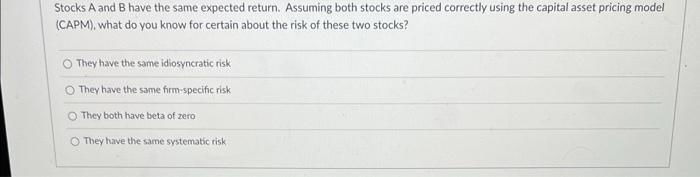

Question: Stocks A and B have the same expected return. Assuming both stocks are priced correctly using the capital asset pricing model (CAPM), what do you

Stocks A and B have the same expected return. Assuming both stocks are priced correctly using the capital asset pricing model (CAPM), what do you know for certain about the risk of these two stocks? They have the same idiosyncratic risk They have the same firm-specific risk They both have beta of zero They have the same systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts