Question: Solve the entire sum in excel B A PC Ltd is considering a new investment whose data are shown below for which you need to

Solve the entire sum in excel

Solve the entire sum in excel

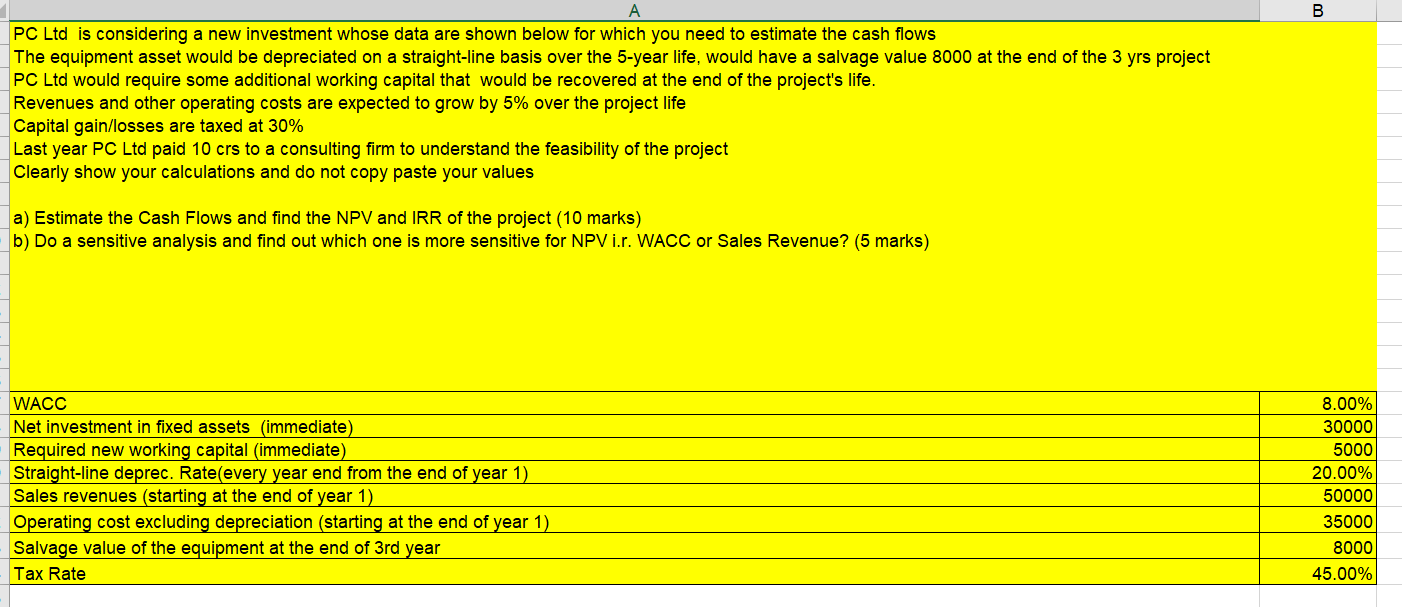

B A PC Ltd is considering a new investment whose data are shown below for which you need to estimate the cash flows The equipment asset would be depreciated on a straight-line basis over the 5-year life, would have a salvage value 8000 at the end of the 3 yrs project PC Ltd would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to grow by 5% over the project life Capital gain/losses are taxed at 30% Last year PC Ltd paid 10 crs to a consulting firm to understand the feasibility of the project Clearly show your calculations and do not copy paste your values a) Estimate the Cash Flows and find the NPV and IRR of the project (10 marks) b) Do a sensitive analysis and find out which one is more sensitive for NPV i.r. WACC or Sales Revenue? (5 marks) WACC Net investment in fixed assets (immediate) Required new working capital (immediate) Straight-line deprec. Rate(every year end from the end of year 1). Sales revenues (starting at the end of year 1) Operating cost excluding depreciation (starting at the end of year 1) Salvage value of the equipment at the end of 3rd year Tax Rate 8.00% 30000 5000 20.00% 50000 35000 8000 45.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts