Question: solve the following with formulas don't write only numbers examples (c20-b22)not only the solution do Cut Calibri (Body) 11 A- A Copy Paste B I

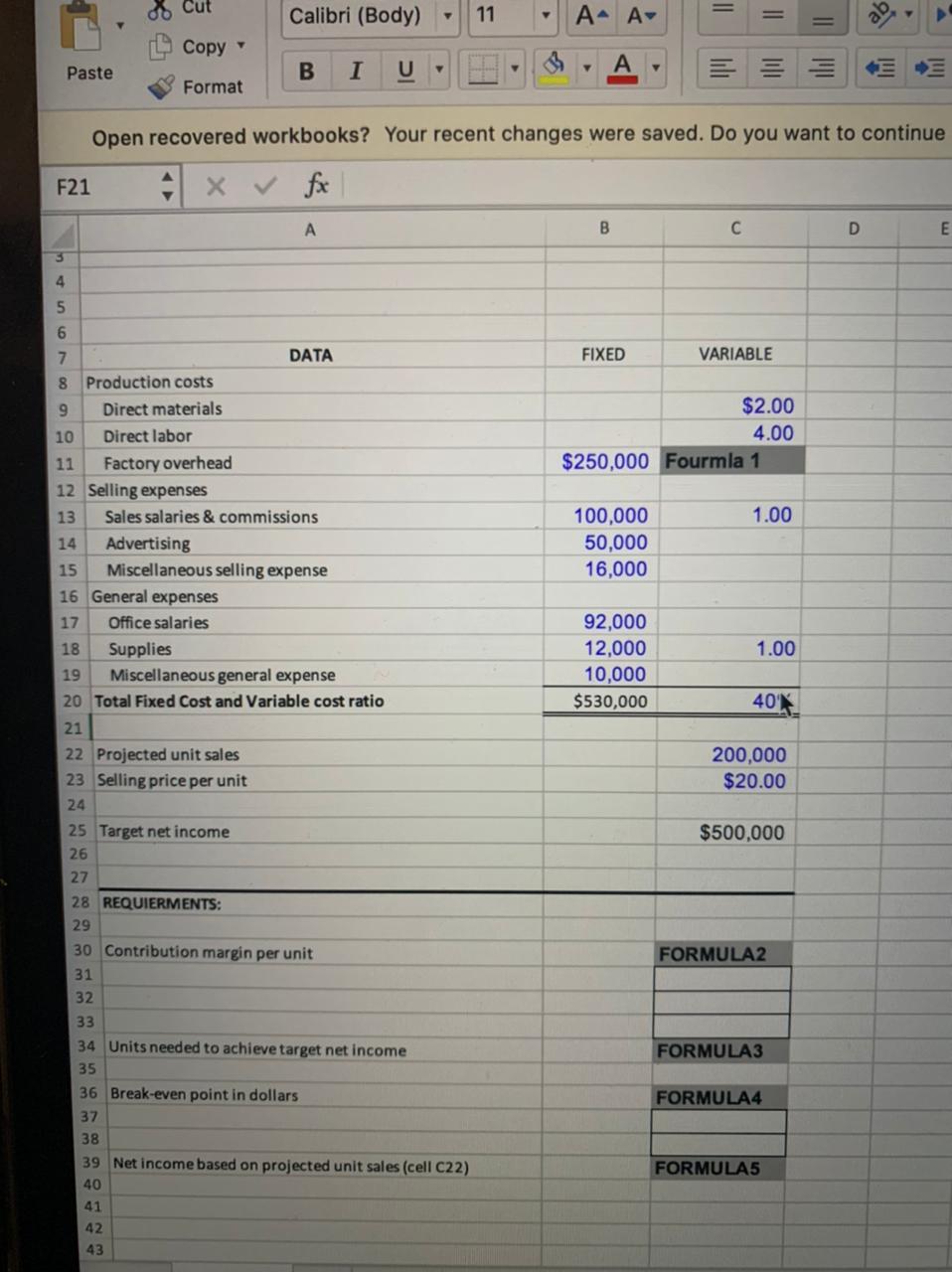

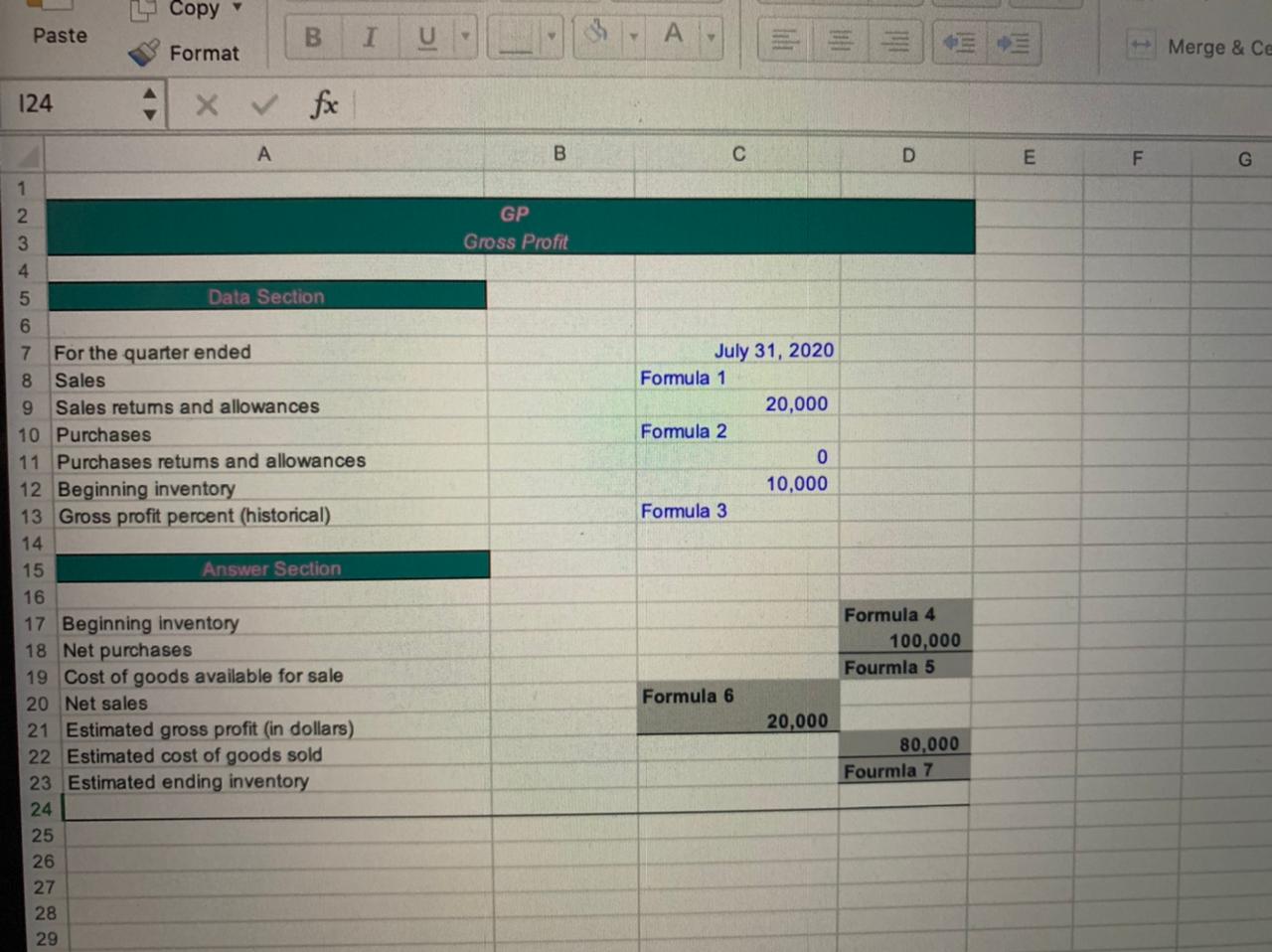

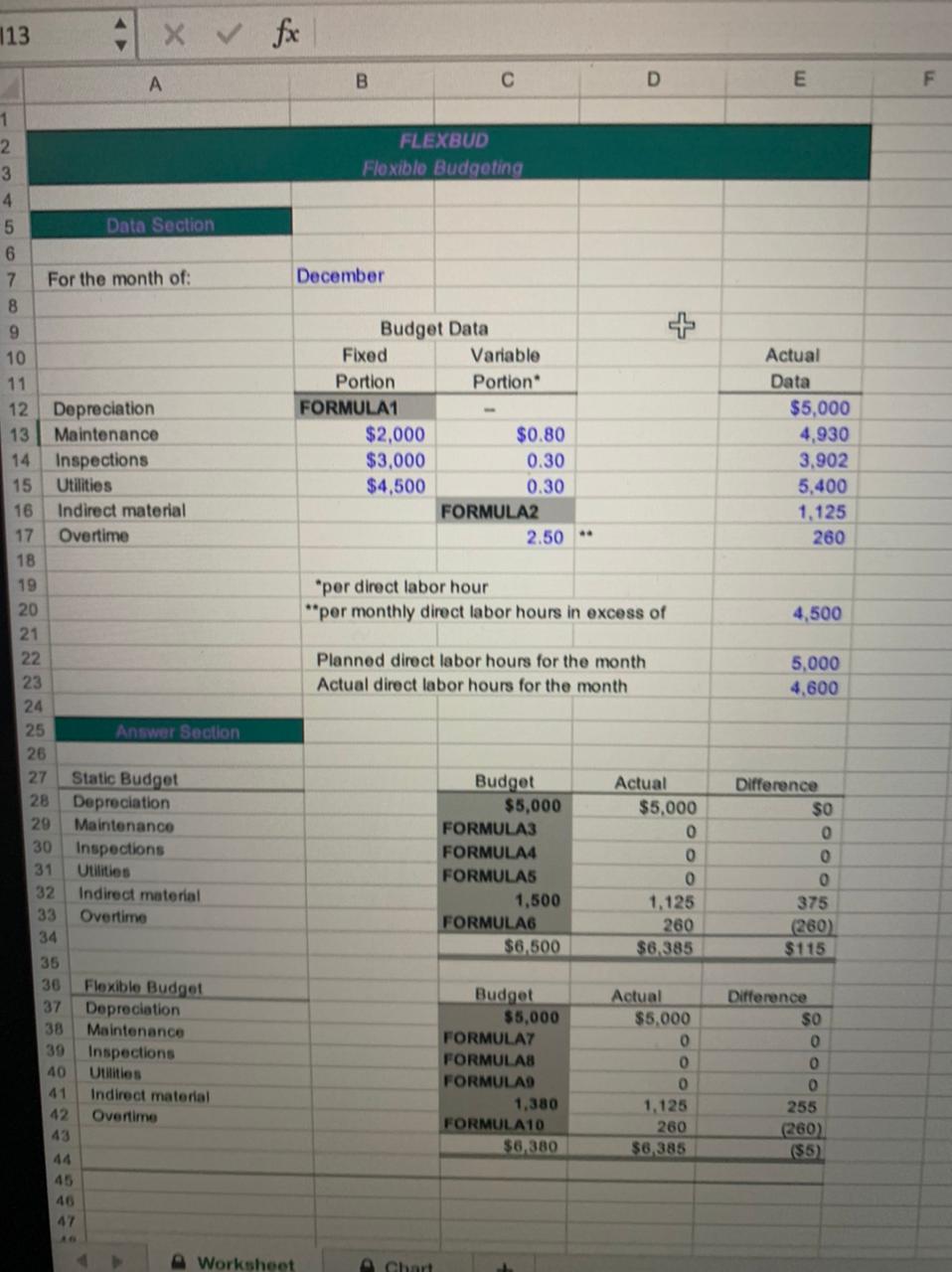

solve the following with formulas don't write only numbers examples (c20-b22)not only the solution

do Cut Calibri (Body) 11 A- A Copy Paste B I U E Format Open recovered workbooks? Your recent changes were saved. Do you want to continue F21 + XVfx A B C D DATA FIXED VARIABLE Production costs LD DO Direct materials $2.00 10 Direct labor 4.00 11 Factory overhead $250,000 Fourmla 1 12 Selling expenses 13 Sales salaries & commissions 100,000 1.00 14 Advertising 50,000 15 Miscellaneous selling expense 16,000 16 General expenses 17 Office salaries 92,000 18 Supplies 12,000 1.00 19 Miscellaneous general expense 10,000 20 Total Fixed Cost and Variable cost ratio $530,000 40% 21 22 Projected unit sales 200,000 23 Selling price per unit $20.00 24 25 Target net income $500,000 26 27 28 REQUIERMENTS: 29 30 Contribution margin per unit FORMULA2 31 32 33 34 Units needed to achieve target net income FORMULA3 35 36 Break-even point in dollars FORMULA4 37 38 39 Net income based on projected unit sales (cell C22) FORMULA5 40 41 42 43Copy Paste B I U A . Format + Merge & Ce 124 X V fx A B C D E F G GP Gross Profit OUT A WN Data Section For the quarter ended July 31, 2020 Sales Formula 1 9 Sales retums and allowances 20,000 10 Purchases Formula 2 11 Purchases retums and allowances 12 Beginning inventory 10,000 13 Gross profit percent (historical) Formula 3 14 15 Answer Section 16 17 Beginning inventory Formula 4 18 Net purchases 100,000 19 Cost of goods available for sale Fourmla 5 20 Net sales Formula 6 21 Estimated gross profit (in dollars) 20,000 22 Estimated cost of goods sold 80,000 23 Estimated ending inventory Fourmla 7 24 25 26 27 28 2913 X V fx A B C D E F FLEXBUD Flexible Budgeting Data Section For the month of: December Budget Data Fixed Variable Actual 11 Portion Portion Data 12 Depreciation FORMULA1 $5,000 13 Maintenance $2,000 $0.80 4,930 14 Inspections $3,000 0.30 3,902 15 Utilities $4,500 0.30 5,400 16 Indirect material FORMULA2 1,125 17 Overtime 2.50 . 260 18 19 *per direct labor hour 20 "per monthly direct labor hours in excess of 4,500 21 22 Planned direct labor hours for the month 5,000 23 Actual direct labor hours for the month 4.600 24 25 Answer Section 26 27 Static Budget Budget Actual Difference 28 Depreciation $5,000 $5,000 SO 29 Maintenance FORMULA3 0 0 30 Inspections FORMULA4 0 0 31 Utilities FORMULAS 0 32 Indirect material 1.500 1,125 375 33 Overtime FORMULAG 260 (260 34 $6,500 $6.385 $115 35 36 Flexible Budget Budget Actual Difference 37 Depreciation $5,000 $5,000 SO 38 Maintenance FORMULA? 0 0 39 Inspections FORMULAS 0 40 Utilities FORMULAS 0 0 41 Indirect material 1,380 1,125 255 42 Overtime FORMULA10 43 260 (260) $6.380 $6,385 ($5) 44 45 Worksheet