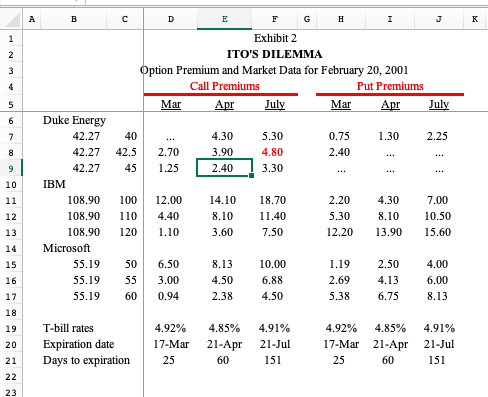

Question: Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity, assume

-

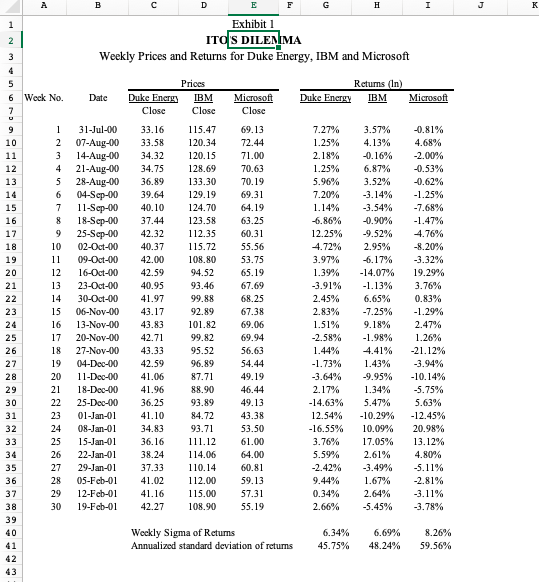

Using the Black-Scholes pricing function in Excel, compute an option value for each strike price and maturity date in case Exhibit 2. For simplicity, assume zero dividend yield. Also, use Louise Itos volatility estimates, provided in case Exhibit 1

-

-

3. 4.-06 3.-3-3-0-9 2.-6 14-1 6.-79-1-41-9. 5. 10 10 17. 2.-312-5 34 13 44 00 63 9 3 9 5 3 5 5 19 69 5 8 06 94 63 44 19 44 3 8 50 00 00 8 339 CI 69 72 71 70 70 69 64 63 60 55 53 65 67 68 67 69 69 56 54 49 46 49 43 53 61 64 60 of 72 .30 52 46 88 89 82 82 52 89 71 90 89 72 71 12 06 14 00 00 90 75 89 64 10 44 3 7 00 59 95 97 7 8 7 3 5 06 96 5 1 8 643 02 16 34 3 6 9 40 37 42 40 42 42 40 4 4 4 4 4 42 4 4 3 4 3 3 3 3 4 12345678911 12 3 4 5 6 7 8 9 20 21 22 23 24 25 26 91 11 2 3 4 5 6 7 123456 Exhibit 2 ITO'S DILEMMA n Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Ll ar Ll Duke Energy 4.30 5.30 4.80 2.40 13.30 42.27 40.. 42.27 42.5 2.70 42.2745 1.25 0.75 30 2.25 2.40 3.90 IBM 10 2.20 4.30 7.00 5.30 8.10 10.50 2.20 13.90 15.60 108.90 100 12.00 14.10 18.70 8.10 11.40 3.60 7.50 108.90 1104.40 108.90 1201.10 12 13 14 Microsoft 15 16 17 18 19 T-bill rates 20 Expiration date 21 Days to expiration 25 8.13 10.00 4.50 2.384.50 55.19 50 6.50 55.19 55 3.00 55.19 60 0.94 1.19 2.50 4.00 2,69 4.13 6.00 5.38 6.75 8.13 6.88 4.92% 4.85% 4.91% 17-Mar 21-Apr 21-Jul 4.92% 4.85% 4.91% 17-Mar 21-Apr 21-Jul 151 151 25 23 3. 4.-06 3.-3-3-0-9 2.-6 14-1 6.-79-1-41-9. 5. 10 10 17. 2.-312-5 34 13 44 00 63 9 3 9 5 3 5 5 19 69 5 8 06 94 63 44 19 44 3 8 50 00 00 8 339 CI 69 72 71 70 70 69 64 63 60 55 53 65 67 68 67 69 69 56 54 49 46 49 43 53 61 64 60 of 72 .30 52 46 88 89 82 82 52 89 71 90 89 72 71 12 06 14 00 00 90 75 89 64 10 44 3 7 00 59 95 97 7 8 7 3 5 06 96 5 1 8 643 02 16 34 3 6 9 40 37 42 40 42 42 40 4 4 4 4 4 42 4 4 3 4 3 3 3 3 4 12345678911 12 3 4 5 6 7 8 9 20 21 22 23 24 25 26 91 11 2 3 4 5 6 7 123456 Exhibit 2 ITO'S DILEMMA n Premium and Market Data for February 20, 2001 Call Premiums Put Premiums Ll ar Ll Duke Energy 4.30 5.30 4.80 2.40 13.30 42.27 40.. 42.27 42.5 2.70 42.2745 1.25 0.75 30 2.25 2.40 3.90 IBM 10 2.20 4.30 7.00 5.30 8.10 10.50 2.20 13.90 15.60 108.90 100 12.00 14.10 18.70 8.10 11.40 3.60 7.50 108.90 1104.40 108.90 1201.10 12 13 14 Microsoft 15 16 17 18 19 T-bill rates 20 Expiration date 21 Days to expiration 25 8.13 10.00 4.50 2.384.50 55.19 50 6.50 55.19 55 3.00 55.19 60 0.94 1.19 2.50 4.00 2,69 4.13 6.00 5.38 6.75 8.13 6.88 4.92% 4.85% 4.91% 17-Mar 21-Apr 21-Jul 4.92% 4.85% 4.91% 17-Mar 21-Apr 21-Jul 151 151 25 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts