Question: Sunlight company needs a machine for its manufacturing process. The cost of the new machine is $80,700. The expected useful life of the machine

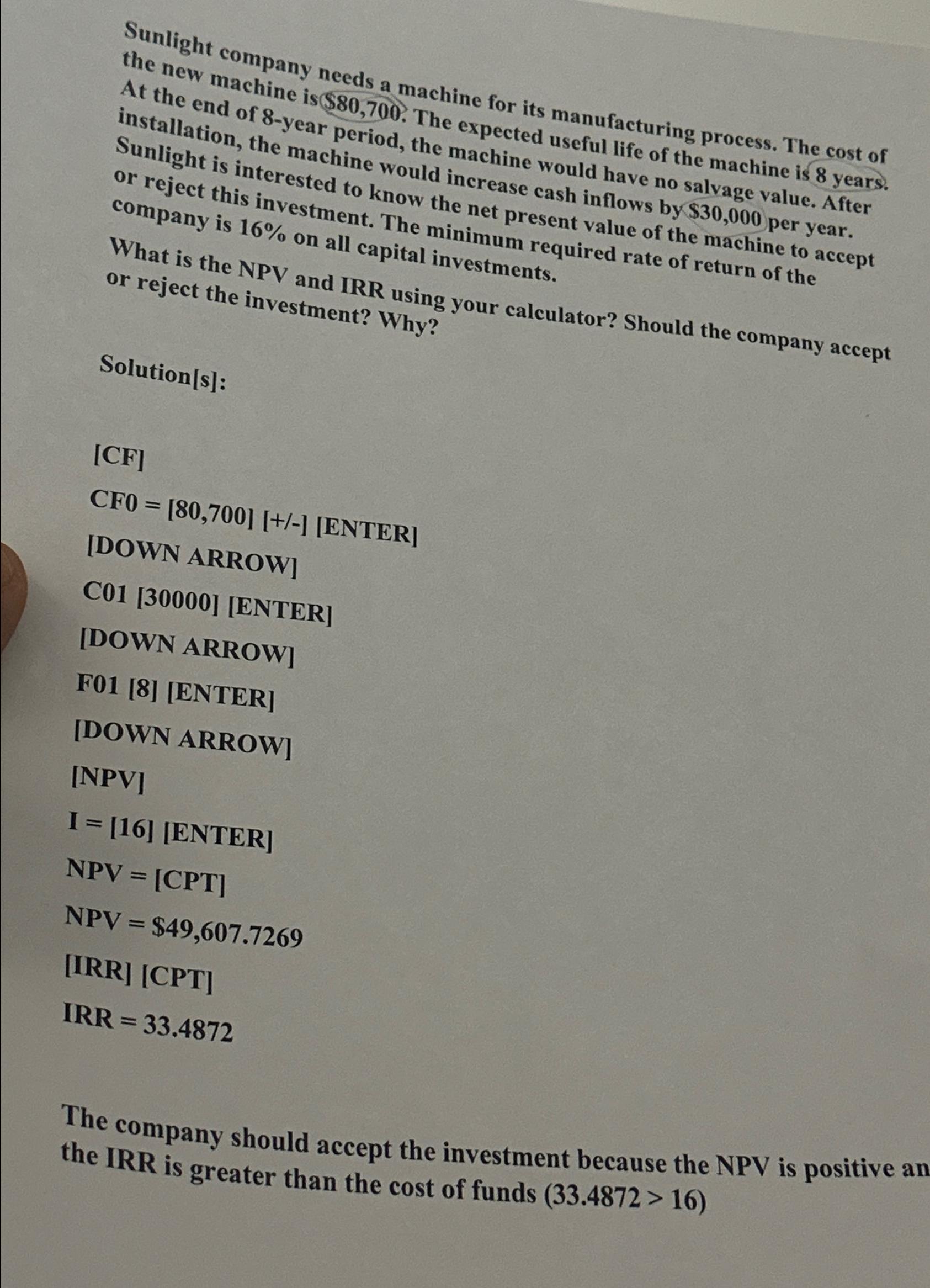

Sunlight company needs a machine for its manufacturing process. The cost of the new machine is $80,700. The expected useful life of the machine is 8 years. At the end of 8-year period, the machine would have no salvage value. After installation, the machine would increase cash inflows by $30,000 per year. Sunlight is interested to know the net present value of the machine to accept or reject this investment. The minimum required rate of return of the company is 16% on all capital investments. What is the NPV and IRR using your calculator? Should the company accept or reject the investment? Why? Solution[s]: [CF] CF0 = [80,700] [+/-] [ENTER] [DOWN ARROW] C01 [30000] [ENTER] [DOWN ARROW] F01 [8] [ENTER] [DOWN ARROW] [NPV] I= [16] [ENTER] NPV = [CPT] NPV = $49,607.7269 [IRR] [CPT] IRR=33.4872 The company should accept the investment because the NPV is positive an the IRR is greater than the cost of funds (33.4872> 16)

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

The analysis youve done is perfect Heres a breakdown of the results and why the company should accep... View full answer

Get step-by-step solutions from verified subject matter experts