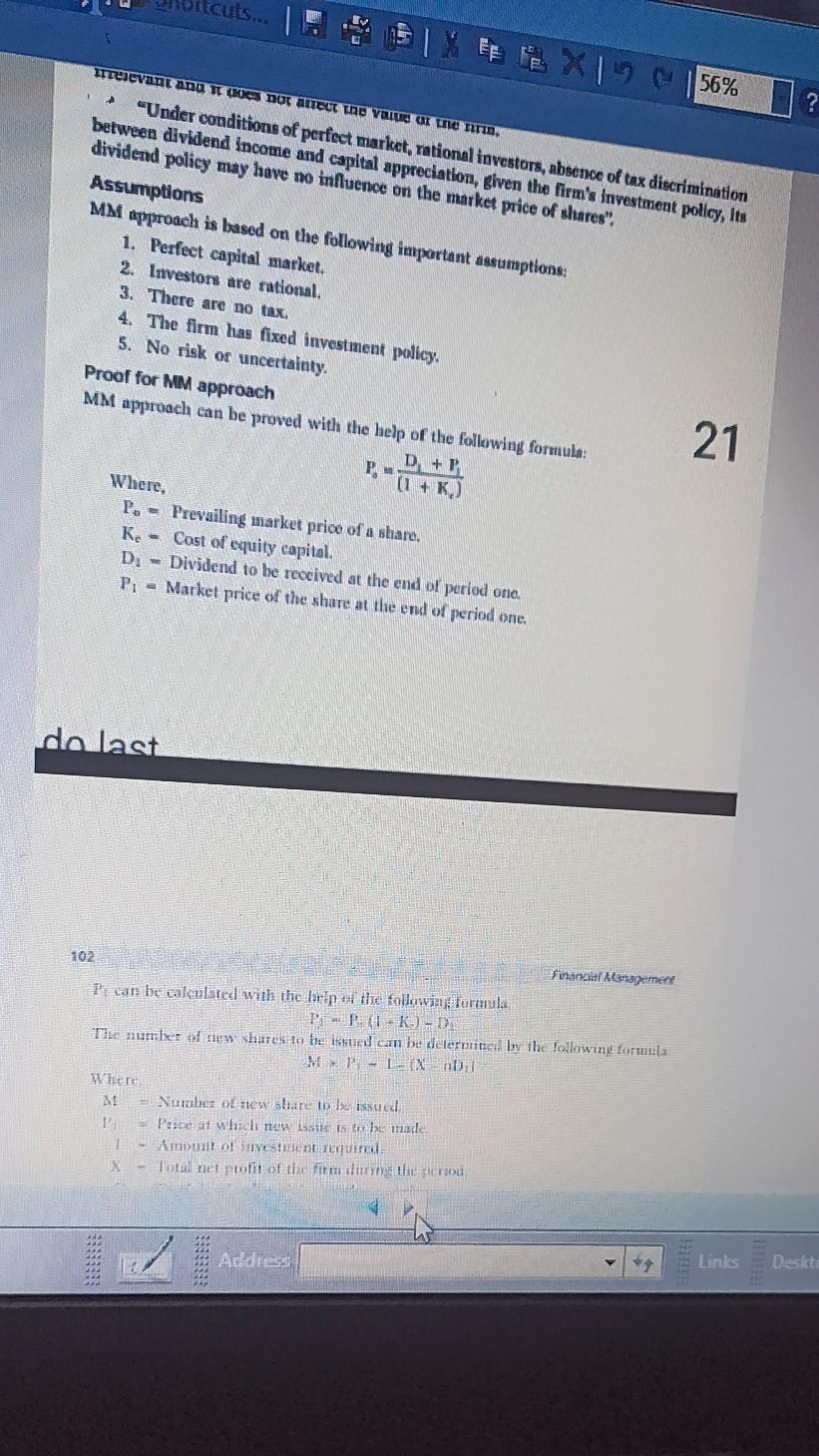

sitcuts... 1 X E X 56% ? TEIEVAD ADOTT not alleet The Vam Or Le murin. "Under conditions of perfect market, rational investors, absence of tax discrimination between dividend income and capital appreciation, given the firm's investment policy, its dividend policy may have no influence on the market price of shares", Assumptions MM approach is based on the following important assumptions: 1. Perfect capital market. 2. Investors are rational, 3. There are no tax. 4. The firm has fixed investment policy. 5. No risk or uncertainty. Proof for MM approach MM approach can be proved with the help of the following formula: D+ P. (1K) Where P. - Prevailing market price of a share. Ke- Cost of equity capital D. - Dividend to be recived at the end of period one. Pi - Market price of the share at the end of period one. 21 de last 102 Financial Management I can be calculated with the brain at the following termula wp-k-) - DE The number andre hues to be issued can be determitteil by the following turla MP-L ni), Where maher blow share to be said Put at which LSK is to be made - Ambuilt over eened X - Tunnettorit of the firm dan terou Actress Links Deskt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock