Question: Solve this question used the decision tree knowledge. Please write the decision tree and attach the picture below. Assume that you have successfully completed the

Solve this question used the decision tree knowledge. Please write the decision tree and attach the picture below.

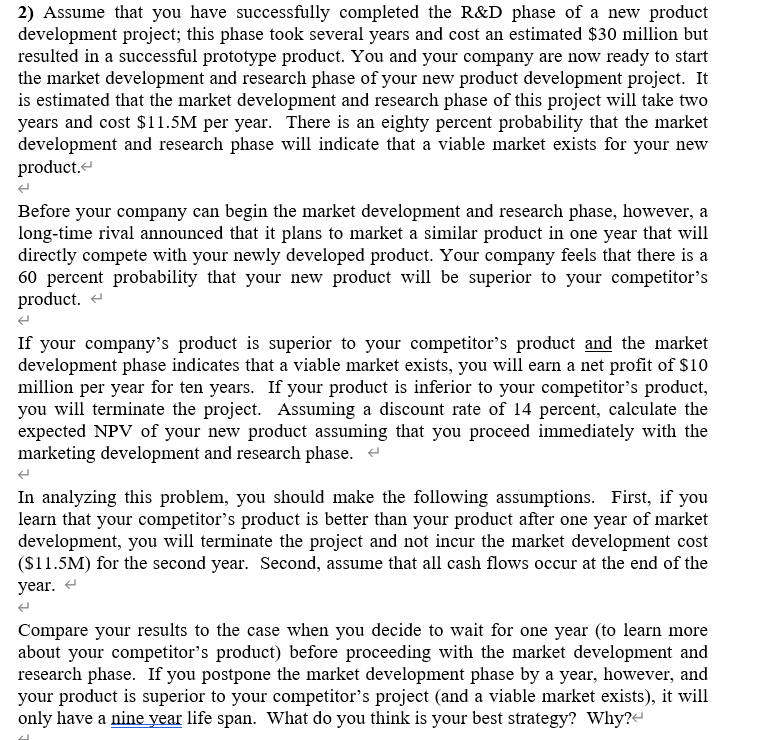

Assume that you have successfully completed the R&D phase of a new product development project; this phase took several years and cost an estimated $30 million but resulted in a successful prototype product. You and your company are now ready to start the market development and research phase of your new product development project. It is estimated that the market development and research phase of this project will take two years and cost $11.5M per year. There is an eighty percent probability that the market development and research phase will indicate that a viable market exists for your new product.

Before your company can begin the market development and research phase, however, a long-time rival announced that it plans to market a similar product in one year that will directly compete with your newly developed product. Your company feels that there is a 60 percent probability that your new product will be superior to your competitors product.

If your companys product is superior to your competitors product and the market development phase indicates that a viable market exists, you will earn a net profit of $10 million per year for ten years. If your product is inferior to your competitors product, you will terminate the project. Assuming a discount rate of 14 percent, calculate the expected NPV of your new product assuming that you proceed immediately with the marketing development and research phase.

In analyzing this problem, you should make the following assumptions. First, if you learn that your competitors product is better than your product after one year of market development, you will terminate the project and not incur the market development cost ($11.5M) for the second year. Second, assume that all cash flows occur at the end of the year.

2) Assume that you have successfully completed the R\&D phase of a new product development project; this phase took several years and cost an estimated $30 million but resulted in a successful prototype product. You and your company are now ready to start the market development and research phase of your new product development project. It is estimated that the market development and research phase of this project will take two years and cost $11.5M per year. There is an eighty percent probability that the market development and research phase will indicate that a viable market exists for your new product. Before your company can begin the market development and research phase, however, a long-time rival announced that it plans to market a similar product in one year that will directly compete with your newly developed product. Your company feels that there is a 60 percent probability that your new product will be superior to your competitor's product. If your company's product is superior to your competitor's product and the market development phase indicates that a viable market exists, you will earn a net profit of $10 million per year for ten years. If your product is inferior to your competitor's product, you will terminate the project. Assuming a discount rate of 14 percent, calculate the expected NPV of your new product assuming that you proceed immediately with the marketing development and research phase. In analyzing this problem, you should make the following assumptions. First, if you learn that your competitor's product is better than your product after one year of market development, you will terminate the project and not incur the market development cost ($11.5M) for the second year. Second, assume that all cash flows occur at the end of the year. Compare your results to the case when you decide to wait for one year (to learn more about your competitor's product) before proceeding with the market development and research phase. If you postpone the market development phase by a year, however, and your product is superior to your competitor's project (and a viable market exists), it will only have a nine year life span. What do you think is your best strategy? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts