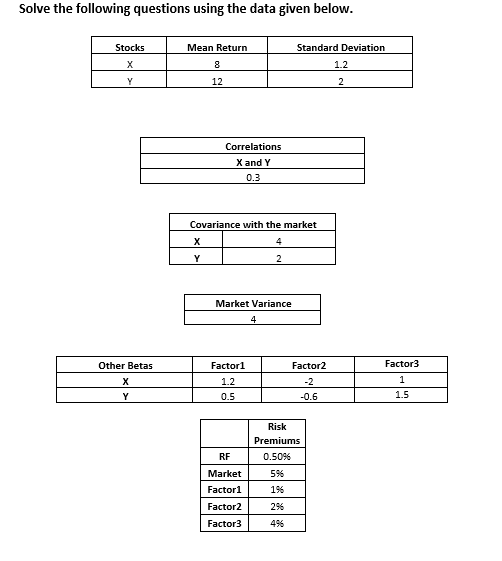

Question: Solve the following questions using the data given below. Stocks Mean Return Standard Deviation 1.2 Y 12 2 Correlations X and Y 0.3 Covariance with

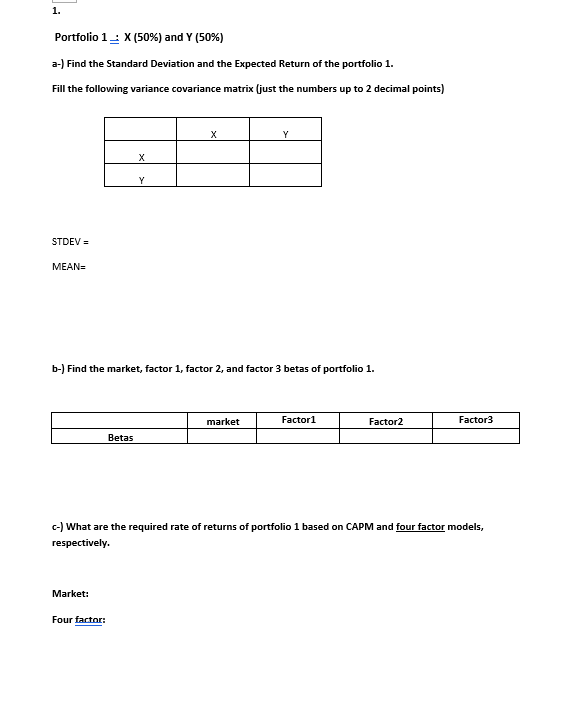

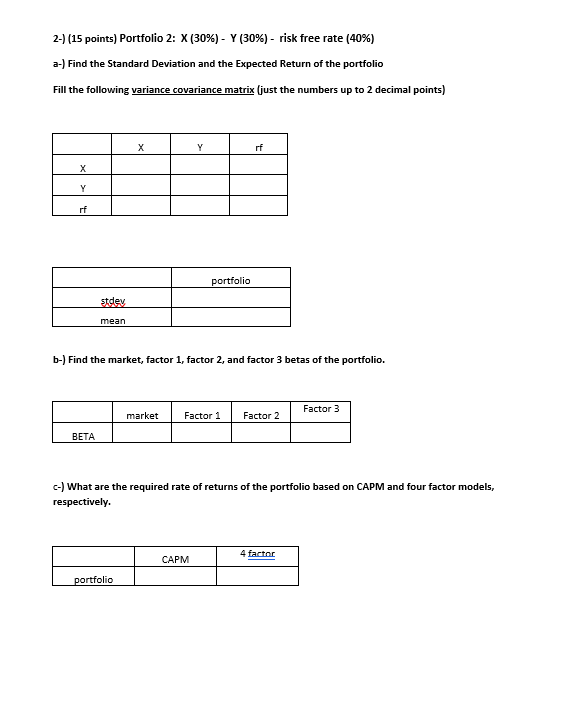

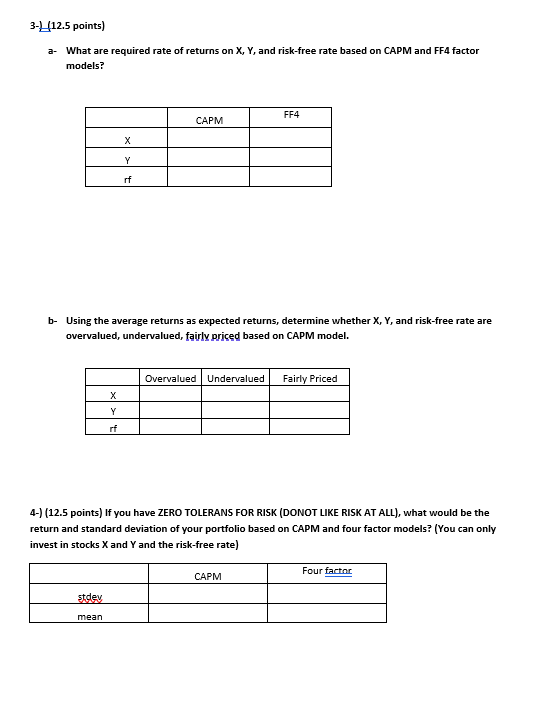

Solve the following questions using the data given below. Stocks Mean Return Standard Deviation 1.2 Y 12 2 Correlations X and Y 0.3 Covariance with the market 4 Y 2 Market Variance 4 Other Betas Factor 1 1.2 0.5 Factor2 -2 -0.6 Factor 3 1 1.5 Y Risk Premiums 0.5096 596 RF 196 Market Factor 1 Factor2 Factor 3 296 496 1. Portfolio 1 _ X (50%) and Y (50%) a-) Find the Standard Deviation and the Expected Return of the portfolio 1. Fill the following variance covariance matrix (just the numbers up to 2 decimal points) Y STDEV = MEAN b-) Find the market, factor 1, factor 2, and factor 3 betas of portfolio 1. market Factor 1 Factor 2 Factor 3 Betas (-) What are the required rate of returns of portfolio 1 based on CAPM and four factor models, respectively. Market: Four factor: 2-) (15 points) Portfolio 2: X (30%) - Y (30%) - risk free rate (40%) a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) Y rf x Y rf portfolio stdev mean b-) Find the market, factor 1, factor 2, and factor 3 betas of the portfolio. Factor 3 market Factor 1 Factor 2 BETA -) What are the required rate of returns of the portfolio based on CAPM and four factor models, respectively. 4 factor CAPM portfolio 3-412.5 points) a- What are required rate of returns on X, Y, and risk-free rate based on CAPM and FF4 factor models? FF4 CAPM Y rf b- Using the average returns as expected returns, determine whether X, Y, and risk-free rate are overvalued, undervalued, fairly priced based on CAPM model. Overvalued Undervalued Fairly Priced Y 4-) (12.5 points) If you have ZERO TOLERANS FOR RISK (DONOT LIKE RISK AT ALL), what would be the return and standard deviation of your portfolio based on CAPM and four factor models? (You can only invest in stocks X and Y and the risk-free rate) CAPM Four factor stdey mean Solve the following questions using the data given below. Stocks Mean Return Standard Deviation 1.2 Y 12 2 Correlations X and Y 0.3 Covariance with the market 4 Y 2 Market Variance 4 Other Betas Factor 1 1.2 0.5 Factor2 -2 -0.6 Factor 3 1 1.5 Y Risk Premiums 0.5096 596 RF 196 Market Factor 1 Factor2 Factor 3 296 496 1. Portfolio 1 _ X (50%) and Y (50%) a-) Find the Standard Deviation and the Expected Return of the portfolio 1. Fill the following variance covariance matrix (just the numbers up to 2 decimal points) Y STDEV = MEAN b-) Find the market, factor 1, factor 2, and factor 3 betas of portfolio 1. market Factor 1 Factor 2 Factor 3 Betas (-) What are the required rate of returns of portfolio 1 based on CAPM and four factor models, respectively. Market: Four factor: 2-) (15 points) Portfolio 2: X (30%) - Y (30%) - risk free rate (40%) a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) Y rf x Y rf portfolio stdev mean b-) Find the market, factor 1, factor 2, and factor 3 betas of the portfolio. Factor 3 market Factor 1 Factor 2 BETA -) What are the required rate of returns of the portfolio based on CAPM and four factor models, respectively. 4 factor CAPM portfolio 3-412.5 points) a- What are required rate of returns on X, Y, and risk-free rate based on CAPM and FF4 factor models? FF4 CAPM Y rf b- Using the average returns as expected returns, determine whether X, Y, and risk-free rate are overvalued, undervalued, fairly priced based on CAPM model. Overvalued Undervalued Fairly Priced Y 4-) (12.5 points) If you have ZERO TOLERANS FOR RISK (DONOT LIKE RISK AT ALL), what would be the return and standard deviation of your portfolio based on CAPM and four factor models? (You can only invest in stocks X and Y and the risk-free rate) CAPM Four factor stdey mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts