Question: SOLVE MANUALLY WITHOUT USING ANY SOFTWARE, AND NO COPYING FROM OTHER CHEGG Q&A MUST BE UR OWN WORK. 1-70 Two mutually exclusive alternatives are being

SOLVE MANUALLY WITHOUT USING ANY SOFTWARE, AND NO COPYING FROM OTHER CHEGG Q&A MUST BE UR OWN WORK.

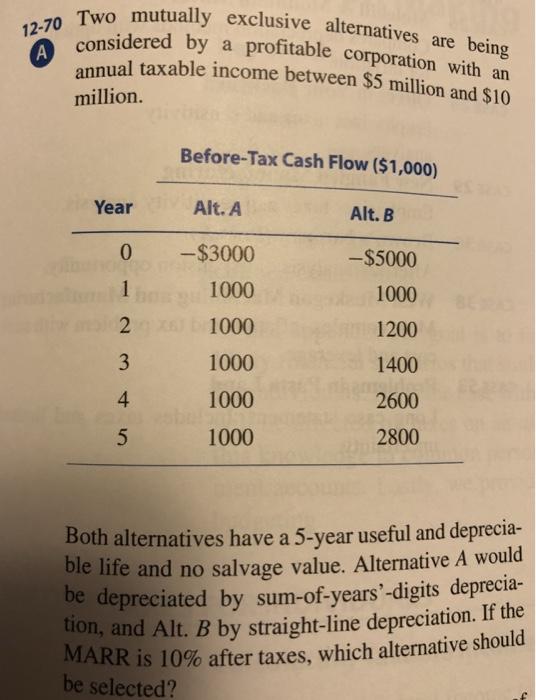

1-70 Two mutually exclusive alternatives are being considered by a profitable corporation with an annual taxable income between $5 million and $10 million. Both alternatives have a 5-year useful and depreciable life and no salvage value. Alternative A would be depreciated by sum-of-years'-digits depreciation, and Alt. B by straight-line depreciation. If the MARR is 10% after taxes, which alternative should be selectedStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock