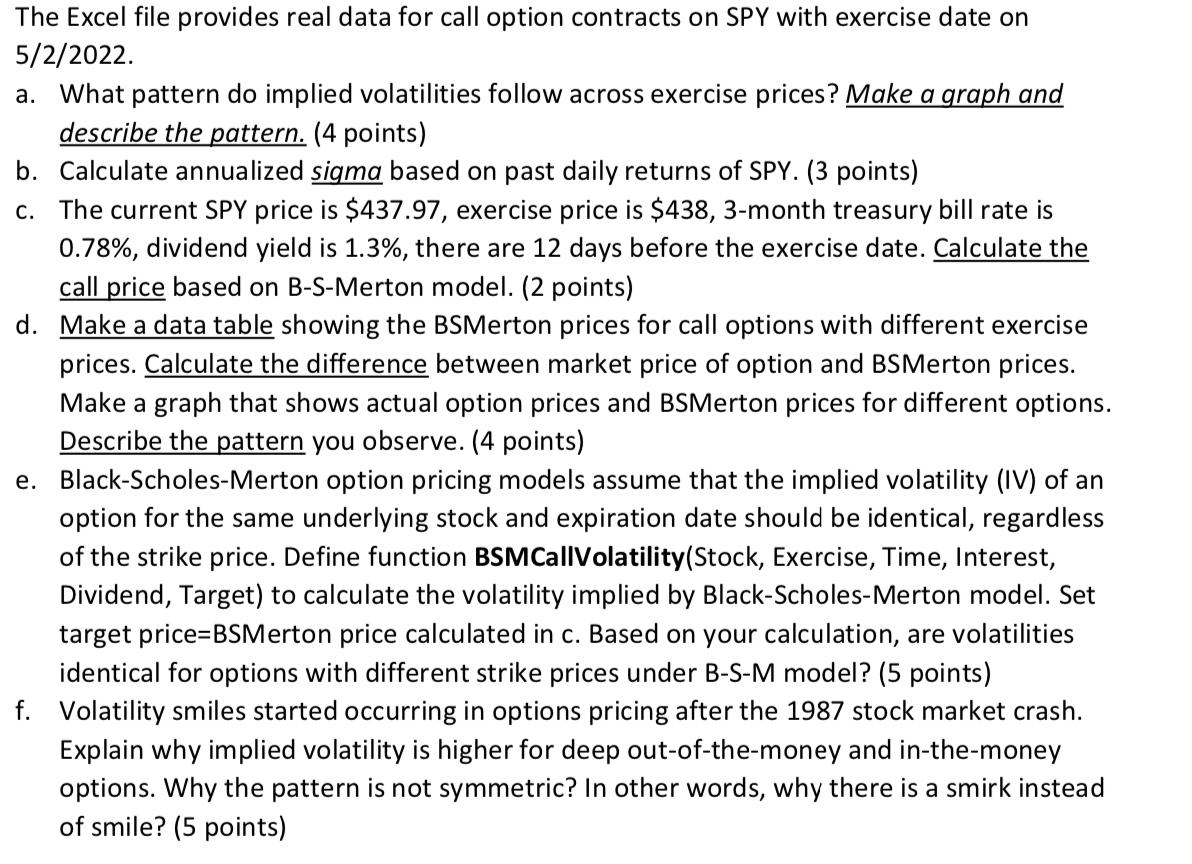

Question: SPY Call Option Data, exercise date 5/2/2022 Contract Name Strike Last Price Volume Open Interest Implied Volatility SPY220502C00355000 355 103.82 - 1 0.682 SPY220502C00360000 360

| SPY Call Option Data, exercise date 5/2/2022 | |||||

| Contract Name | Strike | Last Price | Volume | Open Interest | Implied Volatility |

| SPY220502C00355000 | 355 | 103.82 | - | 1 | 0.682 |

| SPY220502C00360000 | 360 | 83.3 | 2 | 2 | 0.6462 |

| SPY220502C00370000 | 370 | 90.07 | - | 1 | 0.5769 |

| SPY220502C00390000 | 390 | 71.48 | - | 1 | 0.4592 |

| SPY220502C00395000 | 395 | 47.64 | 1 | 2 | 0.4253 |

| SPY220502C00400000 | 400 | 38.2 | 7 | 8 | 0.3923 |

| SPY220502C00404000 | 404 | 38 | - | 1 | 0.3669 |

| SPY220502C00405000 | 405 | 35.3 | 1 | 2 | 0.3601 |

| SPY220502C00406000 | 406 | 34.38 | - | 2 | 0.3549 |

| SPY220502C00408000 | 408 | 31.39 | - | 5 | 0.3431 |

| SPY220502C00410000 | 410 | 29.48 | 29 | 2 | 0.3319 |

| SPY220502C00414000 | 414 | 39.69 | 1 | 1 | 0.3099 |

| SPY220502C00415000 | 415 | 26.85 | 1 | 5 | 0.3051 |

| SPY220502C00416000 | 416 | 25.49 | - | 5 | 0.2999 |

| SPY220502C00420000 | 420 | 20.79 | 36 | 27 | 0.2815 |

| SPY220502C00422000 | 422 | 19.16 | 3 | 99 | 0.2706 |

| SPY220502C00424000 | 424 | 17.51 | - | 3 | 0.2627 |

| SPY220502C00425000 | 425 | 14.52 | 1 | 68 | 0.2606 |

| SPY220502C00426000 | 426 | 19.8 | - | 17 | 0.2566 |

| SPY220502C00428000 | 428 | 12.92 | 12 | 76 | 0.2473 |

| SPY220502C00430000 | 430 | 10.4 | 73 | 82 | 0.2414 |

| SPY220502C00432000 | 432 | 9.51 | 62 | 117 | 0.2324 |

| SPY220502C00434000 | 434 | 8.87 | 429 | 124 | 0.2249 |

| SPY220502C00435000 | 435 | 7.81 | 444 | 411 | 0.2211 |

| SPY220502C00436000 | 436 | 7.95 | 300 | 287 | 0.2142 |

| SPY220502C00438000 | 438 | 6.99 | 889 | 264 | 0.2067 |

| SPY220502C00440000 | 440 | 5.85 | 1555 | 537 | 0.1997 |

| SPY220502C00442000 | 442 | 4.07 | 536 | 606 | 0.1923 |

| SPY220502C00444000 | 444 | 3.46 | 474 | 543 | 0.1851 |

| SPY220502C00445000 | 445 | 3.34 | 272 | 755 | 0.1814 |

| SPY220502C00446000 | 446 | 2.93 | 242 | 312 | 0.1777 |

| SPY220502C00447000 | 447 | 2.3 | 208 | 607 | 0.1744 |

| SPY220502C00448000 | 448 | 1.71 | 244 | 236 | 0.1708 |

| SPY220502C00449000 | 449 | 1.46 | 145 | 428 | 0.1674 |

| SPY220502C00450000 | 450 | 1.62 | 2218 | 1438 | 0.1646 |

| SPY220502C00451000 | 451 | 1.32 | 141 | 423 | 0.1613 |

| SPY220502C00452000 | 452 | 1.11 | 196 | 439 | 0.1587 |

| SPY220502C00453000 | 453 | 0.76 | 299 | 537 | 0.1563 |

| SPY220502C00454000 | 454 | 0.61 | 218 | 1530 | 0.1542 |

| SPY220502C00455000 | 455 | 0.62 | 450 | 969 | 0.152 |

| SPY220502C00456000 | 456 | 0.37 | 129 | 265 | 0.1506 |

| SPY220502C00457000 | 457 | 0.34 | 61 | 364 | 0.1489 |

| SPY220502C00458000 | 458 | 0.33 | 387 | 590 | 0.1475 |

| SPY220502C00459000 | 459 | 0.19 | 117 | 418 | 0.146 |

| SPY220502C00460000 | 460 | 0.19 | 713 | 1865 | 0.1453 |

| SPY220502C00461000 | 461 | 0.17 | 430 | 691 | 0.1436 |

| SPY220502C00462000 | 462 | 0.14 | 77 | 486 | 0.1436 |

| SPY220502C00463000 | 463 | 0.12 | 22 | 245 | 0.1426 |

| SPY220502C00464000 | 464 | 0.08 | 123 | 445 | 0.1426 |

| SPY220502C00465000 | 465 | 0.07 | 325 | 610 | 0.1421 |

| SPY220502C00466000 | 466 | 0.04 | 66 | 188 | 0.1436 |

| SPY220502C00467000 | 467 | 0.06 | 12 | 445 | 0.1436 |

| SPY220502C00468000 | 468 | 0.06 | 2 | 594 | 0.1436 |

| SPY220502C00469000 | 469 | 0.05 | 31 | 642 | 0.1426 |

| SPY220502C00470000 | 470 | 0.03 | 428 | 1243 | 0.1465 |

| SPY220502C00471000 | 471 | 0.02 | 30 | 293 | 0.1445 |

| SPY220502C00472000 | 472 | 0.03 | 6 | 381 | 0.1475 |

| SPY220502C00473000 | 473 | 0.02 | 1 | 448 | 0.1514 |

| SPY220502C00474000 | 474 | 0.01 | 7 | 484 | 0.1543 |

| SPY220502C00475000 | 475 | 0.02 | 2 | 524 | 0.1582 |

| SPY220502C00476000 | 476 | 0.01 | 3 | 602 | 0.1524 |

| SPY220502C00478000 | 478 | 0.01 | 3 | 440 | 0.1582 |

| SPY220502C00480000 | 480 | 0.01 | 84 | 1498 | 0.1641 |

| SPY220502C00482000 | 482 | 0.01 | 5 | 266 | 0.1719 |

| SPY220502C00484000 | 484 | 0.01 | 1 | 33 | 0.1797 |

| SPY220502C00485000 | 485 | 0.01 | 36 | 5009 | 0.1816 |

| SPY220502C00486000 | 486 | 0.02 | 15 | 50 | 0.1836 |

| SPY220502C00488000 | 488 | 0.01 | 33 | 413 | 0.1914 |

| SPY220502C00490000 | 490 | 0.01 | 1 | 188 | 0.1992 |

| SPY220502C00492000 | 492 | 0.01 | 3 | 39 | 0.2031 |

| SPY220502C00494000 | 494 | 0.01 | 5 | 61 | 0.2109 |

| SPY220502C00495000 | 495 | 0.01 | 160 | 207 | 0.2149 |

| SPY220502C00498000 | 498 | 0.01 | 20 | 219 | 0.2227 |

| SPY220502C00500000 | 500 | 0.01 | 100 | 583 | 0.2305 |

| SPY220502C00502000 | 502 | 0.01 | 1 | 6 | 0.2344 |

| SPY220502C00504000 | 504 | 0.01 | 40 | 52 | 0.2422 |

| SPY220502C00506000 | 506 | 0.01 | 1 | 1 | 0.25 |

| SPY220502C00508000 | 508 | 0.01 | 2 | 2 | 0.2539 |

| SPY220502C00510000 | 510 | 0.02 | - | 113 | 0.2617 |

| SPY220502C00520000 | 520 | 0.01 | 39 | 110 | 0.2891 |

| SPY220502C00530000 | 530 | 0.01 | 100 | 200 | 0.3203 |

| SPY220502C00540000 | 540 | 0.01 | - | 7 | 0.3477 |

| SPY Call Option Data, exercise date 5/2/2022 | |||||

| Contract Name | Strike | Last Price | Volume | Open Interest | Implied Volatility |

| SPY220502C00355000 | 355 | 103.82 | - | 1 | 0.682 |

| SPY220502C00360000 | 360 | 83.3 | 2 | 2 | 0.6462 |

| SPY220502C00370000 | 370 | 90.07 | - | 1 | 0.5769 |

| SPY220502C00390000 | 390 | 71.48 | - | 1 | 0.4592 |

| SPY220502C00395000 | 395 | 47.64 | 1 | 2 | 0.4253 |

| SPY220502C00400000 | 400 | 38.2 | 7 | 8 | 0.3923 |

| SPY220502C00404000 | 404 | 38 | - | 1 | 0.3669 |

| SPY220502C00405000 | 405 | 35.3 | 1 | 2 | 0.3601 |

| SPY220502C00406000 | 406 | 34.38 | - | 2 | 0.3549 |

| SPY220502C00408000 | 408 | 31.39 | - | 5 | 0.3431 |

| SPY220502C00410000 | 410 | 29.48 | 29 | 2 | 0.3319 |

| SPY220502C00414000 | 414 | 39.69 | 1 | 1 | 0.3099 |

| SPY220502C00415000 | 415 | 26.85 | 1 | 5 | 0.3051 |

| SPY220502C00416000 | 416 | 25.49 | - | 5 | 0.2999 |

| SPY220502C00420000 | 420 | 20.79 | 36 | 27 | 0.2815 |

| SPY220502C00422000 | 422 | 19.16 | 3 | 99 | 0.2706 |

| SPY220502C00424000 | 424 | 17.51 | - | 3 | 0.2627 |

| SPY220502C00425000 | 425 | 14.52 | 1 | 68 | 0.2606 |

| SPY220502C00426000 | 426 | 19.8 | - | 17 | 0.2566 |

| SPY220502C00428000 | 428 | 12.92 | 12 | 76 | 0.2473 |

| SPY220502C00430000 | 430 | 10.4 | 73 | 82 | 0.2414 |

| SPY220502C00432000 | 432 | 9.51 | 62 | 117 | 0.2324 |

| SPY220502C00434000 | 434 | 8.87 | 429 | 124 | 0.2249 |

| SPY220502C00435000 | 435 | 7.81 | 444 | 411 | 0.2211 |

| SPY220502C00436000 | 436 | 7.95 | 300 | 287 | 0.2142 |

| SPY220502C00438000 | 438 | 6.99 | 889 | 264 | 0.2067 |

| SPY220502C00440000 | 440 | 5.85 | 1555 | 537 | 0.1997 |

| SPY220502C00442000 | 442 | 4.07 | 536 | 606 | 0.1923 |

| SPY220502C00444000 | 444 | 3.46 | 474 | 543 | 0.1851 |

| SPY220502C00445000 | 445 | 3.34 | 272 | 755 | 0.1814 |

| SPY220502C00446000 | 446 | 2.93 | 242 | 312 | 0.1777 |

| SPY220502C00447000 | 447 | 2.3 | 208 | 607 | 0.1744 |

| SPY220502C00448000 | 448 | 1.71 | 244 | 236 | 0.1708 |

| SPY220502C00449000 | 449 | 1.46 | 145 | 428 | 0.1674 |

| SPY220502C00450000 | 450 | 1.62 | 2218 | 1438 | 0.1646 |

| SPY220502C00451000 | 451 | 1.32 | 141 | 423 | 0.1613 |

| SPY220502C00452000 | 452 | 1.11 | 196 | 439 | 0.1587 |

| SPY220502C00453000 | 453 | 0.76 | 299 | 537 | 0.1563 |

| SPY220502C00454000 | 454 | 0.61 | 218 | 1530 | 0.1542 |

| SPY220502C00455000 | 455 | 0.62 | 450 | 969 | 0.152 |

| SPY220502C00456000 | 456 | 0.37 | 129 | 265 | 0.1506 |

| SPY220502C00457000 | 457 | 0.34 | 61 | 364 | 0.1489 |

| SPY220502C00458000 | 458 | 0.33 | 387 | 590 | 0.1475 |

| SPY220502C00459000 | 459 | 0.19 | 117 | 418 | 0.146 |

| SPY220502C00460000 | 460 | 0.19 | 713 | 1865 | 0.1453 |

| SPY220502C00461000 | 461 | 0.17 | 430 | 691 | 0.1436 |

| SPY220502C00462000 | 462 | 0.14 | 77 | 486 | 0.1436 |

| SPY220502C00463000 | 463 | 0.12 | 22 | 245 | 0.1426 |

| SPY220502C00464000 | 464 | 0.08 | 123 | 445 | 0.1426 |

| SPY220502C00465000 | 465 | 0.07 | 325 | 610 | 0.1421 |

| SPY220502C00466000 | 466 | 0.04 | 66 | 188 | 0.1436 |

| SPY220502C00467000 | 467 | 0.06 | 12 | 445 | 0.1436 |

| SPY220502C00468000 | 468 | 0.06 | 2 | 594 | 0.1436 |

| SPY220502C00469000 | 469 | 0.05 | 31 | 642 | 0.1426 |

| SPY220502C00470000 | 470 | 0.03 | 428 | 1243 | 0.1465 |

| SPY220502C00471000 | 471 | 0.02 | 30 | 293 | 0.1445 |

| SPY220502C00472000 | 472 | 0.03 | 6 | 381 | 0.1475 |

| SPY220502C00473000 | 473 | 0.02 | 1 | 448 | 0.1514 |

| SPY220502C00474000 | 474 | 0.01 | 7 | 484 | 0.1543 |

| SPY220502C00475000 | 475 | 0.02 | 2 | 524 | 0.1582 |

| SPY220502C00476000 | 476 | 0.01 | 3 | 602 | 0.1524 |

| SPY220502C00478000 | 478 | 0.01 | 3 | 440 | 0.1582 |

| SPY220502C00480000 | 480 | 0.01 | 84 | 1498 | 0.1641 |

| SPY220502C00482000 | 482 | 0.01 | 5 | 266 | 0.1719 |

| SPY220502C00484000 | 484 | 0.01 | 1 | 33 | 0.1797 |

| SPY220502C00485000 | 485 | 0.01 | 36 | 5009 | 0.1816 |

| SPY220502C00486000 | 486 | 0.02 | 15 | 50 | 0.1836 |

| SPY220502C00488000 | 488 | 0.01 | 33 | 413 | 0.1914 |

| SPY220502C00490000 | 490 | 0.01 | 1 | 188 | 0.1992 |

| SPY220502C00492000 | 492 | 0.01 | 3 | 39 | 0.2031 |

| SPY220502C00494000 | 494 | 0.01 | 5 | 61 | 0.2109 |

| SPY220502C00495000 | 495 | 0.01 | 160 | 207 | 0.2149 |

| SPY220502C00498000 | 498 | 0.01 | 20 | 219 | 0.2227 |

| SPY220502C00500000 | 500 | 0.01 | 100 | 583 | 0.2305 |

| SPY220502C00502000 | 502 | 0.01 | 1 | 6 | 0.2344 |

| SPY220502C00504000 | 504 | 0.01 | 40 | 52 | 0.2422 |

| SPY220502C00506000 | 506 | 0.01 | 1 | 1 | 0.25 |

| SPY220502C00508000 | 508 | 0.01 | 2 | 2 | 0.2539 |

| SPY220502C00510000 | 510 | 0.02 | - | 113 | 0.2617 |

| SPY220502C00520000 | 520 | 0.01 | 39 | 110 | 0.2891 |

| SPY220502C00530000 | 530 | 0.01 | 100 | 200 | 0.3203 |

| SPY220502C00540000 | 540 | 0.01 | - | 7 | 0.3477 |

The Excel file provides real data for call option contracts on SPY with exercise date on 5/2/2022. a. What pattern do implied volatilities follow across exercise prices? Make a graph and describe the pattern. (4 points) b. Calculate annualized sigma based on past daily returns of SPY. (3 points) c. The current SPY price is $437.97, exercise price is $438, 3-month treasury bill rate is 0.78%, dividend yield is 1.3%, there are 12 days before the exercise date. Calculate the call price based on B-S-Merton model. (2 points) d. Make a data table showing the BSMerton prices for call options with different exercise prices. Calculate the difference between market price of option and BSMerton prices. Make a graph that shows actual option prices and BSMerton prices for different options. Describe the pattern you observe. (4 points) e. Black-Scholes-Merton option pricing models assume that the implied volatility (IV) of an option for the same underlying stock and expiration date should be identical, regardless of the strike price. Define function BSMCallVolatility (Stock, Exercise, Time, Interest, Dividend, Target) to calculate the volatility implied by Black-Scholes-Merton model. Set target price=BSMerton price calculated in c. Based on your calculation, are volatilities identical for options with different strike prices under B-S-M model? (5 points) f. Volatility smiles started occurring in options pricing after the 1987 stock market crash. Explain why implied volatility is higher for deep out-of-the-money and in-the-money options. Why the pattern is not symmetric? In other words, why there is a smirk instead of smile? (5 points)

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Here are the answers to the questions a What pattern do implied volatilities follow across exercise ... View full answer

Get step-by-step solutions from verified subject matter experts