Question: solve fast give valuable answer don't provide other sourse answer Question 2 Working as a credit officer, you are examining a loan application by a

solve fast give valuable answer don't provide other sourse answer

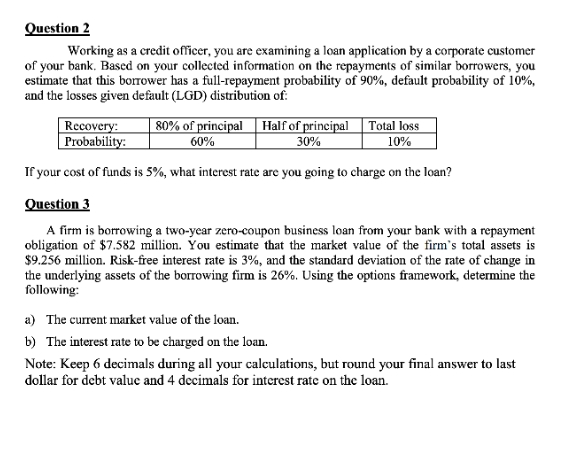

Question 2 Working as a credit officer, you are examining a loan application by a corporate customer of your bank. Based on your collected information on the repayments of similar borrowers, you estimate that this borrower has a full-repayment probability of 90%, default probability of 10%, and the losses given default (LGD) distribution of: Recovery: 80% of principal Half of principal Total loss Probability: 60% 30% 10% If your cost of funds is 5%, what interest rate are you going to charge on the loan? Question 3 A firm is borrowing a two-year zero-coupon business loan from your bank with a repayment obligation of $7.582 million. You estimate that the market value of the firm's total assets is $9.256 million. Risk-free interest rate is 3%, and the standard deviation of the rate of change in the underlying assets of the borrowing firm is 26%. Using the options framework, determine the following: a) The current market value of the loan. b) The interest rate to be charged on the loan. Note: Keep 6 decimals during all your calculations, but round your final answer to last dollar for debt value and 4 decimals for interest rate on the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts