Question: solve only for BCD. USE STDEV. S ON EXCEL AND PLS SHOW WORK/FORMULA Solution a. Calculate the average return for each individual stock. Stock A

solve only for BCD. USE STDEV. S ON EXCEL AND PLS SHOW WORK/FORMULA

solve only for BCD. USE STDEV. S ON EXCEL AND PLS SHOW WORK/FORMULA

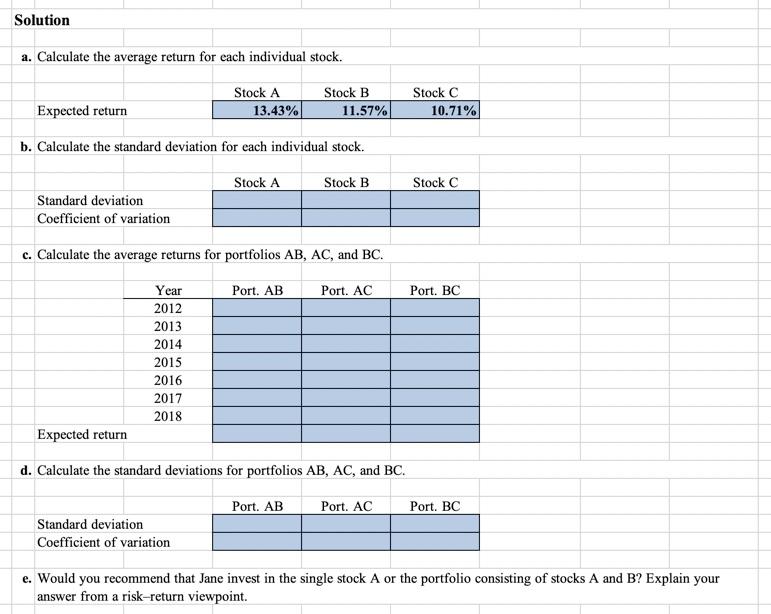

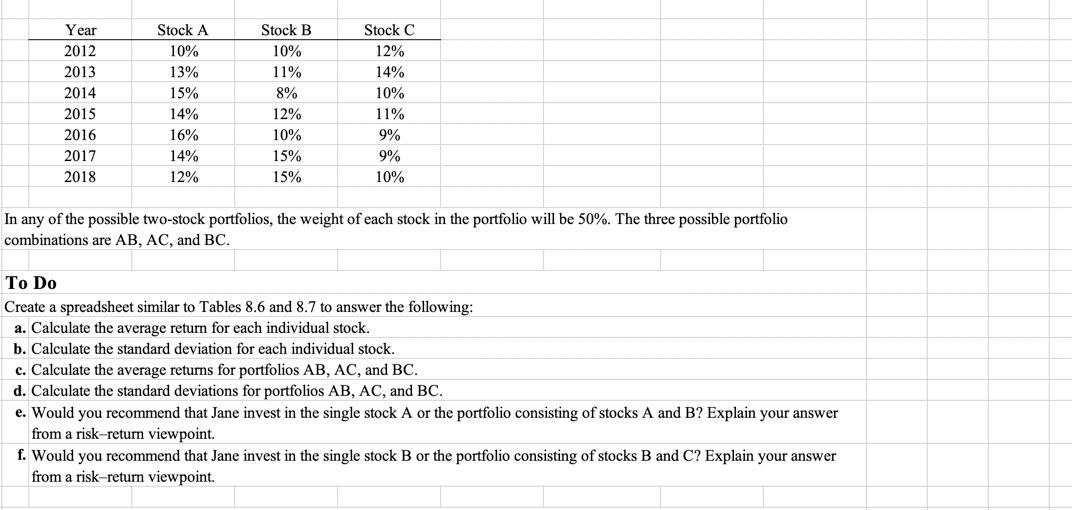

Solution a. Calculate the average return for each individual stock. Stock A 13.43% Stock B 11.57% Stock C 10.71% Expected return b. Calculate the standard deviation for each individual stock. Stock A Stock B Stock C Standard deviation Coefficient of variation c. Calculate the average returns for portfolios AB, AC, and BC. Port AB Port. AC Port. BC Year 2012 2013 2014 2015 2016 2017 2018 Expected return d. Calculate the standard deviations for portfolios AB, AC, and BC. Port. AB Port. AC Port. BC Standard deviation Coefficient of variation e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint. Year 2012 Stock C 12% 14% 10% 2013 Stock A 10% 13% 15% 14% 16% 14% 12% 2014 2015 2016 2017 2018 Stock B 10% 11% 8% 12% 10% 15% 15% 11% 9% 9% 10% In any of the possible two-stock portfolios, the weight of each stock in the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC. To Do Create a spreadsheet similar to Tables 8.6 and 8.7 to answer the following: a. Calculate the average return for each individual stock. b. Calculate the standard deviation for each individual stock. c. Calculate the average returns for portfolios AB, AC, and BC. d. Calculate the standard deviations for portfolios AB, AC, and BC. e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint. f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-return viewpoint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts