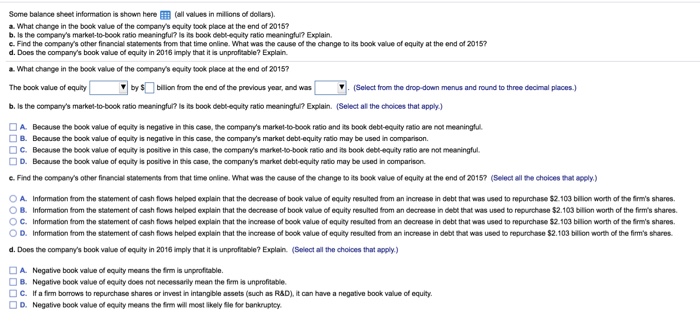

Question: Some balance sheet information is shown here E(all values in milions of dollars). a. What change in the book value of the company's equity took

Some balance sheet information is shown here E(all values in milions of dollars). a. What change in the book value of the company's equity took place at the end of 2015? b. is the company's market-to-book ratio meaningfur? is its book debt-equity ratio meaningfur? Explain eFind te oorpany's other financial statements from that time online, what was the causeoftchange to its book van o'equity at the end of 2015? d. Does the company's book value of equity in 2016 imply that it is unprofitable? Explain. a. What change in the book value of the company's equity took place at the end of 20157 The book value of oquyyilon rom the end of the previous year and was(Selet fom the drop down menus and round to thrededimnal places) b. Is the company's market-to-book ratio mearingful? is its book debt-equity ratio meaningu? Explain. (Select al the choices that appy) A. Because re value of equty is negative in this case, te company's market book ratio and its book debt-egty tatio are not meaningh B. Because the book value of oquty is negative in this case, tecompany's market debt equity ratio may be used i comparison. by billion from the end of the previous year, and was 'I (Select from the drop-down menus and round to three decimal places) C. Because ge value of equity is positive in ris case, ge company's market-lo-book raso and its book debHqity ratio ae not meaingful D. Because the book value of oquty is postive in tis case, te company's market debtequity rato may be used n comparison. .Find the corpany's other financial statements from that time onie. What was the causeofmechange to its book valoo, equity atthe end of 20157CSeoa al hechoces tat apply) O L Informator om the statement ofcash fows helped explain that he decease of book va eo equity resumed tom anianase in debt that was used to repurchase S2 103 bilion wortofte firms shares. B. Information from the statement of cash flows helped explain that the decrease of book value of equity resulted from an decrease in debt that was used to repurchase $2.103 biltion worth of the firm's shares C. Infomation from the statement of cash flows helped explain that the increase of book value of equity resulted from an decrease in debt that was used to repurchase $2.103 billion worth of the irm's shares D. Information from the statement of cash fows helped explain that the increase of book value of equity resulted from an increase in debt that was used to repurchase $2.103 billion worth of the firm's shares d. Does the company's book value of equity in 2016 imply that it is unprofitable? Explain. (Select all the choices that apply) A Negative book value of equity means the frm is unproftable. B. Negative book value of equity does not necessarily mean the firm is unprofitable. C. ifafrm borrows to repurchase shares or invest in intangble assets (such as R&D.itcan have a negative book value of equity D. Negative book value of equity means the frm will most skely Sle for bankruptey Some balance sheet information is shown here E(all values in milions of dollars). a. What change in the book value of the company's equity took place at the end of 2015? b. is the company's market-to-book ratio meaningfur? is its book debt-equity ratio meaningfur? Explain eFind te oorpany's other financial statements from that time online, what was the causeoftchange to its book van o'equity at the end of 2015? d. Does the company's book value of equity in 2016 imply that it is unprofitable? Explain. a. What change in the book value of the company's equity took place at the end of 20157 The book value of oquyyilon rom the end of the previous year and was(Selet fom the drop down menus and round to thrededimnal places) b. Is the company's market-to-book ratio mearingful? is its book debt-equity ratio meaningu? Explain. (Select al the choices that appy) A. Because re value of equty is negative in this case, te company's market book ratio and its book debt-egty tatio are not meaningh B. Because the book value of oquty is negative in this case, tecompany's market debt equity ratio may be used i comparison. by billion from the end of the previous year, and was 'I (Select from the drop-down menus and round to three decimal places) C. Because ge value of equity is positive in ris case, ge company's market-lo-book raso and its book debHqity ratio ae not meaingful D. Because the book value of oquty is postive in tis case, te company's market debtequity rato may be used n comparison. .Find the corpany's other financial statements from that time onie. What was the causeofmechange to its book valoo, equity atthe end of 20157CSeoa al hechoces tat apply) O L Informator om the statement ofcash fows helped explain that he decease of book va eo equity resumed tom anianase in debt that was used to repurchase S2 103 bilion wortofte firms shares. B. Information from the statement of cash flows helped explain that the decrease of book value of equity resulted from an decrease in debt that was used to repurchase $2.103 biltion worth of the firm's shares C. Infomation from the statement of cash flows helped explain that the increase of book value of equity resulted from an decrease in debt that was used to repurchase $2.103 billion worth of the irm's shares D. Information from the statement of cash fows helped explain that the increase of book value of equity resulted from an increase in debt that was used to repurchase $2.103 billion worth of the firm's shares d. Does the company's book value of equity in 2016 imply that it is unprofitable? Explain. (Select all the choices that apply) A Negative book value of equity means the frm is unproftable. B. Negative book value of equity does not necessarily mean the firm is unprofitable. C. ifafrm borrows to repurchase shares or invest in intangble assets (such as R&D.itcan have a negative book value of equity D. Negative book value of equity means the frm will most skely Sle for bankruptey

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts