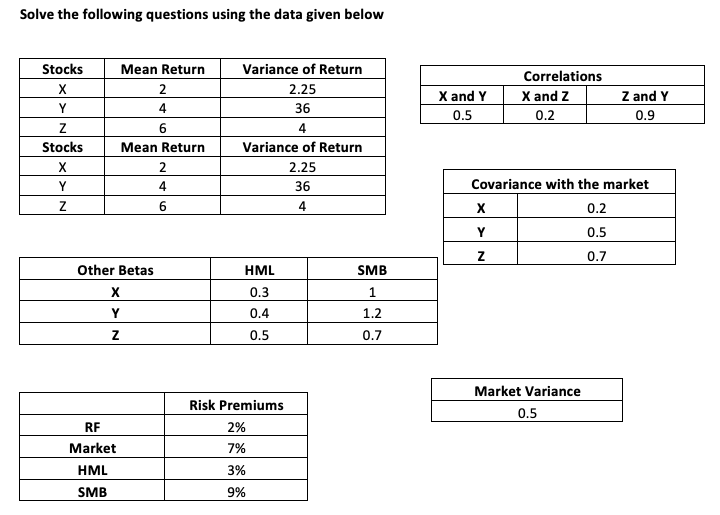

Question: Solve the following questions using the data given below Stocks Mean Return Variance of Return X 2 2.25 Y 4 36 Z 6 4 Stocks

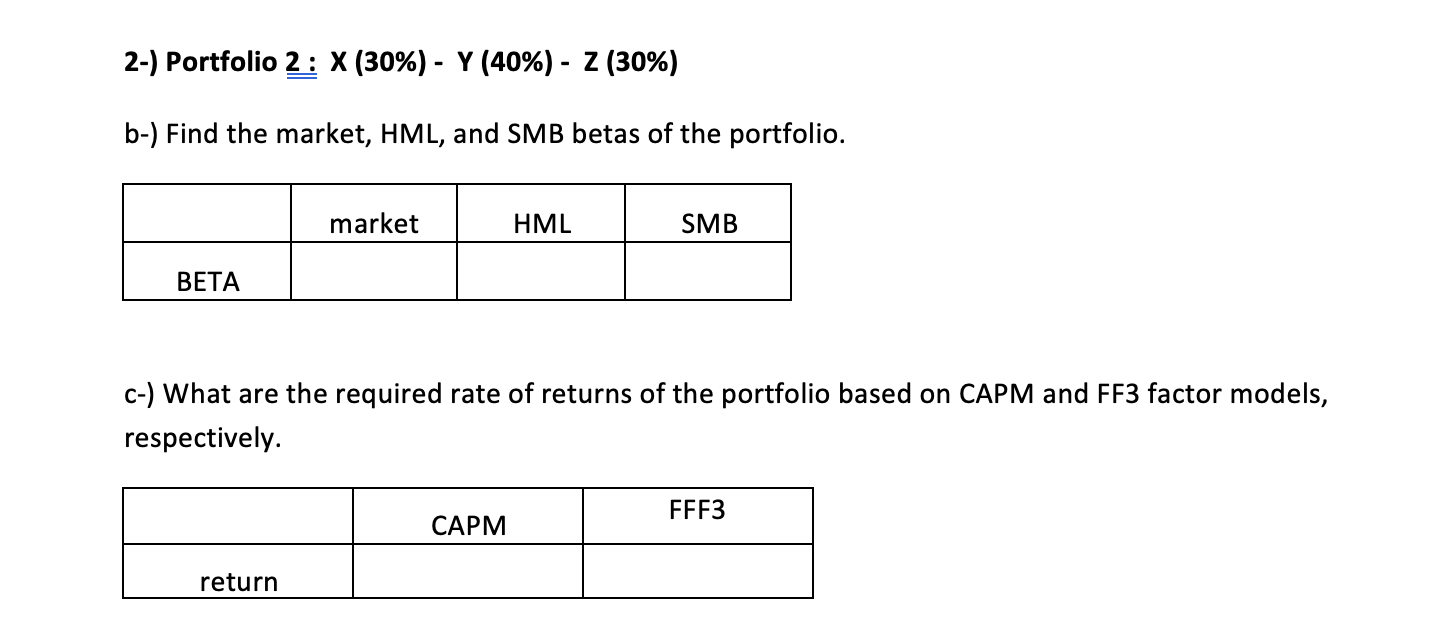

Solve the following questions using the data given below Stocks Mean Return Variance of Return X 2 2.25 Y 4 36 Z 6 4 Stocks Mean Return Variance of Return X 2 2.25 Y 4 36 Z 6 4 Other Betas X Y Z RF Market HML SMB HML 0.3 0.4 0.5 Risk Premiums 2% 7% 3% 9% SMB 1 1.2 0.7 Correlations X and Z Z and Y 0.2 0.9 Covariance with the market X 0.2 Y 0.5 Z 0.7 Market Variance 0.5 X and Y 0.5 2-) Portfolio 2 : X (30%) - Y (40%) - Z (30%) b-) Find the market, HML, and SMB betas of the portfolio. market HML SMB BETA c-) What are the required rate of returns of the portfolio based on CAPM and FF3 factor models, respectively. FFF3 CAPM return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts