Question: solve completely with proper solution otherwise down voted on 1809 July following are the spot rates - Spot USD / EUR 1.20000 and INR /

solve completely with proper solution otherwise down voted

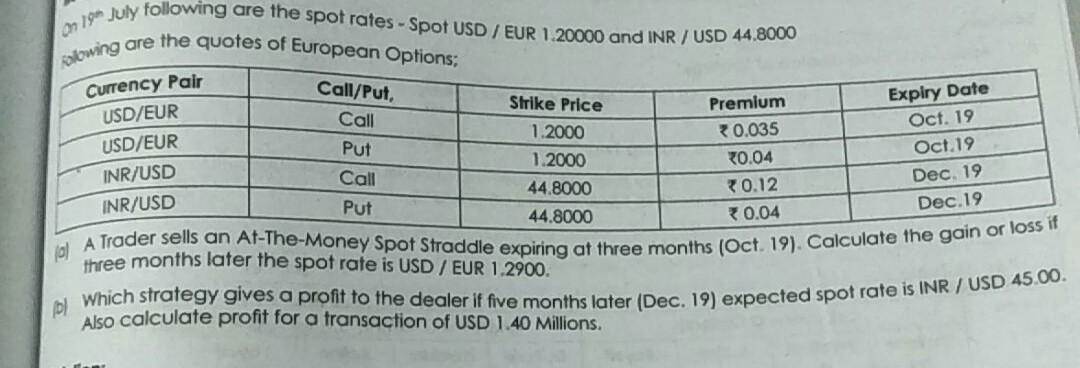

on 1809 July following are the spot rates - Spot USD / EUR 1.20000 and INR / USD 44.8000 powing are the quotes of European Options; Currency Pair USD/EUR USD/EUR Premium Expiry Date INR/USD 30.035 Oct. 19 INR/USD 20.04 Oct.19 30.12 Dec. 19 la A Trader sells an At-The-Money Spot Straddle expiring at three months (Oct. 19). Calculate the gain or loss if 30.04 Dec.19 Call/Put, Call Put Call Put Strike Price 1.2000 1.2000 44.8000 44.8000 three months later the spot rate is USD / EUR 1.2900. ol which strategy gives a profit to the dealer if five months later (Dec. 19) expected spot rate is INR / USD 45.00. Also calculate profit for a transaction of USD 1.40 Millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts