Question: Study case: Dell Computer Theme: Strategic leadership: managing the process of preparing strategies for competitive advantage Dell Computer has enjoyed a very profitable decade. Between

Study case: Dell Computer

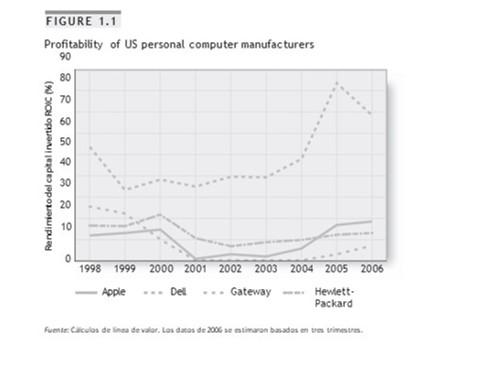

Theme: Strategic leadership: managing the process of preparing strategies for competitive advantage Dell Computer has enjoyed a very profitable decade. Between 1998 and 2006, its average return on invested capital (ROIC) was an impressive 48.3%, well above the profitability of its competitors that make personal computers (see figure 1.1). Additionally, while their profitability declined sharply during 2001-2004, reflecting a difficult sales environment in the personal computer industry, Dell managed to maintain a very high ROIC. Clearly, the company has a competitive advantage over its rivals. What is this about? One answer could be Dell's business model: which is to sell directly to customers or end consumers. Michael Dell thought that eliminating wholesalers and distributors would make the profit he would still receive and could share it with customers in the form of lower prices. Initially, Dell conducted its direct sales through the mail and phone calls, but since the mid-1990s, much of it has been made through their website. This sophisticated website allows customers to mix and match product features such as microprocessors, memory, monitors, internal hard drives, CD and DVD drives, keyboard, mouse, and more, to customize their computer systems. The ability to customize orders kept customers coming back to Dell and helped drive sales to a $ 55.9 billion mark in 2004. Another reason for Dell's high performance is the way it manages its supply chain to reduce the cost of holding inventory. Dell has about 200 vendors, more than half of them based outside of the United States. On the other hand, it uses the internet to transmit its suppliers information in real time about the flow of an order so that they have up-to-the-minute information about demand trends for the components they produce, along with volume expectations for the four twelve weeks ahead. Its suppliers use this information to adjust their own production schedules, manufacture enough components for Dell's needs, and ship them in the most appropriate way so that they arrive just in time for assembly. This close coordination is carried further back up the supply chain because Dell shares this information with those who supply its most important suppliers. The company's goal is to coordinate its supply chain in such a way that all inventories, except those actually in transit between suppliers and Dell, disappear from it, effectively replacing inventory with information. Dell has managed to reduce inventory to the lowest level in the industry. In mid-2006, its inventory rotated every five days, compared to an average of forty-one days for one of its most important competitors, Hewlett-Packard. This high turnover is a critical source of competitive advantage in the computer industry, where component costs account for 75% of revenue and typically decline 1% per week due to rapid obsolescence. Despite its high profitability, between mid-2005 and mid-2006, Dell's stock shares lost half their market value, going from $ 42 to $ 22 each. Several reasons caused this decline. The first reason is that after years of trying, three of Dell's competitors - Acer, Hewlett-Packard, and Lenovo - lowered their cost structure and increased their competitiveness, allowing them to match Dell's prices and still make a profit. . The second, in 2005, the PC consumer market in developed countries had matured. To continue growing, Dell tried to expand its market share. However, here you face stiff competition from Hewlett Packard, which offers business users a broader range of products, in-depth consulting services, as well as after-sales service and support. Business users highly value all of this. Third, Dell's growth had been hurt by poor customer service, an area that, in an attempt to cut costs, the company had outsourced or outsourced to an Indian-based vendor, but found that poor service was driving its customers away. customers. Although he repatriated customer service for business users back to the United States, the damage was done and this only served to highlight the difference between Dell and Hewlett-Packard in the minds of business customers. Fourth, in an attempt to gain market share from its competitors, Dell cut prices in 2005 and 2006, but made little in sales volume, made less profit per computer, and experienced only a slow profit increase in 2006. Many investors thought Dell's years of rapid earnings growth were over and sold their shares. Analysts forecast Dell's profitability, measured by its ROIC, to decline from more than 60% in 2006 to 30% in 2009 as competitors like Acer, Lenovo and Hewlett-Packard begin to match and differentiate from its cost structure. ways users appreciate.

Instructions: Analyze the Dell case by answering the next questions and give your suggestions on how the company can improve the strategies for competitive advantage.

Why do some companies succeed and others fail? Why has Dell done so well in the fiercely competitive personal computer industry, while others, like Gateway, are struggling to survive? In the personal computer industry, what sets Dell apart from less successful companies like Gateway? In the airline industry, how can Southwest Airlines increase its revenue and profits through thick and thin, while rivals like the U.S. Have Airways and United Airlines had to seek bankruptcy protection? What explains the continued growth and profitability of Nucor Steel, now America's largest steelmaker during a period when many of its once-largest competitors went bankrupt?

FIGURE 1.1 Profitability of US personal computer manufacturers 90 80 60 50 Rendimiento del capitalirvertido ROIC (%) 40 30 20 10 1998 1999 2000 2001 2002 2003 2004 2005 2006 Apple Del Gateway Hewlett- Packard Fuente: Circolas de finca devdar. Los datos de 2006 e estimaron basades en een vrimestresStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts