Question: Study Questions for Ito's Dilemma Case Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in

Study Questions for Ito's Dilemma Case

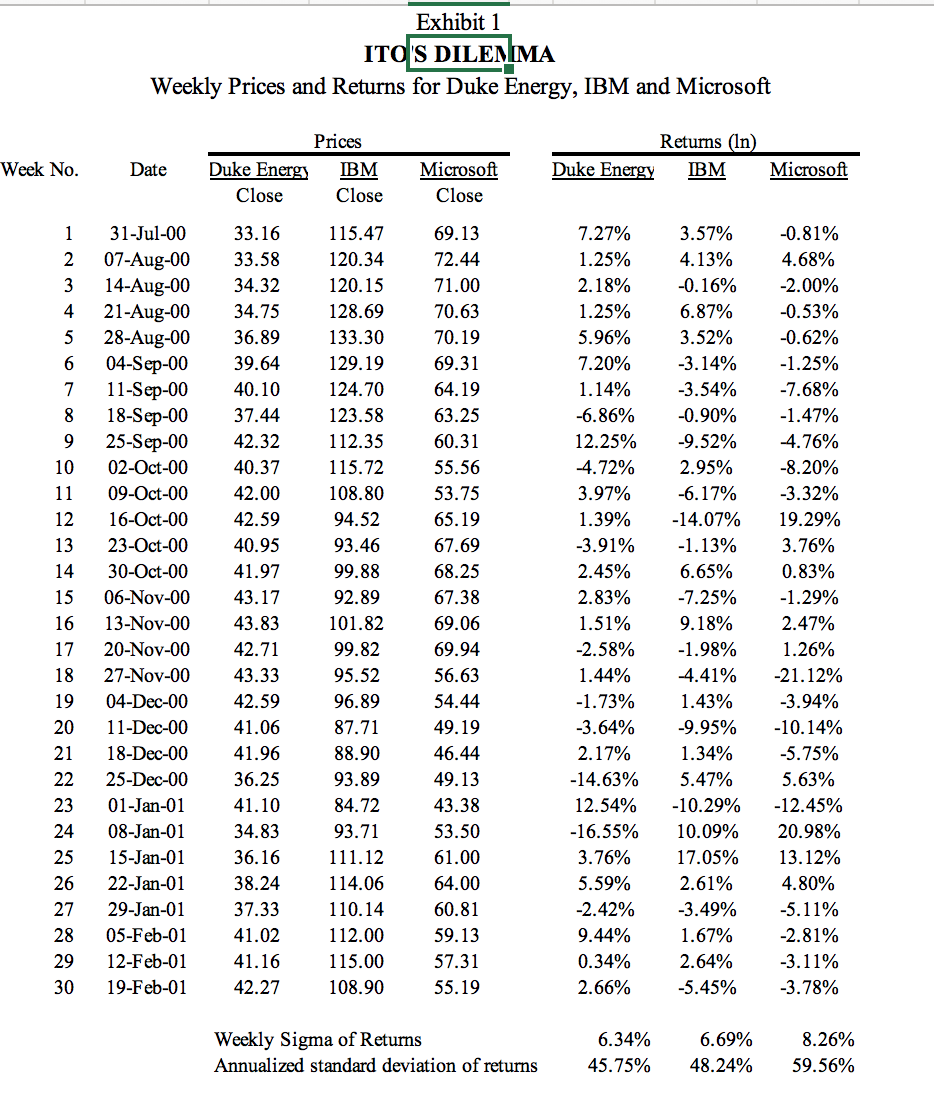

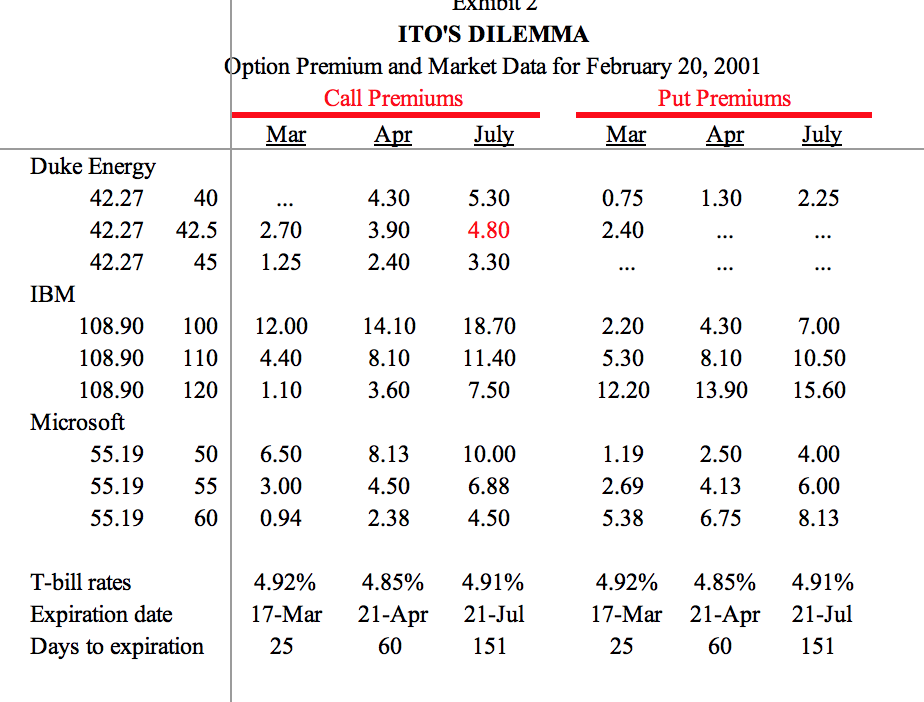

- Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity, assume zero dividend yield. Also, use Louise Ito's volatility estimates, provided in case Exhibit 1.

- Does the model yield logical estimates with respect to intrinsic value and time-to- maturity? What happens to the option premiums as you change the volatility? Can you explain why volatility affects prices in such a manner?

- How's your estimates compare with the actual quoted prices? Can you explain the differences? Assuming your prices are correct, which options would you buy or sell?

- Are there any problems with the way Ito estimated the volatility numbers? Can you think of another way to estimate volatility that might yield estimates closer to the actual quotes?

- Using the Black-Scholes pricing function in Excel, calculate how sensitive IBM's March 110 call price is to changes in stock price. How much does the call price vary for $0.50 changes in IBM share price when the option is at the money (assume stock price=$110), in the money (assume stock price=$115), and out of the money (assume stock price=$105)? What does this sensitivity analysis tell you?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock