Question: So im having a hard applying the equation that they are telling me to use. what exactly would I need to plug in in order

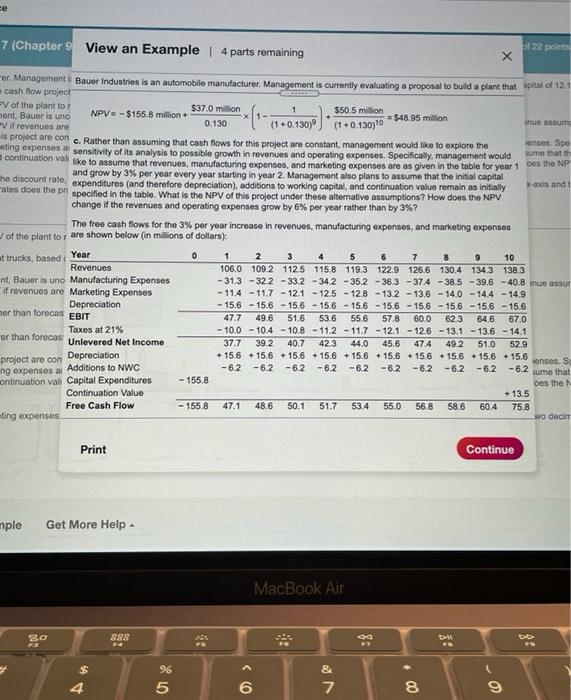

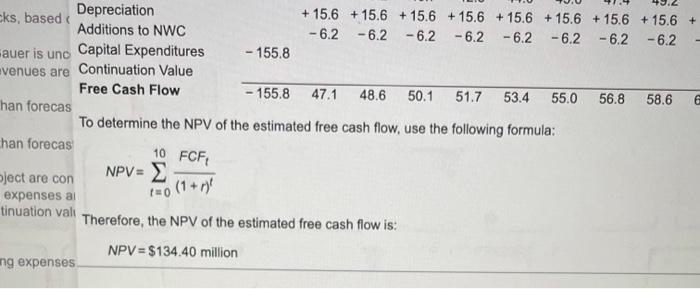

7 (Chapter 9 View an Example 4 parts remaining 22 points or Management Bauer Industries is an automobile manufacturer Management is currently evaluating a proposal to build a plant that apital of 121 cash flow project V of the plant to NPV - $155.8 million $37.0 million bont, Bauer is uno $50.5 million $48.95 million Vif revenues are 0.130 (1 +0.130) (1 +0.130)10 inue assume is project are con c. Rather than assuming that cash flows for this project are constant, management would like to explore the Ons Spe eting expenses a sensitivity of its analysis to possible growth in revenues and operating expenses. Specifically, management would me that the continuation von Uke to assume that revenues, manufacturing expenses, and marketing expenses are as given in the table for year 1 oes the NP and grow by 3% per year every year starting in year 2. Management also plans to assume that the initial capital he discount rate, expenditures (and therefore depreciation) additions to working capital, and continuation value remain as initially x-axis and atos does the pr specified in the table. What is the NPV of this project under these alternative assumptions? How does the NPV change if the revenues and operating expenses grow by 6% per year rather than by 3%? The free cash flows for the 3% per year increase in revenues, manufacturing expenses, and marketing expenses of the plant to are shown below (in millions of dollars): at trucks, based Year 0 1 2 3 4 5 6 7 8 9 10 Revenues 106.0 109.2 112.5 115.8 119.3 122.9 126.6 130.4 134.3 138.3 nt, Bauer is uno Manufacturing Expenses - 31.3 -32.2 -33.2 -34.2 -35.2 -36.3 -37.4 -38.5 39.6 - 40.8 nue BSSU if revenues are Marketing Expenses - 11.4 -11.7 -12.1 - 12.5 -12.8 - 13.2 - 13.6 -14.0 - 14.4 - 14.9 Depreciation - 15.6 -15.6 - 15.6 - 15,6 - 15.6 - 15,6 - 15.6 -15,6 -15,6 - 15.6 her than forecas EBIT 47.7 55.6 57.8 60.0 623 64.6 67.0 Taxes at 21% - 10.0 -10.4 - 10.8 - 11.2 - 11.7 -12.1 -126 - 13.1 - 13.6 - 14.1 er than forecas Unlevered Net Income 37.7 39.2 40.7 42.3 44.0 45.6 47.4 492 51.0 52.9 + 15.6 +15.6 +15.6 +15.6 +15.6 +15.6 + 15.6 +15,6 + 15.6 + 15.6 enses. S - 6.2 - 6.2 -6.2 - 6.2 -6.2 -62 -8.2 ng expenses a Additions to NWC -6.2 - 6.2 -62 sume that continuation val Capital Expenditures - 155.8 oes the Continuation Value + 13.5 Free Cash Flow - 155.8 47.1 48.6 50.1 51.7 55.0 56.8 58.6 60.4 75.8 ting expenses wo decin 49.6 51.6 53.6 project are con Depreciation 534 Print Continue mple Get More Help MacBook Air 80 888 D FT $ 4 % 5 0 > @ & 7 6 8 9 Depreciation + 15.6 +15.6 +15.6 + 15.6 + 15.6 + 15.6 + 15.6 +15.6 + oks, based Additions to NWC -6.2 -6.2 -6.2 -6.2 -6.2 -6.2 -6.2 -6.2 auer is uno Capital Expenditures - 155.8 evenues are Continuation Value Free Cash Flow - 155.8 47.1 48.6 50.1 51.7 53.4 55.0 56.8 58.6 han forecas To determine the NPV of the estimated free cash flow, use the following formula: han forecas ject are con NPV = expenses al tinuation valt Therefore, the NPV of the estimated free cash flow is: NPV = $134.40 million ng expenses 10 FCF 150 (1+1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts