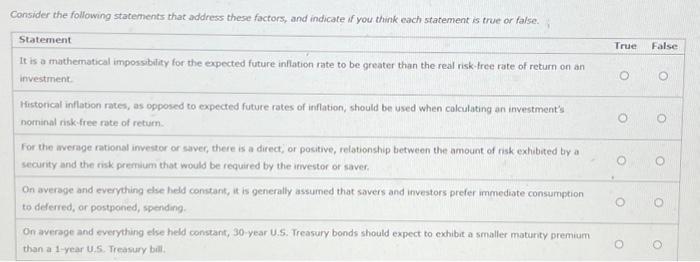

Question: Statement True It is a mathematical impossibitity for the expected future inflation rate to be greater than the real risk-free rate of return on an

Statement True It is a mathematical impossibitity for the expected future inflation rate to be greater than the real risk-free rate of return on an investment Hestorical inflation rates, as opposed to expected future rates of inflation, should be used when colculating an investment's nominal risk-free rate of return. for the average rational imvestor or saver, there is a direct, or positive, relationship between the amount of fisk exhibited ty a security and the risk prerium that would be required by the irvestor or saver. On average and everything else held consant, it is generally assumed that savers and investors prefer immediate consumption to deferied, or postponed, speriding. On average and everything else held constant, 30 -year U.S. Treasury bonds should expect to exhibit a smaller maturity premium than a 1 -year 4,5. Treasury bull

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts