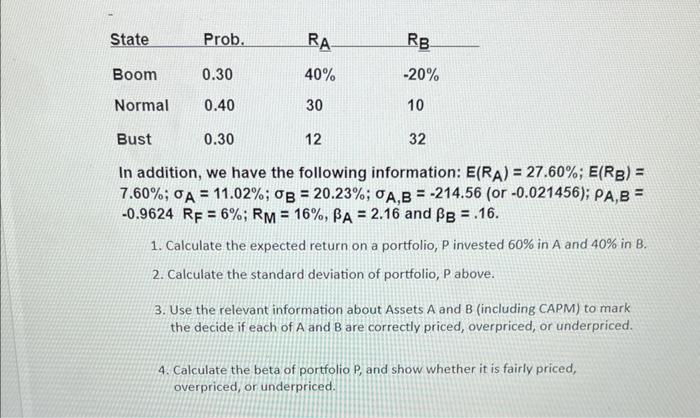

Question: State Prob. RA RB Boom 0.30 40% -20% Normal 0.40 30 10 Bust 0.30 12 32 In addition, we have the following information: E(RA)

State Prob. RA RB Boom 0.30 40% -20% Normal 0.40 30 10 Bust 0.30 12 32 In addition, we have the following information: E(RA) = 27.60%; E(RB) = 7.60%; A = 11.02%; B = 20.23%; A,B = -214.56 (or -0.021456); PA,B = -0.9624 RF = 6%; RM = 16%, BA = 2.16 and B = .16. 1. Calculate the expected return on a portfolio, P invested 60% in A and 40% in B. 2. Calculate the standard deviation of portfolio, P above. 3. Use the relevant information about Assets A and B (including CAPM) to mark the decide if each of A and B are correctly priced, overpriced, or underpriced. 4. Calculate the beta of portfolio P, and show whether it is fairly priced, overpriced, or underpriced.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts