Question: Sunland Corp. exchanged Building 24, which has an appraised value of $1,815,000, a cost of $2,842,000, and accumulated depreciation of $1,272,000, for Building M

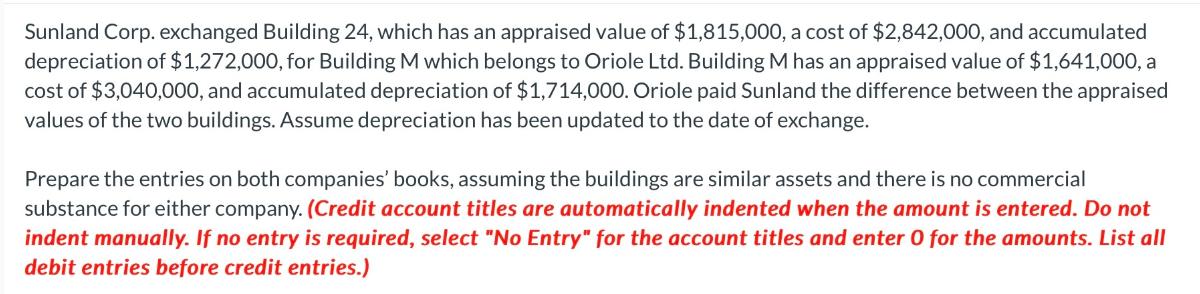

Sunland Corp. exchanged Building 24, which has an appraised value of $1,815,000, a cost of $2,842,000, and accumulated depreciation of $1,272,000, for Building M which belongs to Oriole Ltd. Building M has an appraised value of $1,641,000, a cost of $3,040,000, and accumulated depreciation of $1,714,000. Oriole paid Sunland the difference between the appraised values of the two buildings. Assume depreciation has been updated to the date of exchange. Prepare the entries on both companies' books, assuming the buildings are similar assets and there is no commercial substance for either company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Based on the information provided in the image the appraised value of Sunland Corps Building 24 is 1815000 while Oriole Ltds Building M is valued at 1... View full answer

Get step-by-step solutions from verified subject matter experts