Question: - Subject: The asset allocation phase in the portfolio construction process: Comparative analysis among different asset classes. - Consider the asset classes below: 1. Listed

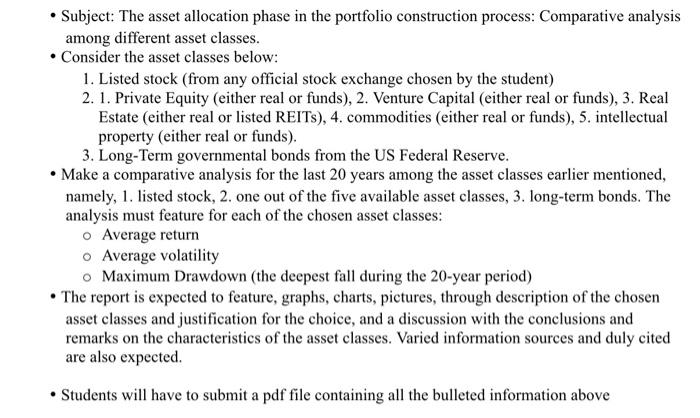

- Subject: The asset allocation phase in the portfolio construction process: Comparative analysis among different asset classes. - Consider the asset classes below: 1. Listed stock (from any official stock exchange chosen by the student) 2. 1. Private Equity (either real or funds), 2. Venture Capital (either real or funds), 3. Real Estate (either real or listed REITs), 4. commodities (either real or funds), 5. intellectual property (either real or funds). 3. Long-Term governmental bonds from the US Federal Reserve. - Make a comparative analysis for the last 20 years among the asset classes earlier mentioned, namely, 1. listed stock, 2. one out of the five available asset classes, 3. long-term bonds. The analysis must feature for each of the chosen asset classes: Average return Average volatility Maximum Drawdown (the deepest fall during the 20-year period) - The report is expected to feature, graphs, charts, pictures, through description of the chosen asset classes and justification for the choice, and a discussion with the conclusions and remarks on the characteristics of the asset classes. Varied information sources and duly cited are also expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts