Question: solve the return on capital employed for 2018 and 2019 with the analysis, explanation of results and decision makin Dubai Islamic Bank P.J.S.C. Condensed consolidated

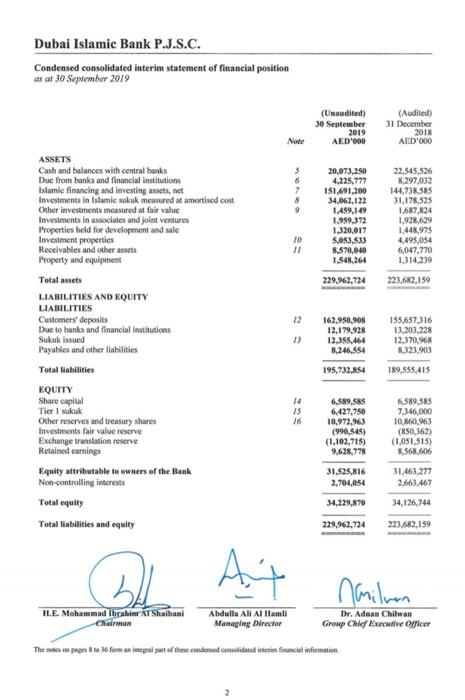

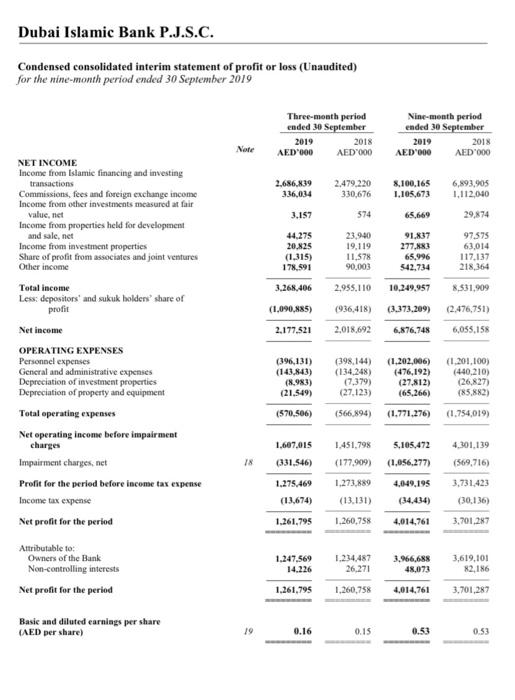

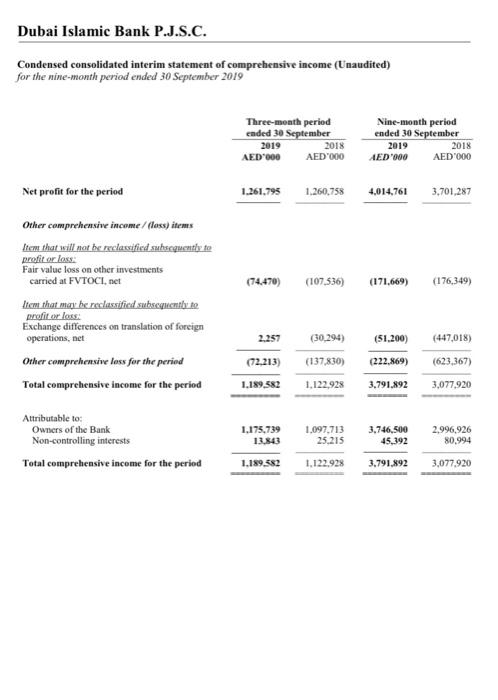

Dubai Islamic Bank P.J.S.C. Condensed consolidated interim statement of financial position a af 30 September 2019 (Unaudited) 30 September 2019 AED'000 (Audited) 31 December 2018 AED'000 Note ASSETS Cash and balances with central banks Due from banks and financial institutions Islamie financing and investing assets, net Investments in Islamic sukuk measured at amortised cost Other investments measured at fair value Investments in associates and joint ventures Properties held for development and sale Investment properties Receivables and other assets Property and equipment 5 6 7 8 9 20.073.250 4,225,779 151.691.200 34,062,122 1,459,149 1.999_372 1.320.017 5,053,533 8.570,040 1.548,264 22,545,526 8,297,032 144,738,585 31.178.525 1,687,824 1.928,629 1.448,975 4,495,054 6,047,770 1.314.239 10 11 229,767,724 223,682.159 12 13 162,950.908 12.179,928 12.358.464 1.246,554 195,732,854 155.657.316 13.203,228 12.370,968 2.323.908 189,555,415 Total assets LIABILITIES AND EQUITY LIABILITIES Customers' deposits Due to hunks and financial institutions Sukuk issued Payables and other liabilities Total liabilities EQUITY Share capital Tier 1 sukuk Other reserves and treasury shares Investments fair value reserve Exchange translation reserve Retained earnings Equity attributable to owners of the Bank Non-controlling interests Total equity Total liabilities and equity 15 16 6.589.585 6,427,750 10,972,963 (990,545) (1.102,715) 9,628,778 31.525,816 2,704,054 6,589,585 7,346,000 10.860,463 (850,362) (1,051,515) 8.568.606 31.463,277 2.663,467 34,229,870 34,126,744 223,682,159 229.962.724 At Nilvan H.E. Mohammad Ibrahim Al Shabani Chairman Abdulla Ali Al Hamli Managing Director Dr. Adaan Chilwan Group Chief Executive Officer The same on pages 3 to 6 Fon an integral part of the condensed comolded interien financial information Dubai Islamic Bank P.J.S.C. Condensed consolidated interim statement of profit or loss (Unaudited) for the nine-month period ended 30 September 2019 Three-month period ended 30 September 2019 2018 AED'000 AED'000 Nine-month period ended 30 September 2019 2018 AED'000 AED'000 Note 2.686.839 336,034 2.479.220 330,676 8.100.165 1.105,673 6,893,905 1,112,000 NET INCOME Income from Islamic financing and investing transactions Commissions, fees and foreign exchange income Income from other investments measured at fair value, net Income from properties held for development and sale, net Income from investment properties Share of profit from associates and joint ventures Other income 3.157 574 65.669 29,874 44.275 20.825 (1.315) 178,591 23,940 19.119 11.578 90,003 91,837 277.883 65.996 542.734 97.575 63,014 117,137 218,364 3.268.406 2.955.110 10,249.957 8,531,909 (1,090,885) (936,418) (3.373.209) (2.476,751) 2.177.521 2.018,692 6,876.748 6,055,158 (396,131) (143,843) (8.983) (21.549) (398.144) (134,248) (7,379) (27.123) (1,202,006) (476,192) (27.812) (65.266) (1,201.100) (440,210) (26.827) (85.882) Total income Less: depositors and sukuk holders" share of profit Net income OPERATING EXPENSES Personnel expenses General and administrative expenses Depreciation of investment properties Depreciation of property and equipment Total operating expenses Net operating income before impairment charges Impairment charges, net Profit for the period before income tax expense Income tax expense Net profit for the period (570.506) (566,894) (1.771.276) (1.754,019) 1.607.015 1.451,798 5,105,472 (1,056,277) 4.301,139 (569,716) 18 (331.546) (177,909) 3,731,423 1.275.469 (13.674) 1.273.889 (13.131) 4,049,195 (34,434) (30,136) 1.261,795 1.260,758 4,014,761 3.701,287 Attributable to: Owners of the Bank Non-controlling interests Net profit for the period 1.247.569 14.226 1.234,487 26.271 3,966,688 48,073 3,619,101 22.186 1.261,795 1,260,758 4,014,761 3,701,287 Basic and diluted earnings per share (AED per share) 19 0.16 0.15 0.53 0.53 Dubai Islamic Bank P.J.S.C. Condensed consolidated interim statement of comprehensive income (Unaudited) for the nine-month period ended 30 September 2019 Three-month period ended 30 September 2019 2018 AED'000 AED'000 Nine-month period ended 30 September 2019 2018 AED'000 AED'000 Net profit for the period 1.261,795 1,260,758 4,014,761 3,701,287 (14.470) (107.536) (171,669) (176,349) Other comprehensive income / aluss) items Items that will not be reclassified subscquently to profit or loss Fair value loss on other investments carried at FVTOCI.net tion that may be reclassified subsequently to profit or loss, Exchange differences on translation of foreign operations, net Other comprehensive less for the period Total comprehensive income for the period (447,018) 2.257 (2,213) 1.189.382 (30.294) (137,830) 1.122,928 (51.200) (222,869) (623,367) 3.791,892 3,077.920 Attributable to Owners of the Bank Non-controlling interests Total comprehensive income for the period 1.175,739 13.843 1.097,713 25.215 3,746,500 45.392 2,996,926 80.994 1.189.582 1,122,928 3.791,892 3,077.920

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts