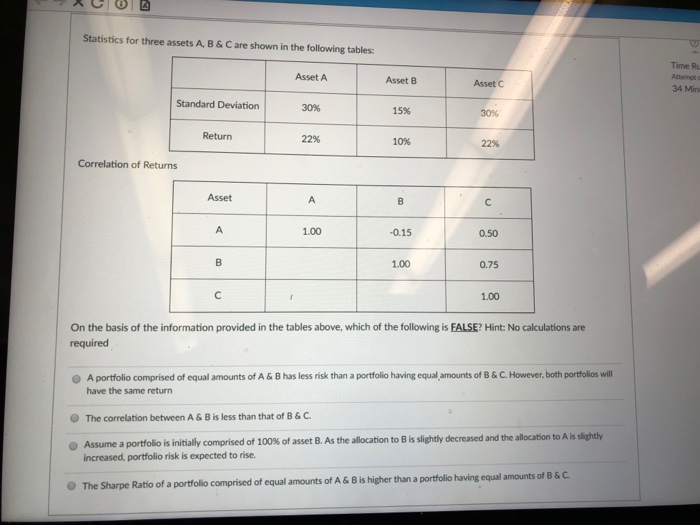

Question: Statistics for three assets A, B&C are shown in the following tables: Time R Asset A Asset B Asset C 34 Min Standard Deviation 30%

Statistics for three assets A, B&C are shown in the following tables: Time R Asset A Asset B Asset C 34 Min Standard Deviation 30% 15% 30% Return 10% 22% Correlation of Returns 1.00 0.15 0.50 1.00 0.75 1.00 On the basis of the information provided in the tables above, which of the following is FALSE? Hint: No calculations are required O A portfolio comprised of equal amounts of A & B has less risk than a portfolio having equal, amounts of B &C. However, both portfolios will have the same return The correlation between A & B is less than that of B & C. Assume a portfolio is initially comprised of 100% of asset B. As the allocation to B is slightly decreased and the allocation to A is slightly 0 increased, portfolio risk is expected to rise. Ratio of a portfolio comprised of equal amounts of A & B is higher than a portfolio having equal amounts of B & C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts