Question: Step by step solution needed for the question and with the answer thanks An ordinary share pays half-yearly dividends. The last dividend payment that has

Step by step solution needed for the question and with the answer thanks

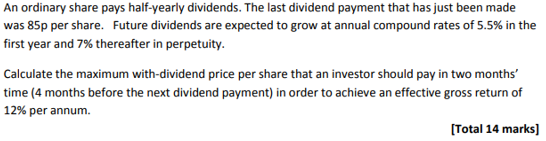

An ordinary share pays half-yearly dividends. The last dividend payment that has just been made was 85p per share. Future dividends are expected to grow at annual compound rates of 5.5% in the first year and 7% thereafter in perpetuity Calculate the maximum with-dividend price per share that an investor should pay in two months' time (4 months before the next dividend payment) in order to achieve an effective gross return of 12% per annum. Total 14 marks] An ordinary share pays half-yearly dividends. The last dividend payment that has just been made was 85p per share. Future dividends are expected to grow at annual compound rates of 5.5% in the first year and 7% thereafter in perpetuity Calculate the maximum with-dividend price per share that an investor should pay in two months' time (4 months before the next dividend payment) in order to achieve an effective gross return of 12% per annum. Total 14 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts