Question: Someone kindly assists me with this... Using Table 3.1 on page 62 of the textbook complete the following: If you decide to buy the S&R

Someone kindly assists me with this...

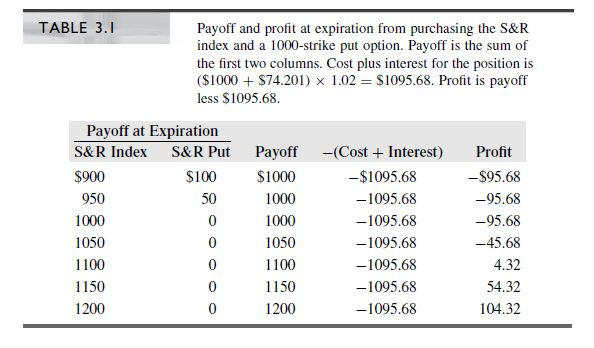

Using Table 3.1 on page 62 of the textbook complete the following:

If you decide to buy the S&R index for 1150 and buy a 1050 strike put as well as borrow 900. Calculate the Payoff and Profit. No need to draw any graphs just set up as a table.

TABLE 3.1 Payoff and profit at expiration from purchasing the S&R index and a 1000-strike put option. Payoff is the sum of the first two columns. Cost plus interest for the position is ($1000 + $74.201) x 1.02 = $1095.68. Profit is payoff less $1095.68. Payoff at Expiration S&R Index S&R Put $900 $100 950 1000 1050 1100 0 Payoff $1000 1000 1000 1050 1100 1150 1200 -(Cost + Interest) -$1095.68 -1095.68 -1095.68 - 1095.68 -1095.68 -1095.68 - 1095.68 Profit -$95.68 -95.68 -95.68 -45.68 4.32 54.32 104.32 1150 1200 TABLE 3.1 Payoff and profit at expiration from purchasing the S&R index and a 1000-strike put option. Payoff is the sum of the first two columns. Cost plus interest for the position is ($1000 + $74.201) x 1.02 = $1095.68. Profit is payoff less $1095.68. Payoff at Expiration S&R Index S&R Put $900 $100 950 1000 1050 1100 0 Payoff $1000 1000 1000 1050 1100 1150 1200 -(Cost + Interest) -$1095.68 -1095.68 -1095.68 - 1095.68 -1095.68 -1095.68 - 1095.68 Profit -$95.68 -95.68 -95.68 -45.68 4.32 54.32 104.32 1150 1200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts